Bitcoin network adapts as mining rewards decrease, showcasing market resilience and sustainability

Bitcoin network adapts as mining rewards decrease, showcasing market resilience and sustainability Quick Take

As diminishing mining rewards in the Bitcoin network cause anxieties over the security budget, analyzing the market’s behavior provides a different perspective.

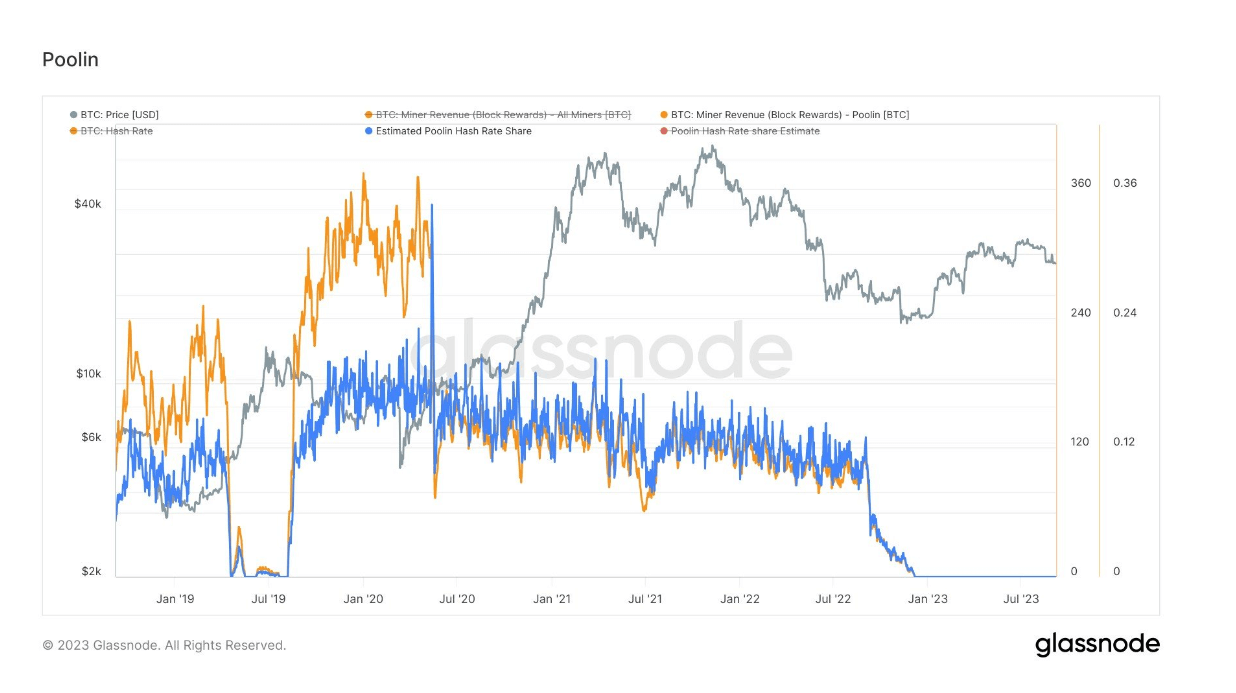

A year ago, Poolin, a significant player with 20% of the hash rate in 2020, saw its share reduce to zero, raising concerns over Bitcoin’s security. However, no discussions about the security budget ensued. Instead, other mining pools filled the void left by Poolin in a classic free market response, demonstrating the market’s ability to self-correct and maintain balance.

This indication of resilience underscores that mining operations will persist as long as there is access to inexpensive energy, which Earth has in abundance.

Despite concerns over diminishing rewards, the critical parameters of the Bitcoin network – hash rate, difficulty, and fees – will continue to adjust dynamically, ensuring continuous operation. This adaptability ensures that the most efficient miners survive, reinforcing the network’s stability and security.

The self-regulating nature of Bitcoin’s mining infrastructure offers an insightful perspective into its resilience, making a case for its sustainability even amidst diminishing mining rewards.