Bitcoin miner wallet balances continue to shrink

Bitcoin miner wallet balances continue to shrink Onchain Highlights

DEFINITION: The total supply held in miner addresses.

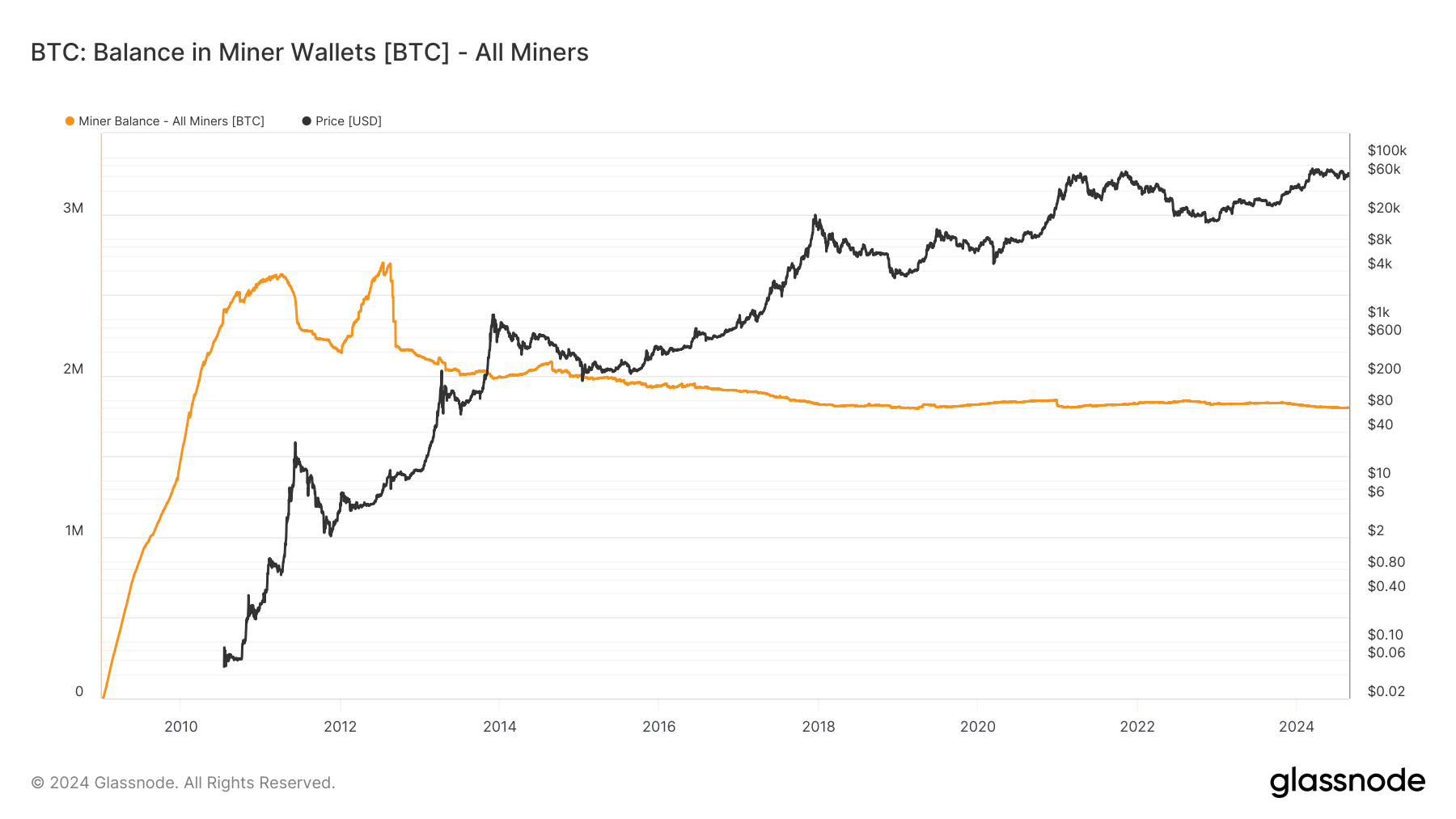

Bitcoin miners’ wallet balances have been on a steady decline since 2011, with the trend continuing into 2024. The first chart illustrates a significant reduction from an all-time high of over 2.5 million BTC in late 2011 to under 2 million BTC by mid-2024.

This decline has been influenced by miners liquidating assets to cover operational costs, especially during periods of market volatility and post-halving events.

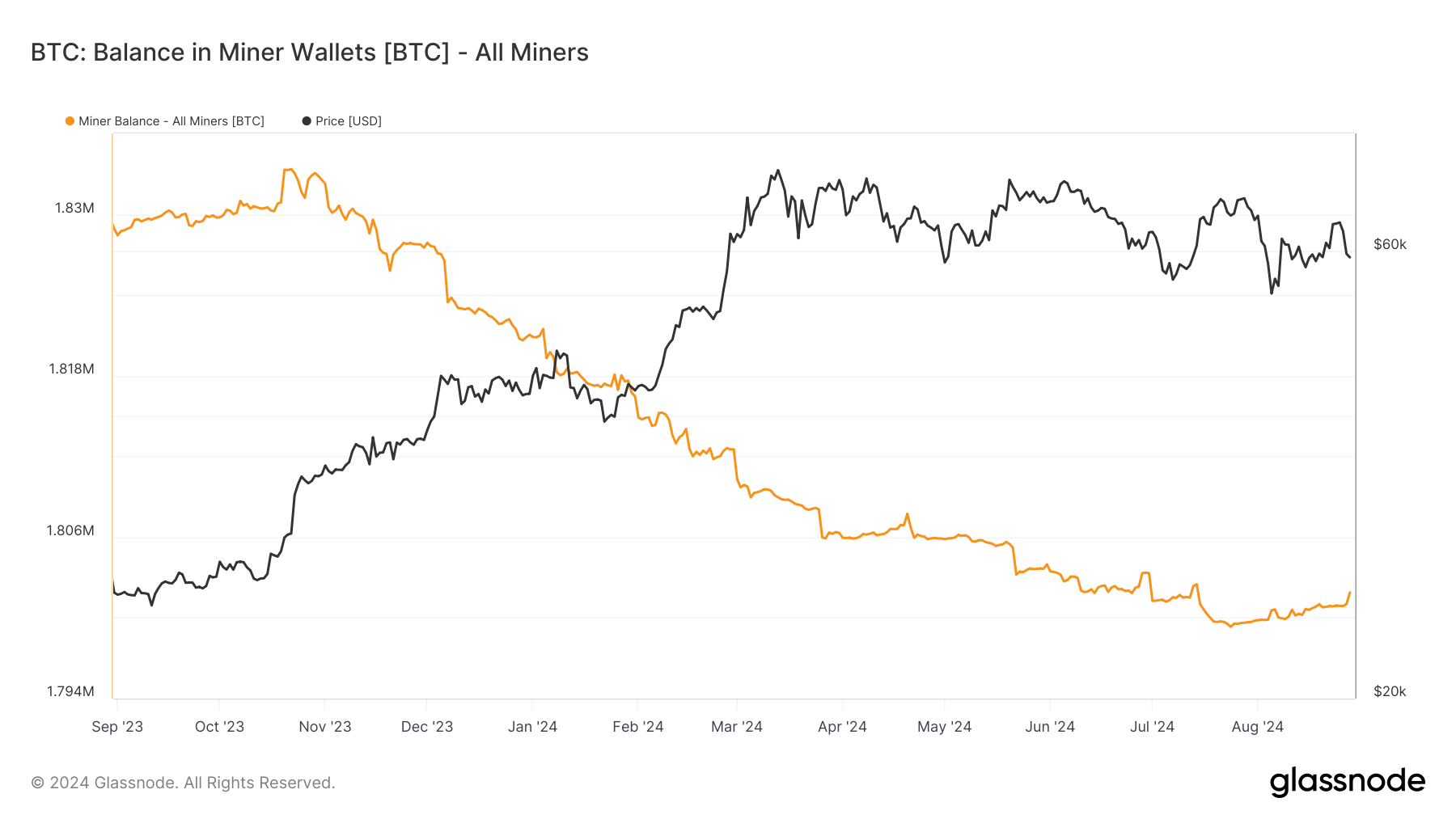

This pattern suggests that miners took advantage of the price surge to sell off accumulated Bitcoin, likely to lock in profits or reinvest in more efficient mining operations as profitability became more challenging post-halving.

BTC: Balance in Miner Wallets: (Source: Glassnode)This ongoing reduction in miners’ BTC holdings reflects broader market trends and the increasing operational pressures within the mining industry.