Bitcoin maintained independence from traditional market forces in 2023

Bitcoin maintained independence from traditional market forces in 2023 Quick Take

The data, analyzed from Jan. 1 to Dec. 31, 2023, was provided by esteemed sources Coinbase International and Glassnode.

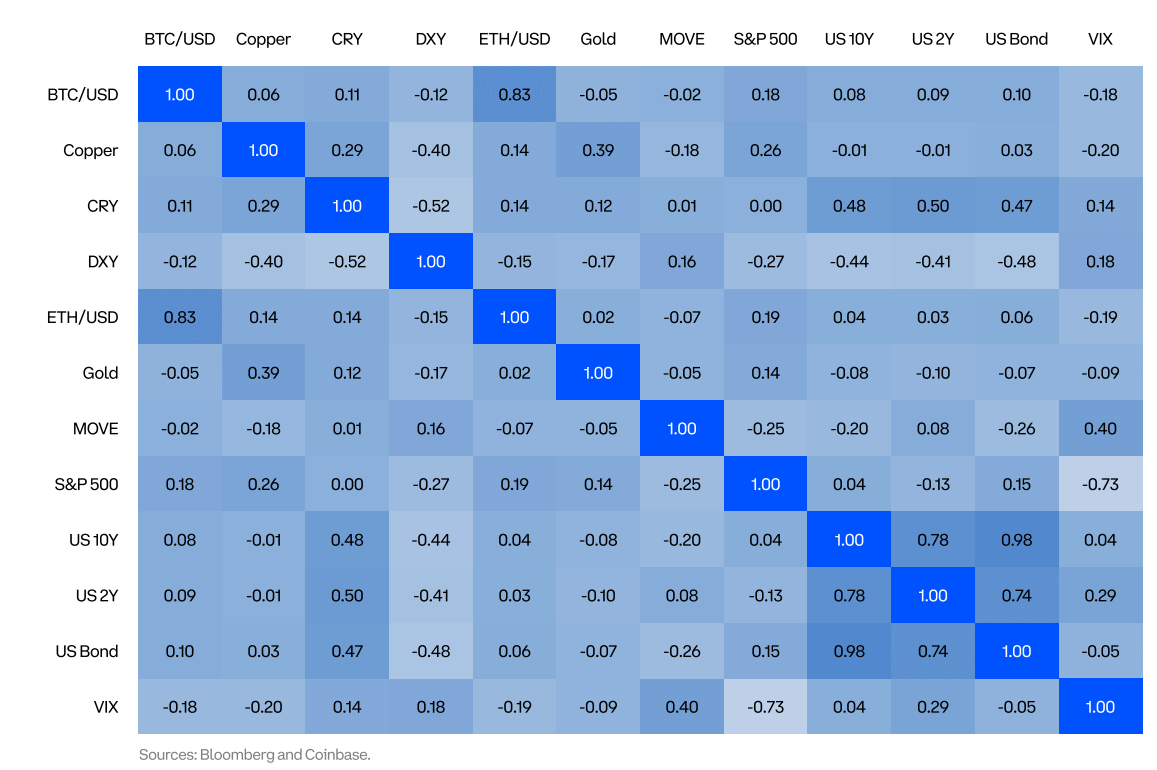

A recent correlation matrix analysis highlights the intricate relationship between Bitcoin (BTC/USD) and other financial instruments. The analysis reveals a strong positive correlation between BTC/USD and ETH/USD, indicating that market trends and investor sentiments affecting Bitcoin’s value often likewise impact Ethereum.

In contrast, Bitcoin showcases a near-zero or weak correlation with traditional assets such as gold and various indices (S&P 500, MOVE, US Bonds), underlining its potential as a diversification tool in traditional investment portfolios. This behavior suggests that Bitcoin’s performance is largely unaffected by the movements of these traditional assets, pointing towards its potential for hedging against investment risks in traditional portfolios.

However, the analysis also brings to light Bitcoin’s volatility, visible in its negative correlation with the DXY (US Dollar Index). This suggests an inverse relationship, where a strengthening dollar could potentially decrease Bitcoin’s value in USD terms and vice versa. It’s crucial to note that Bitcoin’s interaction with traditional financial markets is multifaceted, affected by factors such as investor sentiment, regulatory news, technological developments, and macroeconomic trends.

As the digital asset market advances, the relationships displayed in this matrix may shift, reflecting Bitcoin’s evolving influence on the broader financial landscape.