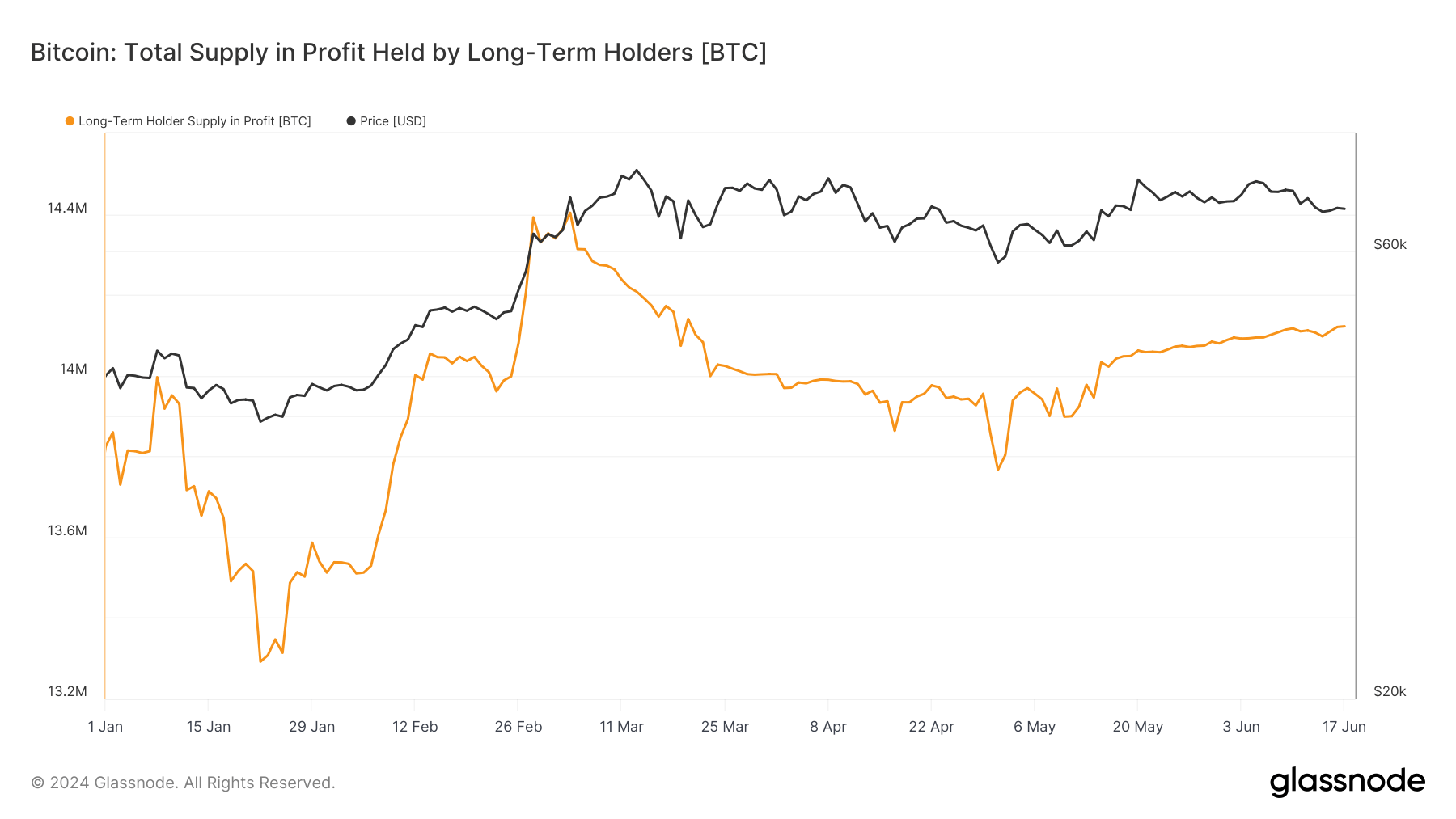

Bitcoin long-term holders’ supply in profit holds above 14 million BTC

Bitcoin long-term holders’ supply in profit holds above 14 million BTC Onchain Highlights

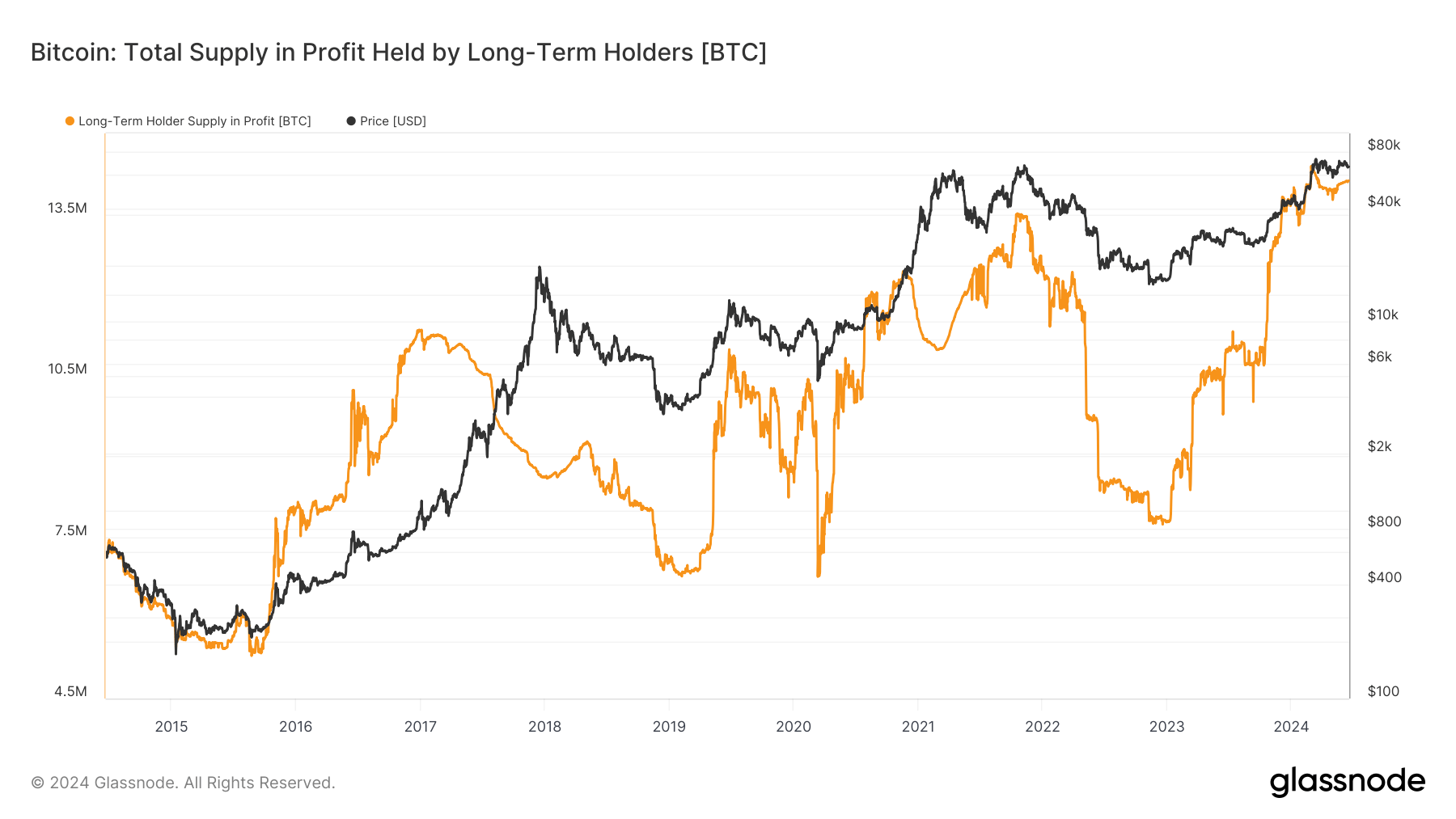

DEFINITION: Bitcoin’s total supply in profit held by long-term holders [BTC] is the total amount of circulating supply currently in profit and held by long-term holders. Long-term and Short-Term Holder supply is defined with respect to the entity’s averaged purchasing date, with weights given by a logistic function centered at an age of 155 days and a transition width of 10 days.

Bitcoin’s long-term holders demonstrate resilience with a significant portion of the total supply in profit, even amidst price fluctuations. This trend suggests strong market confidence, as long-term holders tend to maintain their positions regardless of short-term market volatility.

Recent data from Glassnode shows that the total supply of profit held by long-term holders has seen a steady increase, signaling robust market confidence. As of early 2024, these long-term investors held over 14 million BTC, a substantial rise from previous years. While it dipped below 14 million throughout April and May, it has since recovered and is steadily rising. This growth reflects a broader market sentiment in which long-term holders are not swayed by short-term price movements, maintaining their holdings as a hedge against volatility.

Interestingly, this trend contrasts with the behavior of short-term holders, who have been actively transferring profits to exchanges, particularly during market surges. For instance, when Bitcoin’s price first surpassed $50,000 in early 2024, short-term holders saw a notable increase in profit-taking, contributing to increased market liquidity and short-term price adjustments.

In summary, while short-term holders’ activities highlight immediate profit-taking tendencies, the steady accumulation by long-term holders illustrates their enduring confidence in Bitcoin’s value proposition. This dichotomy between long-term stability and short-term volatility continues to shape the Bitcoin market forces.