Bitcoin ETPs surpass 1 million BTC, amid gold and bond ETF outflows

Bitcoin ETPs surpass 1 million BTC, amid gold and bond ETF outflows Quick Take

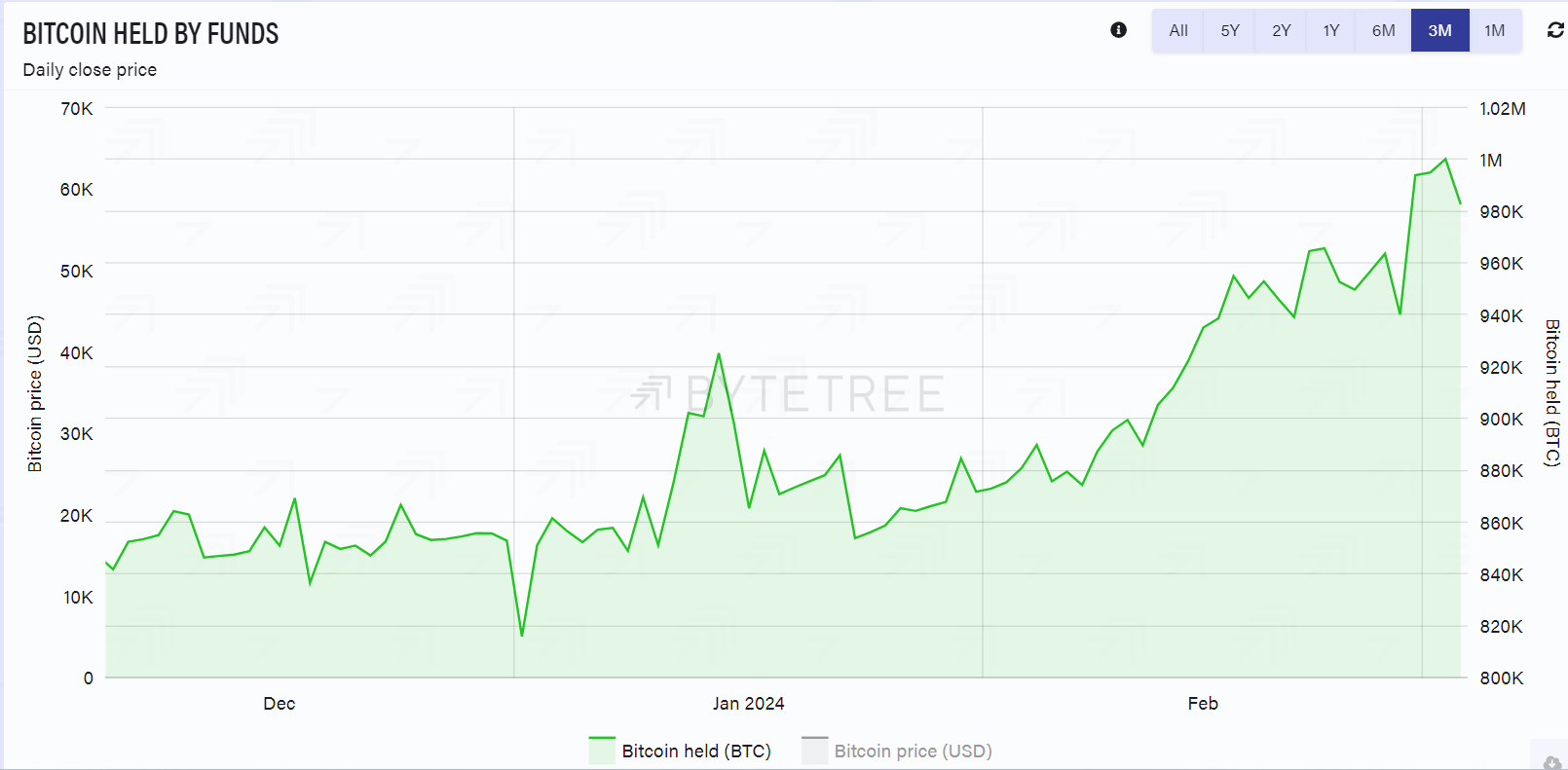

Recent data from ByteTree highlights Bitcoin held in global Exchange Traded Products (ETPs) had crossed the one million Bitcoin mark, setting a new record. In the past 90 days, these ETPs have experienced a significant inflow of 133,000 BTC, largely attributed to the success of US spot Bitcoin ETFs.

Interestingly, this surge in Bitcoin ETPs is occurring alongside outflows from other ETFs, notably those associated with gold and bonds. As of data up to Mar. 1, year-to-date observations indicate that some of the largest bond ETFs, including TLT, have experienced negative returns. TLT, in particular, is currently down 4.5% year-to-date, according to HODL15Capital.

Concurrently, spot Bitcoin ETFs have demonstrated impressive performance since inception. Although it’s currently speculative to quantify how much of these traditional asset outflows are transitioning into Bitcoin ETFs, a potential correlation cannot be disregarded.