Bitcoin ETFs sees $197 million inflow, BlackRock and Fidelity lead the charge

Bitcoin ETFs sees $197 million inflow, BlackRock and Fidelity lead the charge Bitcoin ETFs sees $197 million inflow, BlackRock and Fidelity lead the charge

A four-day streak of net inflows marks a bullish trend for Bitcoin ETFs.

Quick Take

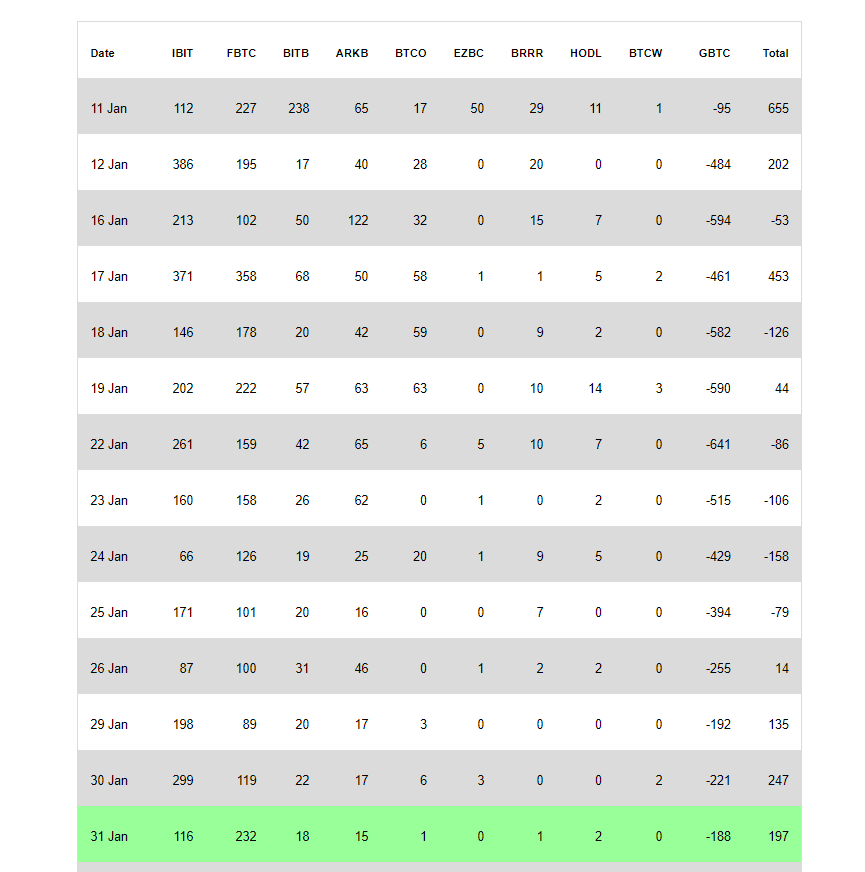

Day 14 for the new Bitcoin ETFs marked another day of net inflows, with a considerable $197 million entering the market on Jan. 31, according to Whale Panda.

This marks the fourth successive trading day of net inflows, underlining a trend in the market’s dynamic. Among the prominent contributors, BlackRock’s IBIT showed a strong performance, with net inflows of $116 million, according to Whale Panda, boosting its total to an impressive $2.8 billion.

Meanwhile, Fidelity’s FBTC recorded one of its strongest inflows since inception, with a significant $232 million, leading its total to $2.4 billion.

In contrast, GBTC experienced further outflows of $188 million, pushing its total to $5.6 billion outflows, showcasing the lowest amount since its launch.

In aggregate, the Bitcoin ETFs have acquired a hefty $1.3 billion in Bitcoin, suggesting a potent attraction for investors toward these financial products.