Fidelity inflows smash Grayscale outflows as $255 million Bitcoin enters US market

Fidelity inflows smash Grayscale outflows as $255 million Bitcoin enters US market Fidelity inflows smash Grayscale outflows as $255 million Bitcoin enters US market

Grayscale retains liquidity lead in crypto ETF space despite declining outflows

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Grayscale’s Bitcoin Trust (GBTC) is experiencing a slowdown in outflows, with just under $200 million withdrawn from the fund on Jan. 29.

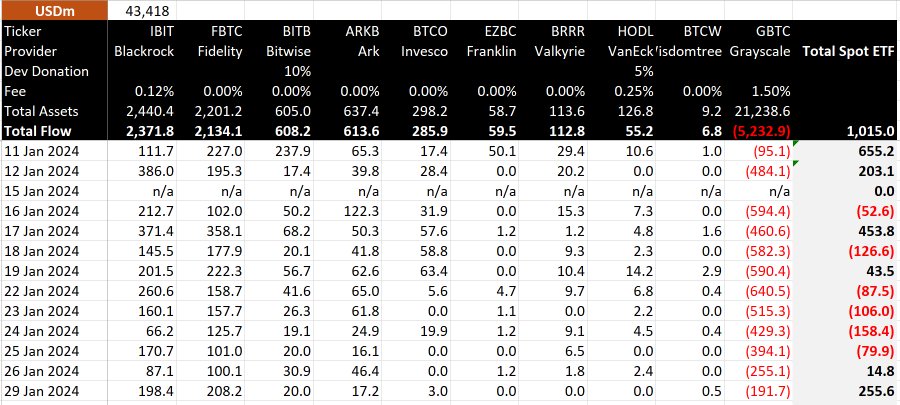

Data from BitMEX Research indicates a total outflow of around $192 million during this reporting period. Notably, this marks the lowest outflows since the fund’s inception, surpassing only the initial day of trading when withdrawals amounted to $95 million.

Meanwhile, a look at the newborn nine shows that the inflows into the funds keep offsetting that of Grayscale.

The Fidelity Wise Origin Bitcoin Fund (FBTC) emerged as a standout, concluding the twelfth trading day with the highest inflow at $208 million. In comparison, other funds, including BlackRock’s IBIT, experienced a $198 million inflow. ETFs such as BITB, ARKB, and BTCO recorded inflows of $20 million, $17 million, and $3 million, respectively, while others reported zero inflows.

The robust trading activities contributed a net inflow of $255.6 million during the twelfth trading day.

GBTC maintains ‘liquidity crown’

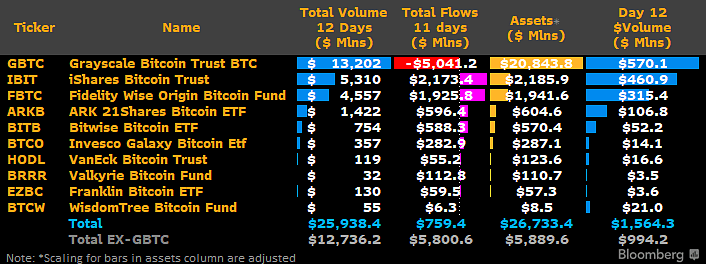

However, Grayscale’s GBTC remains the top cryptocurrency ETF in liquidity, as Bloomberg Intelligence analyst James Seyffart observed.

Despite recent outflows, GBTC’s trading volume reached $570 million on Jan. 29, surpassing BlackRock’s IBIT by $110 million and reaffirming its market dominance.

Following its recent conversion, Grayscale’s ETF has experienced substantial outflows totaling more than $5 billion. Analysts attribute the outflows to profit-taking maneuvers by investors exposed to its previous net asset value discount.

Furthermore, the fund’s relatively high 1.5% management fee is cited as a factor that has led some investors to shift towards competing ETF providers such as BlackRock and Fidelity, who charge a lower fee of 0.25%.

As of Jan. 29, the outflows have resulted in Grayscale’s ETF’s Assets Under Management (AUM) dropping to approximately $21.431 billion (equivalent to 496,573 BTC) from its year-to-date peak of nearly $29 billion (623,390 BTC), as reported by the fund’s official website. This data indicates that fund users have divested over 100,000 units of the leading cryptocurrency since the approval of the ETF conversion.

Mentioned in this article

Bitcoin

Bitcoin  Grayscale Investments

Grayscale Investments  BlackRock

BlackRock  Fidelity Investments

Fidelity Investments  Grayscale Bitcoin Trust

Grayscale Bitcoin Trust  Fidelity Wise Origin Bitcoin Trust

Fidelity Wise Origin Bitcoin Trust  iShares Bitcoin Trust

iShares Bitcoin Trust  Invesco Galaxy Bitcoin ETF

Invesco Galaxy Bitcoin ETF

Arkham Intelligence

Arkham Intelligence

Farside Investors

Farside Investors

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass