Bitcoin ETFs record sixth consecutive trading day of inflows amid BlackRock surge

Bitcoin ETFs record sixth consecutive trading day of inflows amid BlackRock surge Quick Take

Bitcoin

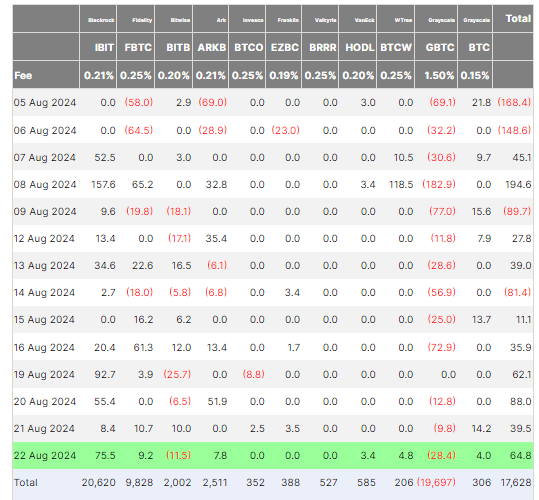

Bitcoin ETFs continued their positive momentum, recording their sixth consecutive trading day of inflows on Aug. 22, with a total inflow of $64.8 million. BlackRock’s IBIT led the surge, attracting $75.5 million, bringing its total net inflow to an impressive $20.6 billion. Other inflows included Fidelity’s FBTC with $9.2 million, Ark’s ARKB with $7.8 million, WisdomTree’s BTCW with $4.8 million, and VanEck’s HODL with $3.4 million.

Grayscale’s BTC also contributed with a $4 million inflow. However, there were outflows from Grayscale’s GBTC, which saw a $28.4 million decline, and Bitwise’s BITB, which lost $11.5 million. Despite these outflows, the total inflows for Bitcoin ETFs stand strong at $17.6 billion.

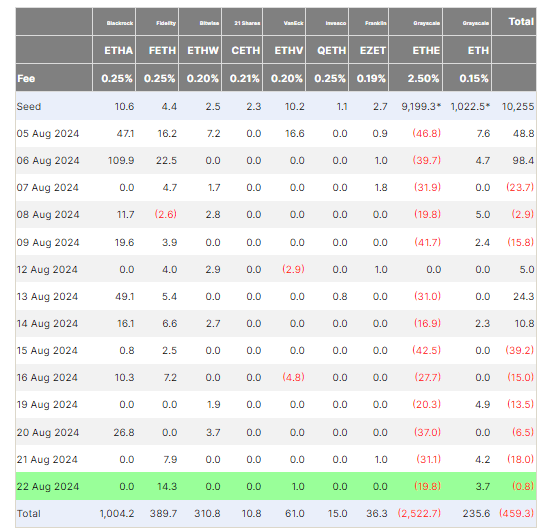

Ethereum

In contrast, Ethereum ETFs experienced a net outflow, continuing their recent trend. The sector saw a modest $0.8 million outflow overall on Aug. 22. Grayscale’s ETHE was the biggest contributor to this decline, with a $19.8 million outflow, while Fidelity’s FETH partially offset the loss with a $14.3 million inflow. The cumulative outflows for Ethereum ETFs now total $459.3 million, highlighting the ongoing divergence in investor sentiment between Bitcoin and Ethereum ETFs.