Bitcoin echoes past patterns, trading below short-term holders’ cost basis yet signaling potential recovery

Bitcoin echoes past patterns, trading below short-term holders’ cost basis yet signaling potential recovery Quick Take

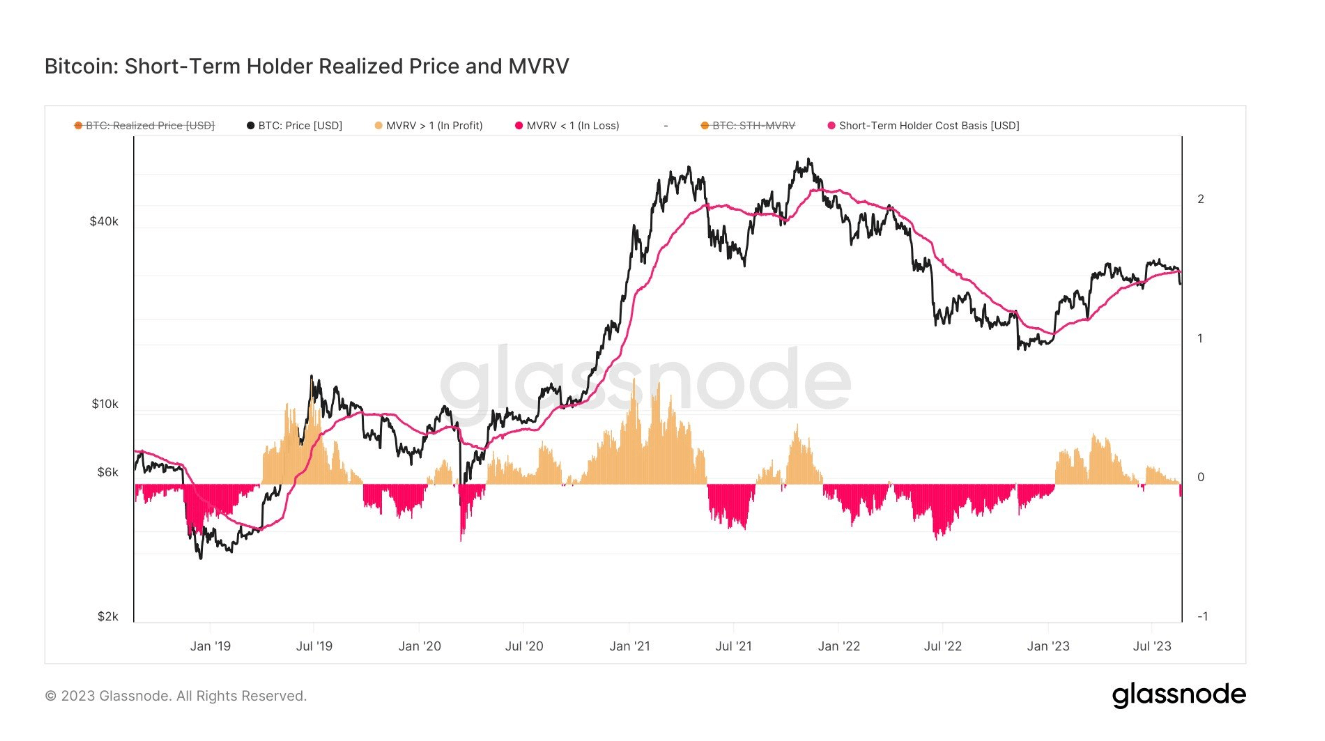

Bitcoin is exhibiting a repeat pattern, currently trading below the Short-Term Holder (STH) cost basis of $28,680 for the fourth consecutive day. Back in June, Bitcoin traded similarly under the STH cost basis for a span of 10 days.

Historically, this pattern isn’t new. A strikingly similar situation unfolded in 2019 as we transitioned out from the bear market’s bottom. During that period, bitcoin prices plummeted from $12,500 to $6,500 and remained under the STH cost basis from September 2019 until January 2020.

While this trend might raise concerns, it’s important to note that such patterns have occurred in the past and have been followed by significant market recovery. Therefore, the current scenario might be a signal of an approaching turn-around, but it’s crucial to keep a close eye on the market trends for additional signals.