Bitcoin derivatives market shows stability with balanced open interest levels

Bitcoin derivatives market shows stability with balanced open interest levels Quick Take

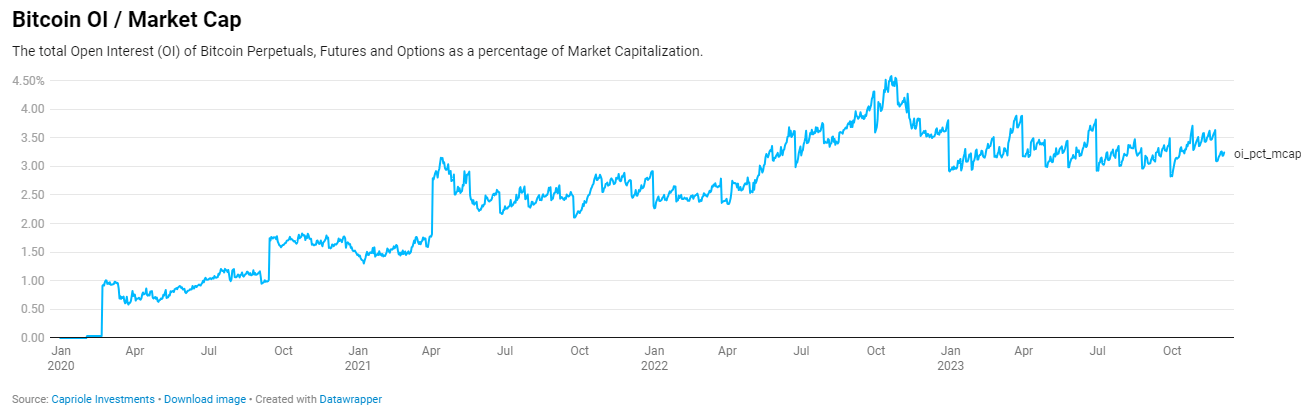

An analysis of derivative market indicators presents an encouraging health check. Historically, an open interest as a percentage of Bitcoin’s market capitalization around 2% is considered healthy.

Advancing this measure, the total open interest (OI) of Bitcoin perpetual, futures, and options, as a percentage of market capitalization, is currently standing at 3.24%, according to Capriole Investments. This figure has maintained a steady range throughout 2023, swinging between 3.00% and 3.5%, with brief overheating noted in March and June.

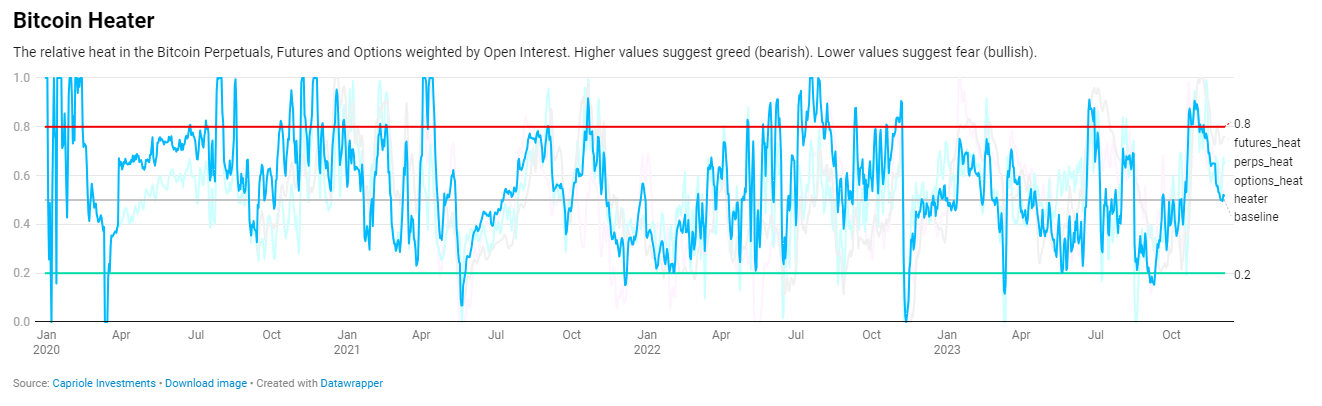

Complementing this data, examining the Bitcoin heater model by Capriole Investments – which measures the relative heat in the Bitcoin perpetual, futures, and options weighted by open interest – provides further evidence of market balance. Higher values here indicate a greed-driven market (bearish), while lower values suggest a fear-driven market (bullish). Current figures place the market squarely in the middle of the range, indicating a balanced state. Along with a steady OI as a percentage of market cap throughout the year, these metrics suggest the Bitcoin derivatives market is in a healthy condition