Ethereum ETF filing triggers spike in open interest as Bitcoin steadies

Ethereum ETF filing triggers spike in open interest as Bitcoin steadies Quick Take

On Nov. 9, the crypto market saw significant turmoil, with over $400 million in liquidations. There was a notable change in open interest, especially for Bitcoin and Ethereum.

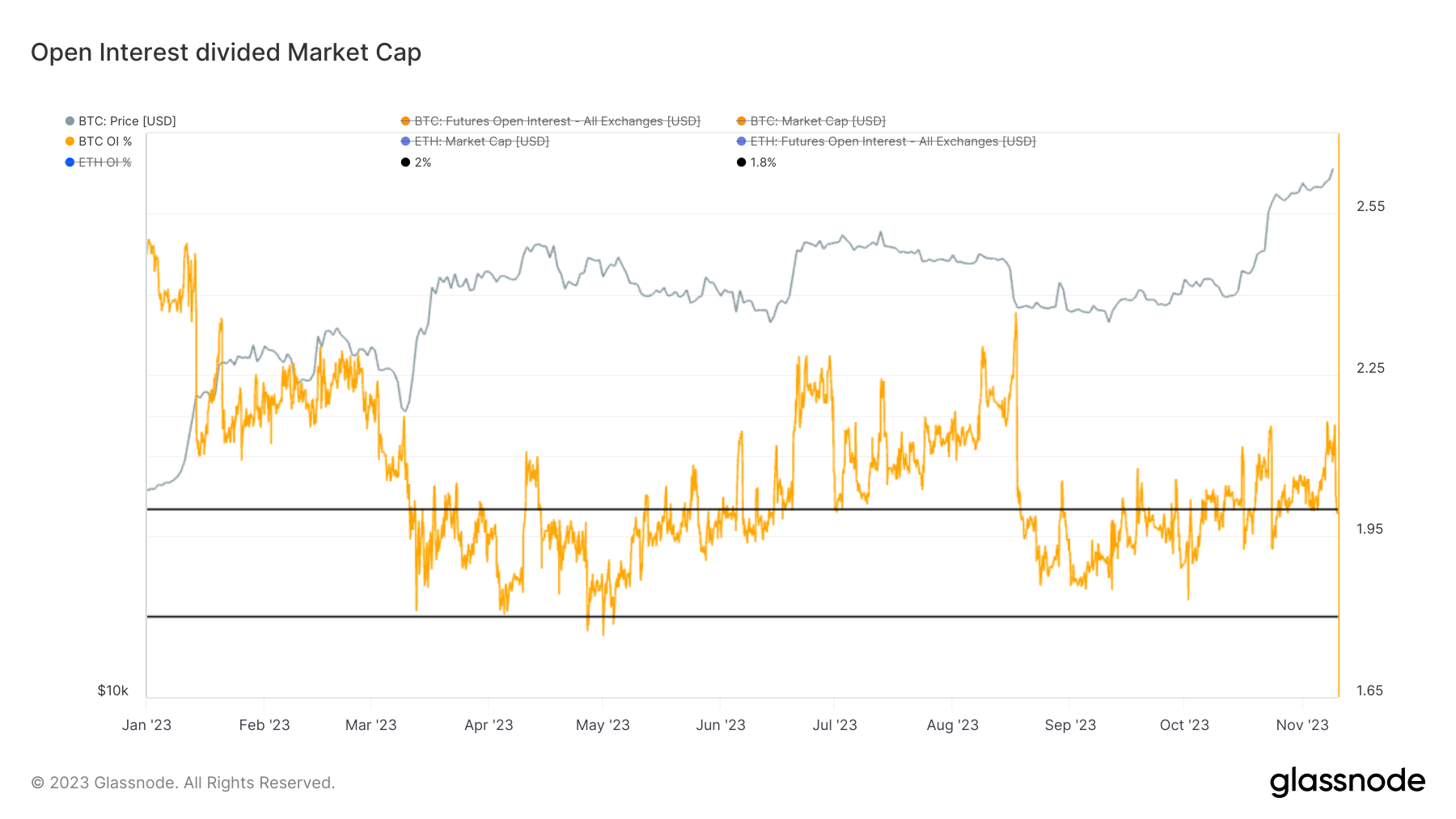

The majority of Bitcoin’s open interest now sits in the U.S. capital markets, with the Chicago Mercantile Exchange (CME) playing a dominant role. This open interest represents just 2% of Bitcoin’s total market cap, which has remained mostly unchanged since August. Despite the steadiness in open interest, Bitcoin’s price has surged from $26,000 to $36,500 since then, indicating a substantial increase.

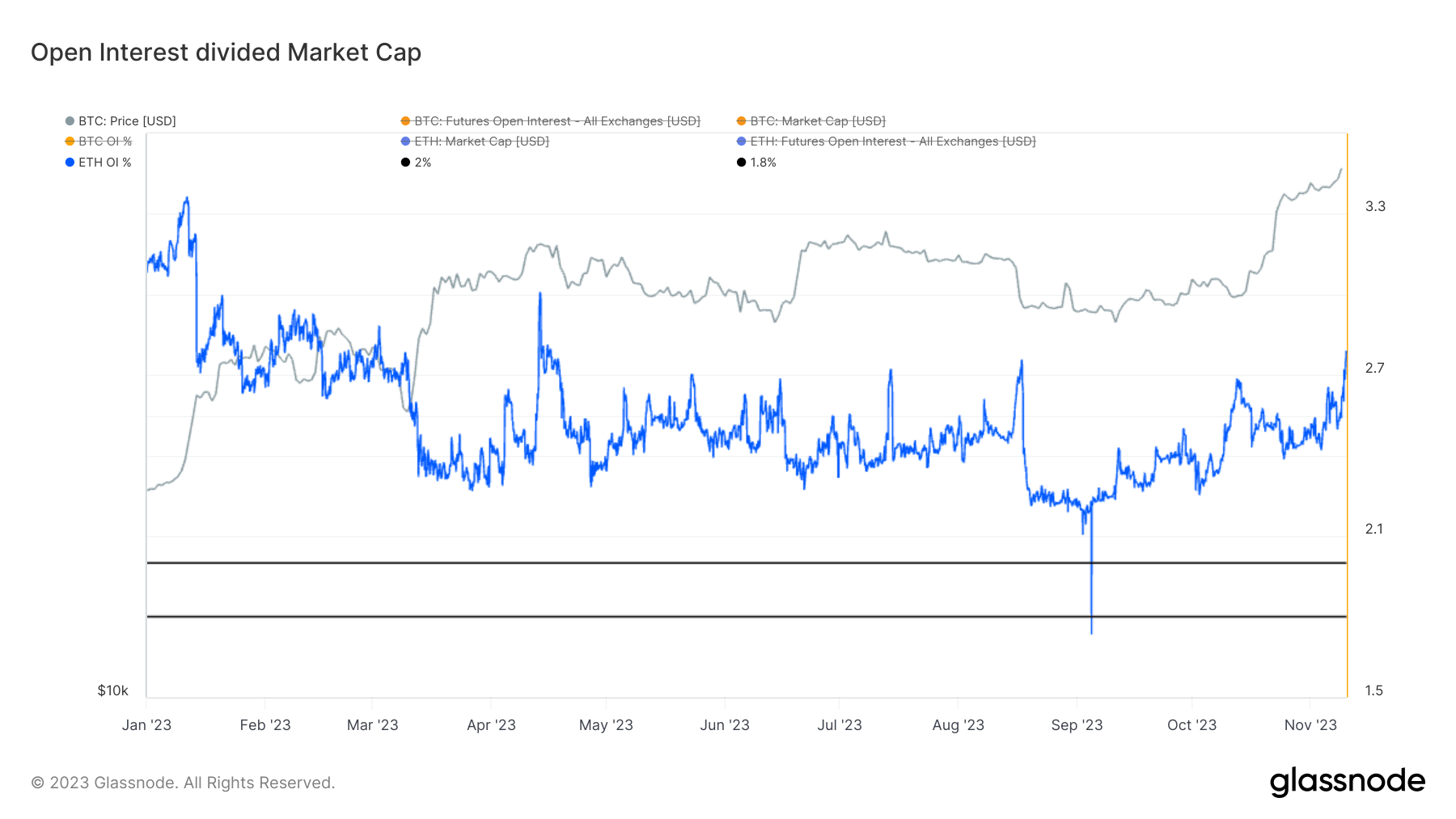

In contrast, Ethereum witnessed a notable surge in open interest following the news of BlackRock’s spot Ethereum ETF filing. This resulted in a more than 17% increase in 24 hours, equal to around $8 billion in notional value. Consequently, Ethereum’s open interest as a percentage of its market cap surpassed 2.65% – one of the highest levels witnessed this year.