Bitcoin addresses holding at least 10 BTC recover from Q1 decline

Bitcoin addresses holding at least 10 BTC recover from Q1 decline Onchain Highlights

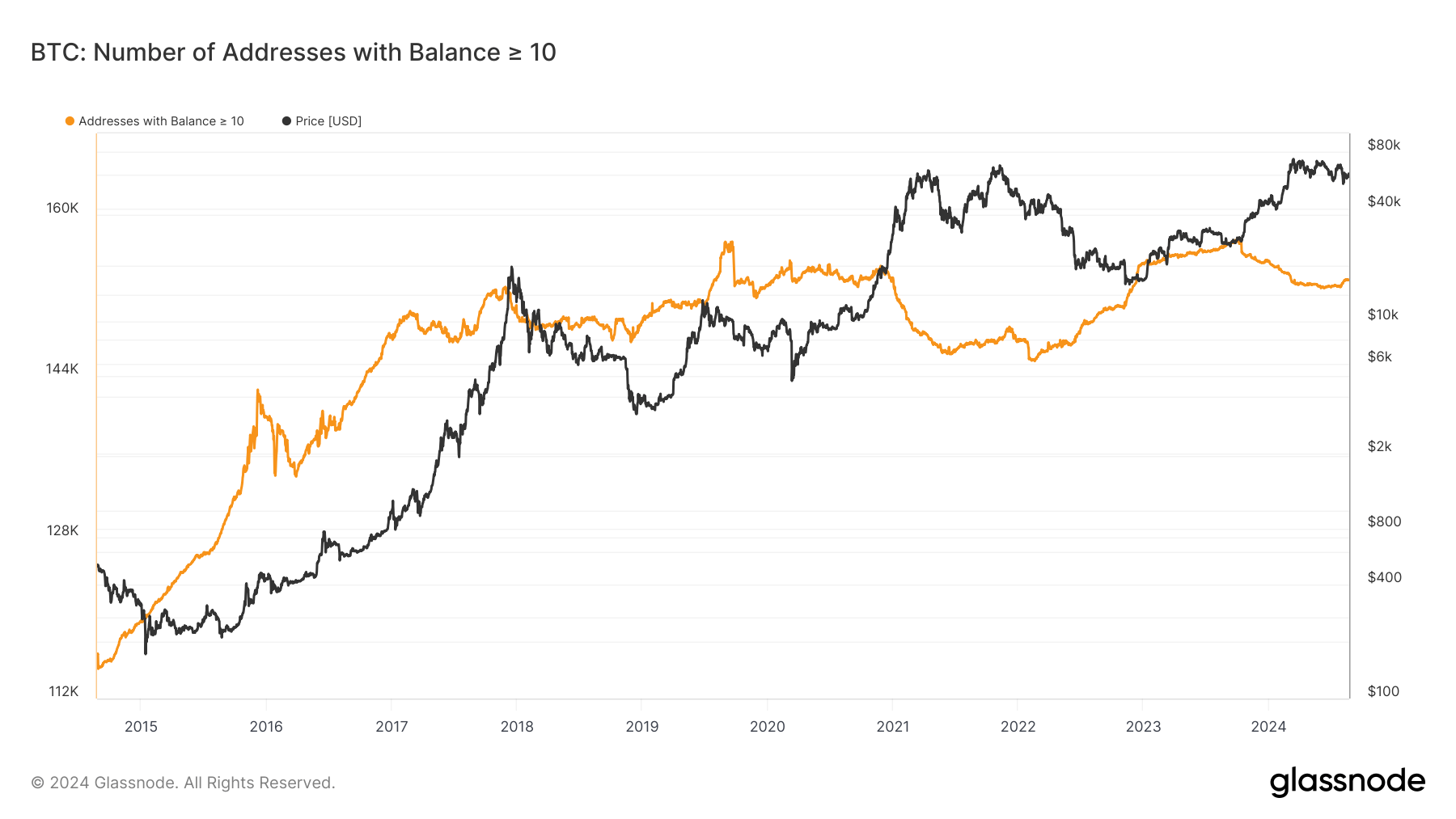

DEFINITION: The number of unique addresses holding at least ten coins.

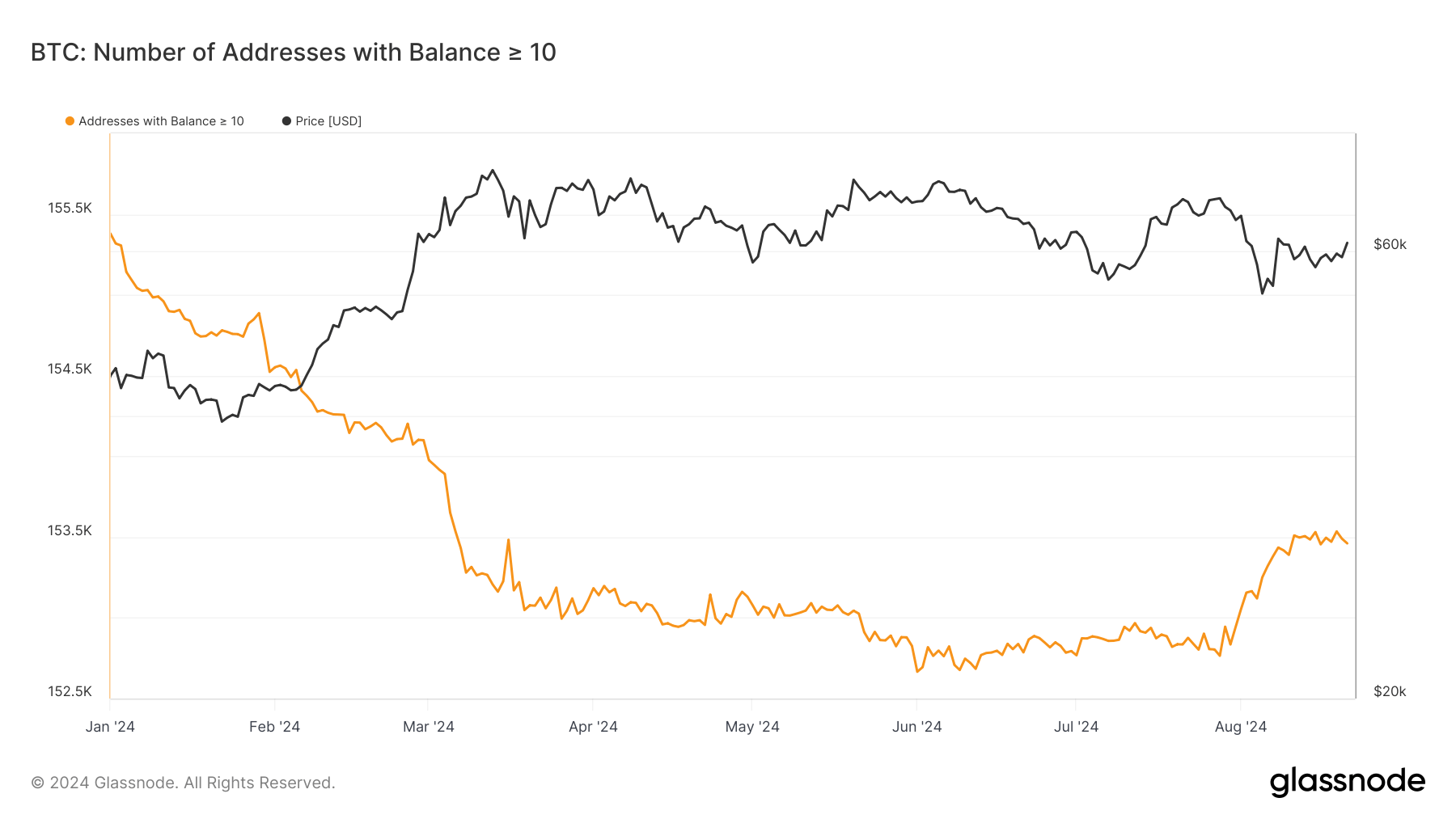

Bitcoin addresses holding at least 10 BTC have declined in 2024. The number of such addresses began the year at approximately 155,500, with the number falling through the first quarter to hit a low of around 152,600 in late March.

This decrease diverged with Bitcoin’s price movements during the same period, reflecting smart money taking profit. However, a reversal occurred in August, with addresses holding over 10 BTC rising back toward 153,500 as Bitcoin’s price stabilized near $60,000.

Historically, the number of addresses with at least 10 BTC has trended upward, particularly since 2015, as Bitcoin’s price surged from under $500 to over $60,000 by 2021. This long-term increase highlights growing accumulation among large holders, often seen as a signal of confidence in Bitcoin’s value proposition. However, the mid-2024 drop indicates short-term distribution or reallocation as the market adjusted post-halving.