Binance sees 18% Open Interest drop as CME Bitcoin futures hit record levels

Binance sees 18% Open Interest drop as CME Bitcoin futures hit record levels Quick Take

CryptoSlate’s recent analysis paints a vivid picture of Bitcoin futures’ open interest across key exchanges.

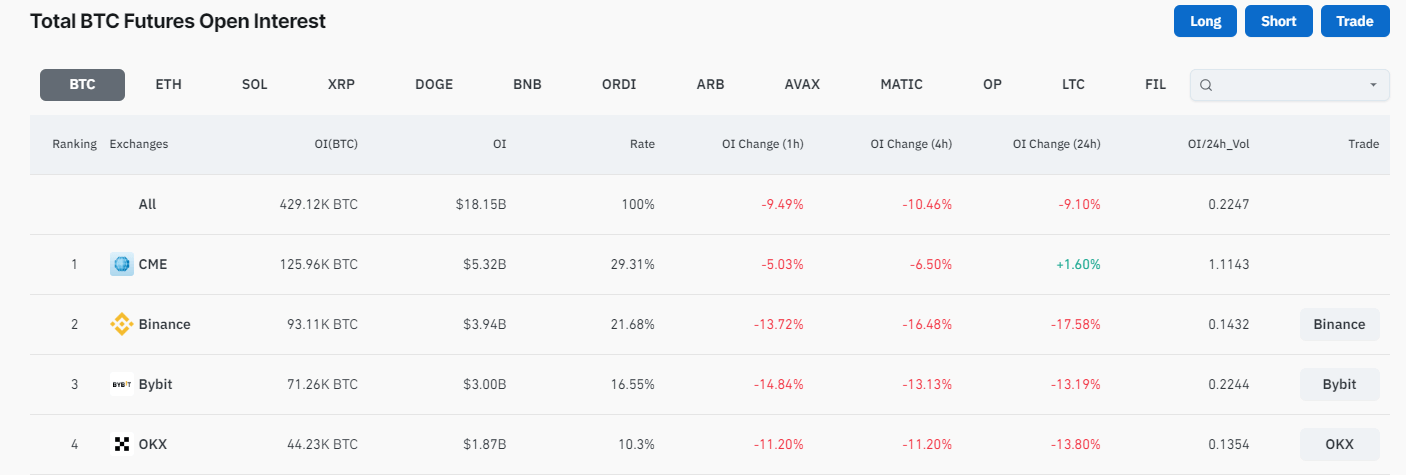

The past 24 hours have seen a significant repositioning of open interest in Bitcoin, with a notable surge and subsequent drop of around 10%. The primary contributor to this fluctuation was Binance, which saw an 18% open interest decrease in the past 24 hours.

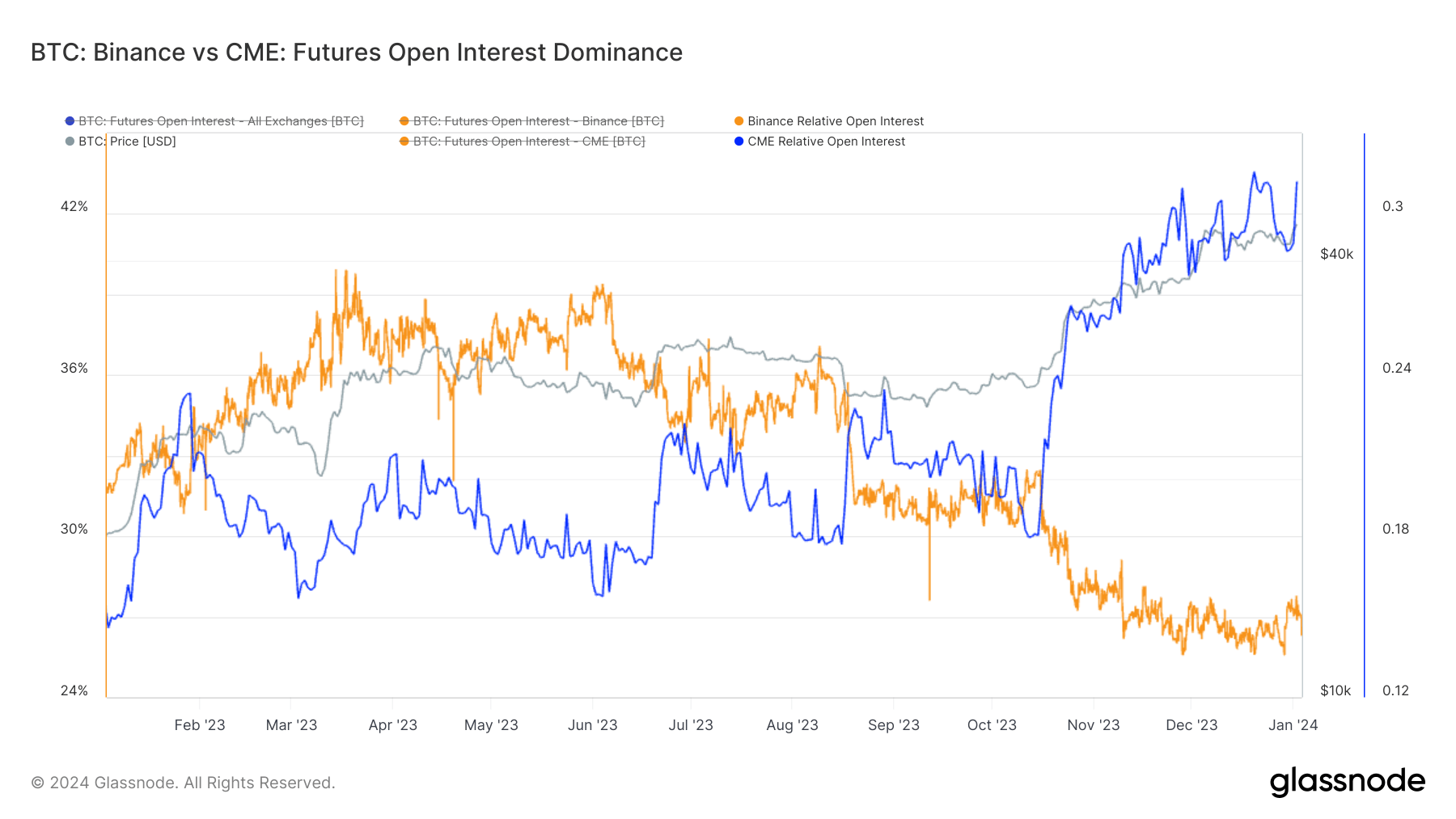

This shift has further widened the gap between Binance and the Chicago Mercantile Exchange (CME), the latter experiencing a contrary trend with a 2% increase in open interest in the past 24 hours. Consequently, CME recorded an all-time high of 126,000 Bitcoin in open interest, while Binance has 93,000 BTC.

Amid these dynamics, Coinglass noted a sizable wipeout of nearly $3 billion in Bitcoin open interest, marking the largest long liquidation event in a year, coinciding with Bitcoin’s hovering around the $42,200 mark.