Bitcoin’s early 2024 rally stokes anticipation for potential ETF green light

Bitcoin’s early 2024 rally stokes anticipation for potential ETF green light Quick Take

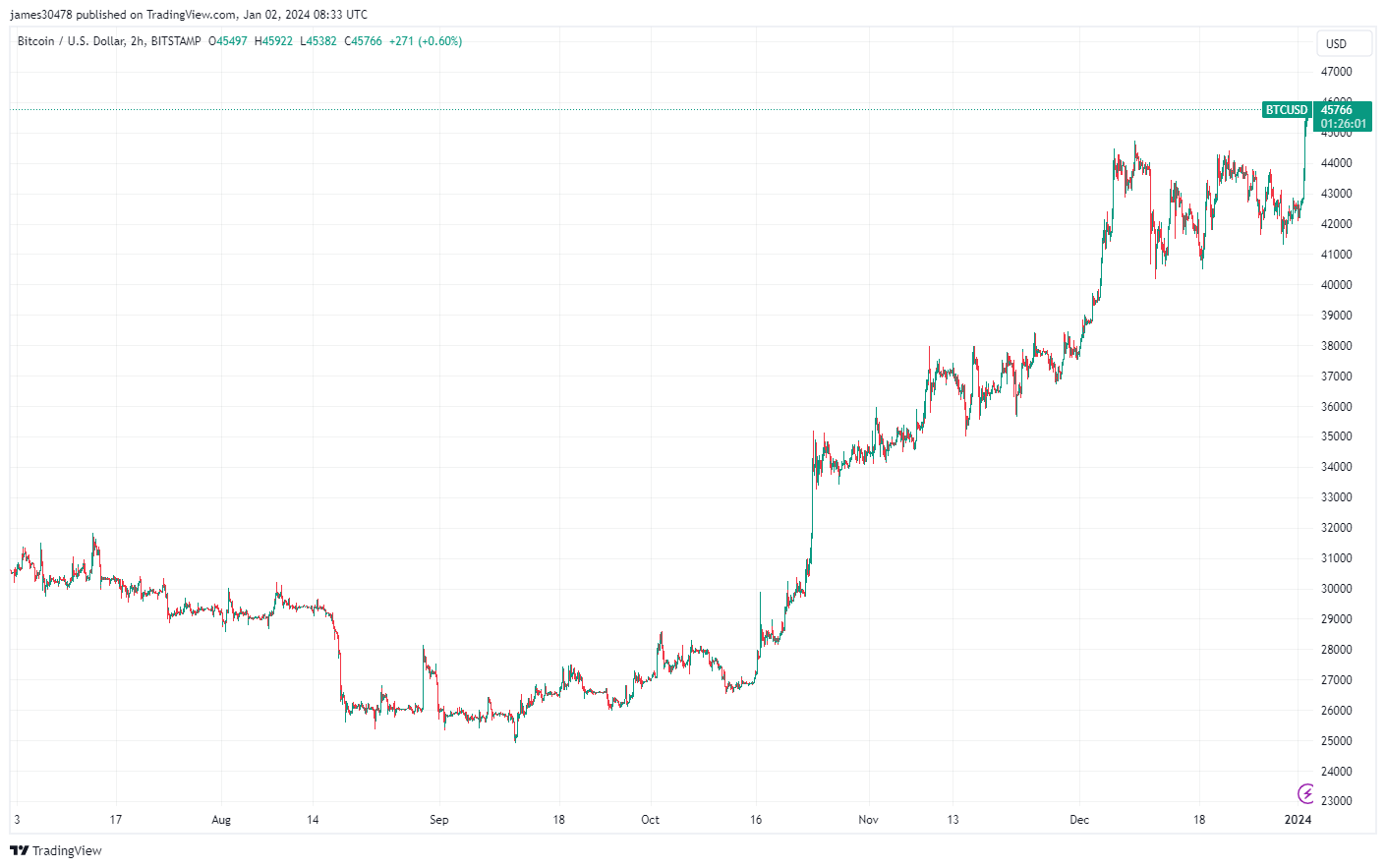

The opening of 2024 has seen Bitcoin demonstrating a robust performance, with an 8% increase already recorded. A notable milestone was achieved when Bitcoin hit the $45,900 mark, which, interestingly, would be a high in 2023.

Despite a minor sell-off towards the end of 2023, recent data shows a significant surge in the total amount of funds allocated in open futures contracts, indicating a growing interest in the leading digital asset, which is a potential spot for ETF approval on the horizon.

In the last 24 hours, there has been a 10% increase in the total open interest, with the top two exchanges, CME and Binance, recording an increase of 8% and 14%, respectively, according to Coinglass.

In conjunction with this, the total digital asset market has experienced a substantial $160 million liquidation in the past 24 hours, with $130 million being shorts. Specifically, Bitcoin has seen $80 million shorts liquidated, according to Coinglass.