Binance leverage ratio hits YTD low while Deribit reaches all-time high

Binance leverage ratio hits YTD low while Deribit reaches all-time high Quick Take

The Estimated Leverage Ratio is a crucial metric that provides a window into the leverage activity within the futures market of a particular exchange, where a higher ratio signals a higher risk due to the market’s susceptibility to significant losses (or gains) from minor market movements.

Analyses of two major exchanges, Binance and Deribit, offer a comparative insight into leverage dynamics in their futures markets.

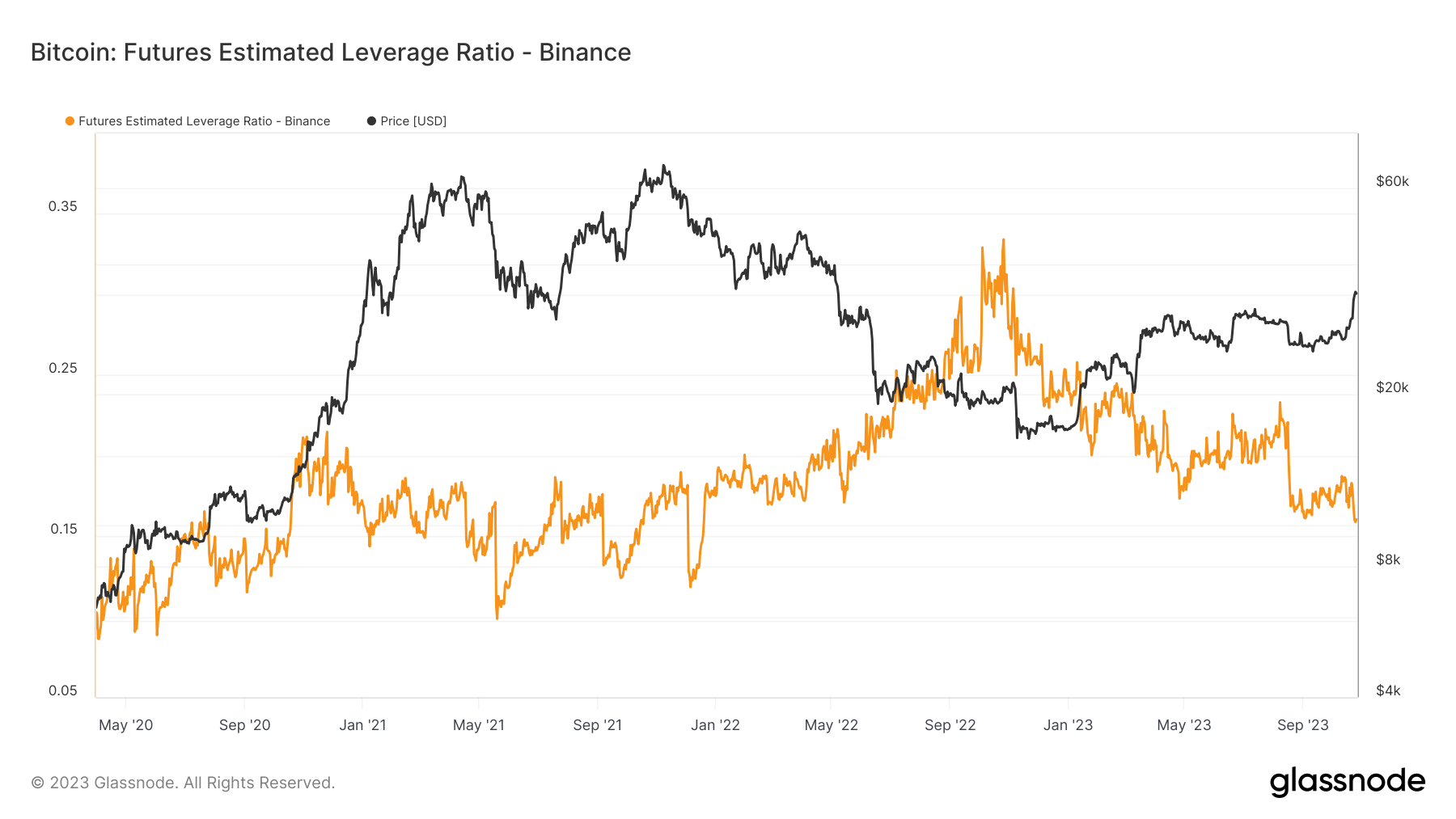

In the case of Binance, the ratio sits at 0.16, which is at Year-To-Date (YTD) lows. This indicates that open interest in futures contracts comprises only 16% of the total funds on Binance.

Binance boasts a total open interest of 108,000 Bitcoin against an on-exchange Bitcoin balance, approximately tallying 675,000.

This could imply that traders may be less eager to hold leveraged positions due to bearish sentiment or uncertainty around Binance as the market sentiment is, overall, bullish. Moreover, it may suggest an increased risk aversion, with more funds remaining unused for leveraged trading.

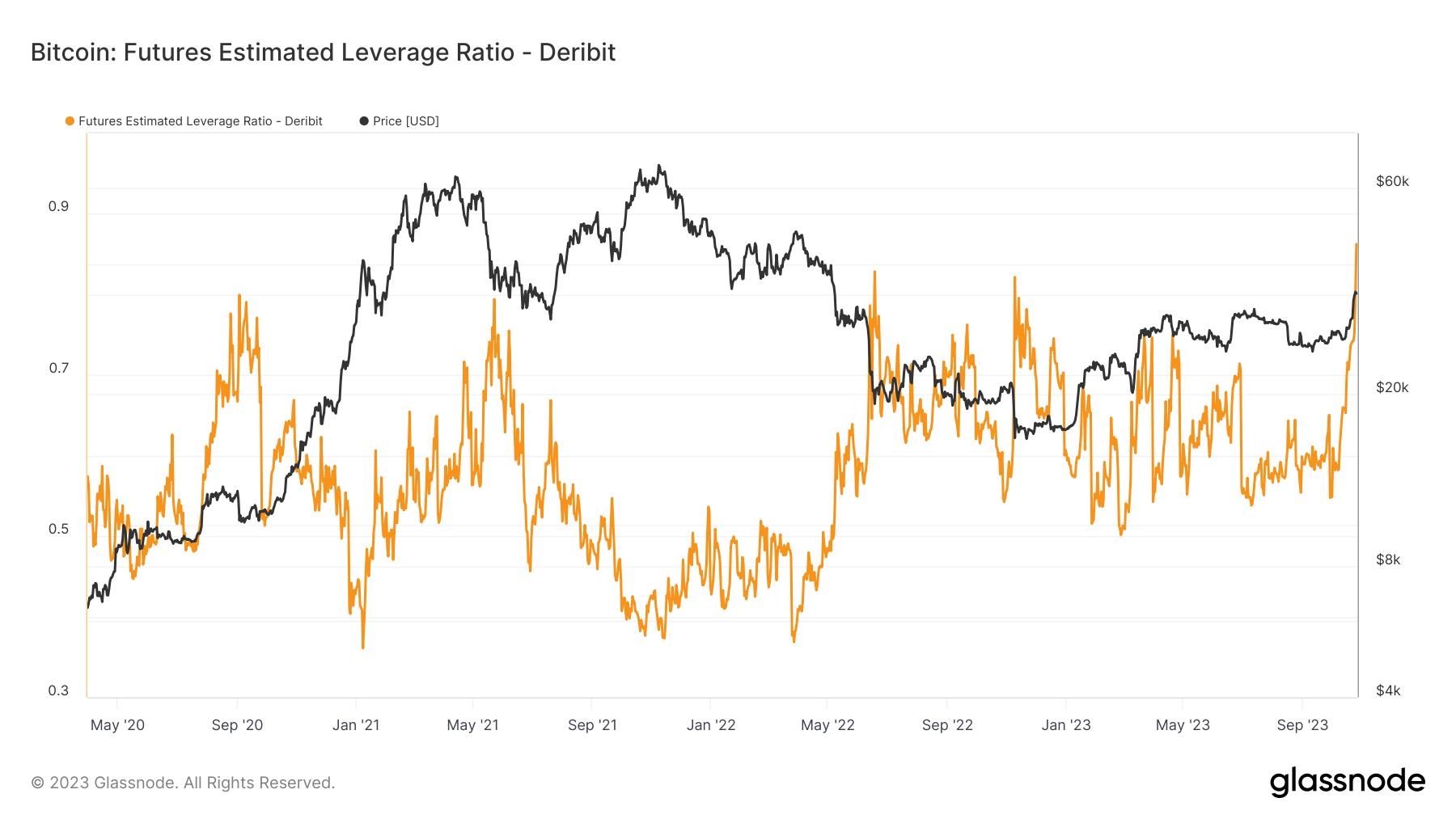

In stark contrast, Deribit’s ratio stands at a notably high 0.86, an all-time peak.

This suggests that there’s a significant amount of open interest relative to the total funds on Deribit. Deribit presents a tighter margin with 37,000 Bitcoin registered in open interest, while its on-exchange Bitcoin reserve is roughly around 43,000.

This could indicate a bullish sentiment or simply reflect the fact that traders on Deribit are more comfortable with high levels of leverage.

However, such high leverage could amplify the risk of substantial losses in volatile market conditions, potentially resulting in a cascade of liquidations if the market swings unfavorably.