94% of Bitcoin’s total supply has now been mined

94% of Bitcoin’s total supply has now been mined Onchain Highlights

DEFINITION: Bitcoin is a uniquely scarce asset, with a hard-capped limit of 21,000,000 coins that can be mined.

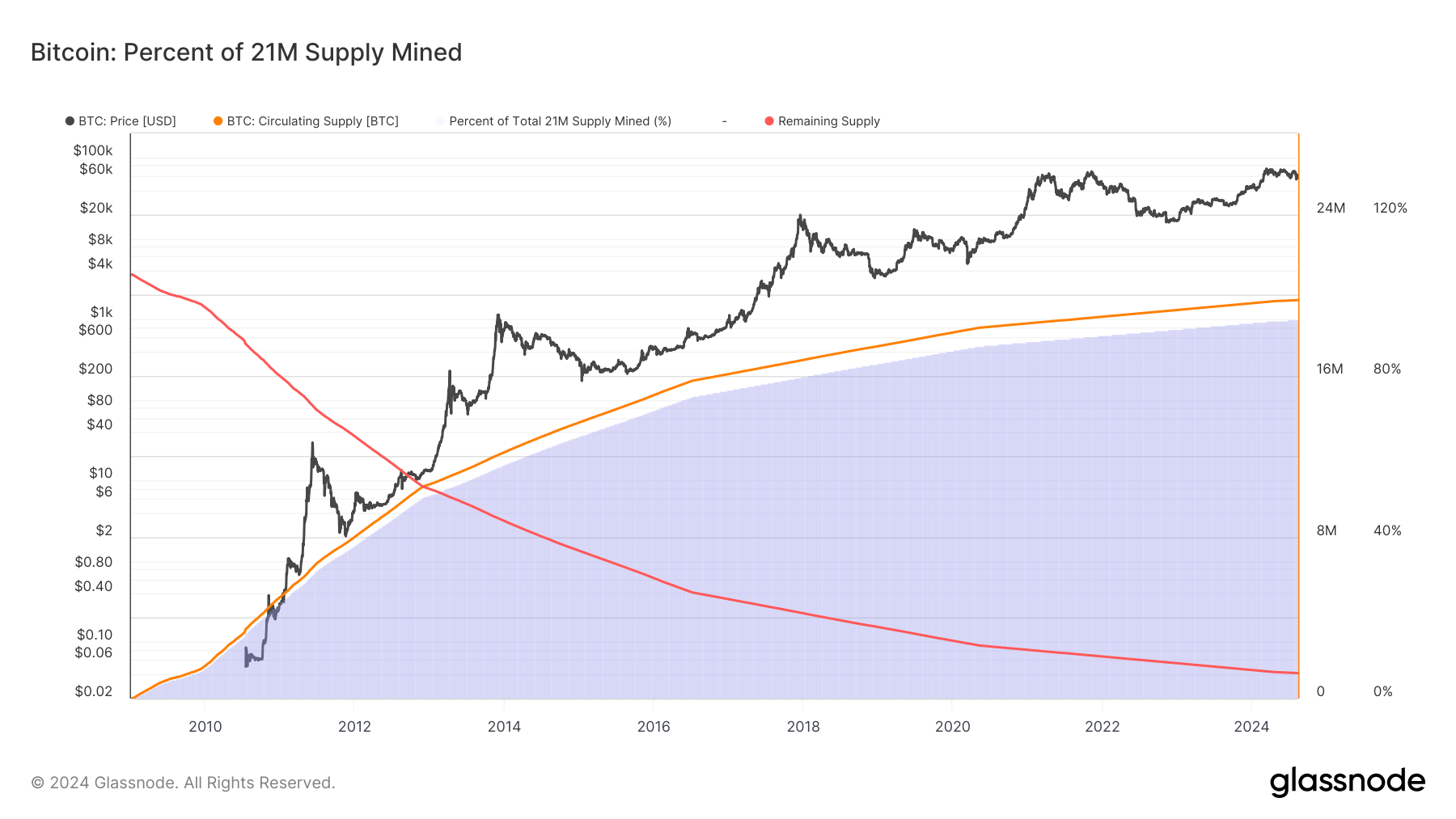

This chart shows the following traces:

- 🟠 Circulating Supply, which reflects the cumulative amount of Bitcoin that has been minted to date.

- 🔴 Remaining Supply, which shows how many coins are left to be mined, with the last coin estimated to be minted in the year 2140.

- 🔵 Percentage of 21M Bitcoin Supply Mined to date.

Bitcoin’s finite supply plays a critical role in its value, particularly when examining the 94% of the total 21 million Bitcoin supply that has been mined as of Aug. 15.

The steady decrease in remaining supply highlights Bitcoin’s disinflationary nature, with scarcity becoming increasingly significant as fewer coins are left to be mined. This scarcity could influence Bitcoin’s price trajectory as demand pressures grow.

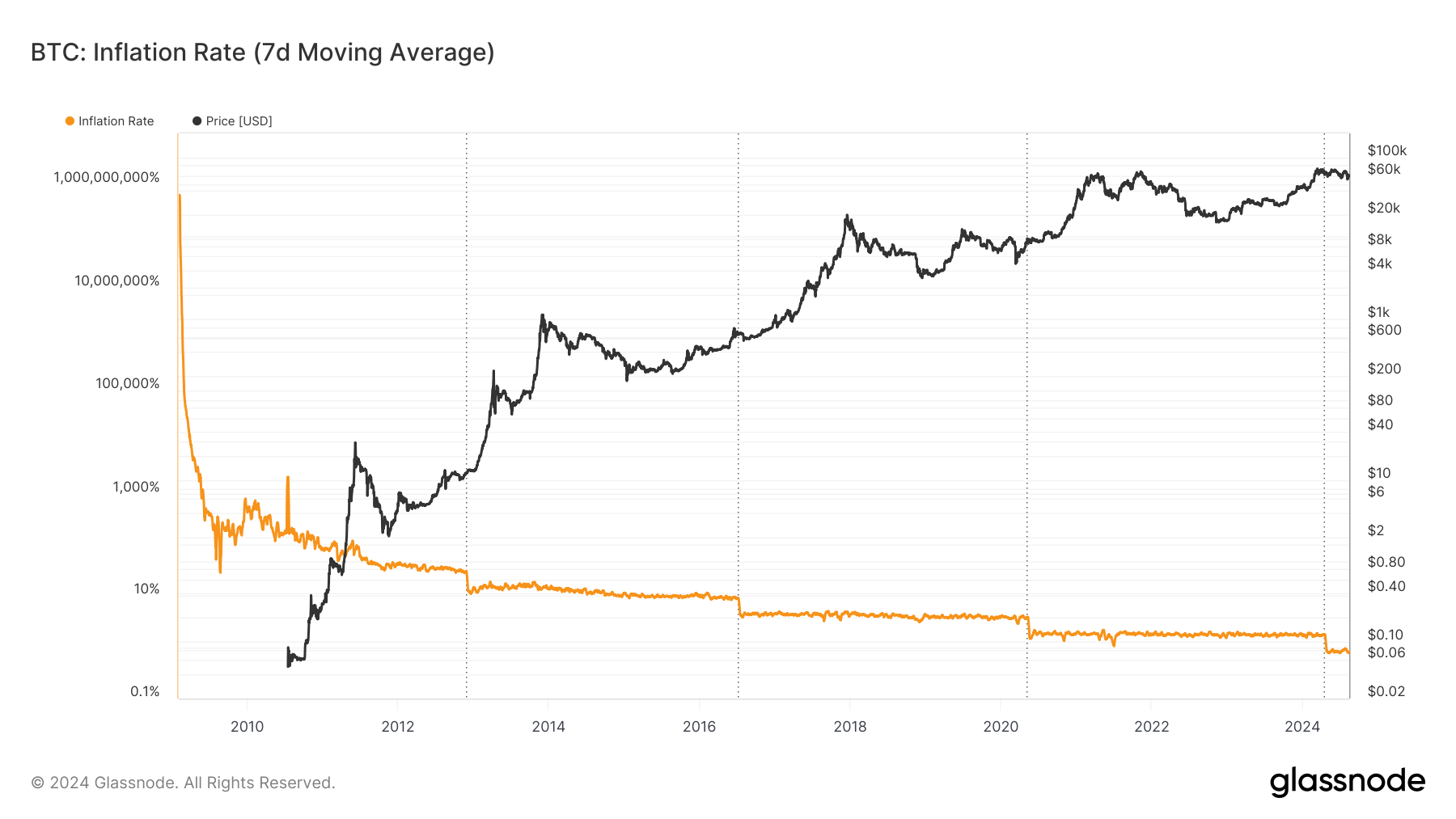

Additionally, Bitcoin’s inflation rate, which started extraordinarily high, has steadily declined due to its halving events every four years. This has stabilized the inflation rate at much lower levels, enhancing Bitcoin’s appeal as a store of value.

The ongoing reduction in Bitcoin’s inflation rate highlights its disinflationary characteristics, making it an attractive option for investors looking for a hedge against traditional fiat currency inflation, which is often more unpredictable and higher.