Idled Ethereum tokens are on the move suggesting incoming volatility

Idled Ethereum tokens are on the move suggesting incoming volatility Idled Ethereum tokens are on the move suggesting incoming volatility

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Ethereum suffered a significant correction over the weekend, dropping more than 18 percent. The price of the second most valued cryptocurrency in the market went from trading at a high of $215 to hit a low of $176 on Monday.

Data from Datamish reveals that the recent bearish impulse saw nearly 5,900 ETH worth of long positions get wiped out on Hong Kong-based cryptocurrency exchange Bitfinex.

Since then, the smart contracts giant has been consolidating within a narrow trading range, but on-chain activity suggests that Ethereum is poised for a significant price movement.

Old tokens on the move

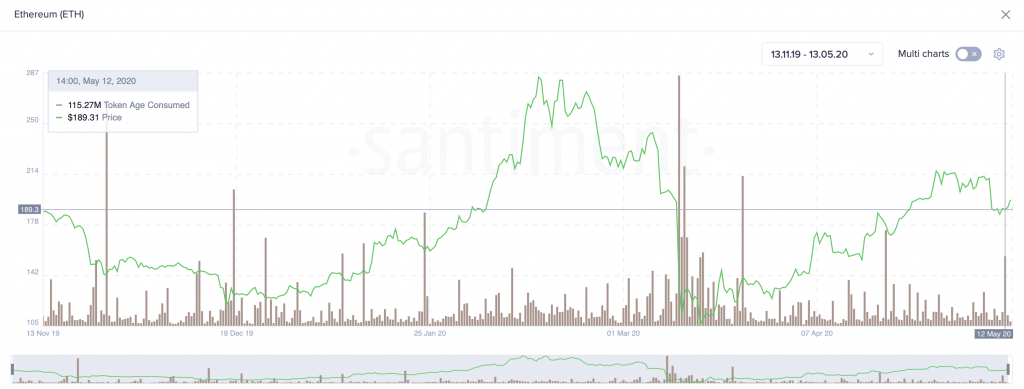

Santiment’s token age consumed chart shows the ratio between the number of tokens changing addresses at a given date and the time since they were last moved. Spikes on this metric are indicative of a large portion of tokens moving after being idle for an extended period, according to the behavior analytics platform.

While token age consumed is not necessarily a price forshadower, there has been a certain level correlation between the two over the past six months. Each time idled tokens are on the move, Ethereum experiences a significant price movement.

During March’s Black Thursday, for instance, as Ether crashed by more than 50 percent to a low of $90, a massive number of old ETH tokens rapidly changed hands. Subsequently, the price of this altcoin rebounded to a high of $154 a few days later.

Then, on Mar. 24, idled tokens began moving, which was followed by a 10% correction. A month later, something similar happened. As Ether was pulling back, there was a spike in token age consumed that led to a full price recovery.

Now, something appears to be brewing in Ethereum.

Ethereum prepares for high volatility

The token age consumed chart shows a substantial spike after the 18 percent nosedive Ether went through over the weekend. If history repeats itself, Ethereum could be preparing for an upswing that allows it to recover the losses recently incurred.

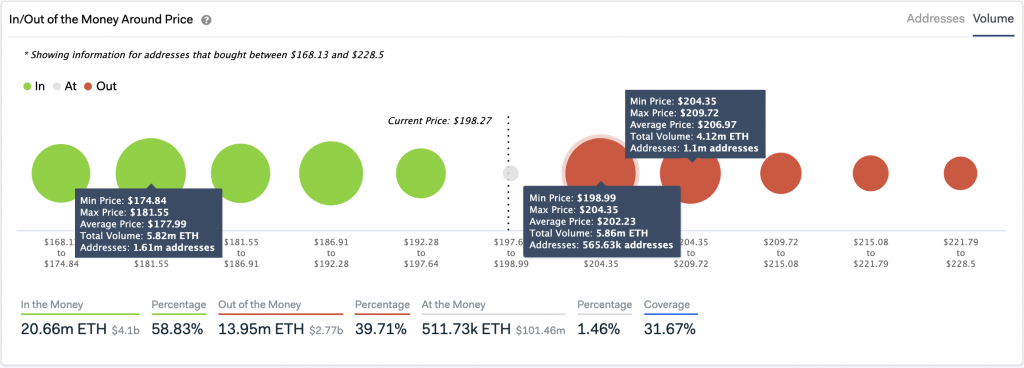

IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model suggests that such an upward advance will not be easy. This fundamental index estimates that more than 1.6 million addresses bought nearly 10 million ETH at an average price of $204.

The massive supply barrier could put a stop to Ether’s rise. However, the IOMAP reveals that if the buying pressure behind ETH is strong enough to break above this wall, the next resistance level to watch out for sits around $228.

The strength of the overhead resistance is something to consider when betting to the upside. Getting rejected from this level could send Ethereum down to $180, where 1.6 million addresses are holding nearly 6 million ETH.

Only time will tell whether or not Santiment’s token age consumed chart can once again anticipate Ethereum’s price movement.

Ethereum Market Data

At the time of press 9:28 am UTC on May. 14, 2020, Ethereum is ranked #2 by market cap and the price is up 4.54% over the past 24 hours. Ethereum has a market capitalization of $22.04 billion with a 24-hour trading volume of $18.15 billion. Learn more about Ethereum ›

Crypto Market Summary

At the time of press 9:28 am UTC on May. 14, 2020, the total crypto market is valued at at $257.38 billion with a 24-hour volume of $154.28 billion. Bitcoin dominance is currently at 67.38%. Learn more about the crypto market ›