Here’s why Bitcoin’s open interest is rocketing despite lackluster price action

Here’s why Bitcoin’s open interest is rocketing despite lackluster price action Here’s why Bitcoin’s open interest is rocketing despite lackluster price action

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoin has once again found itself caught in the throes of another period of consolidation as the benchmark crypto trades just a hair above its key near-term support at $6,800.

This sideways trading has come about shortly after BTC posted a notable breakdown below the support that had been established within the lower-$7,000 region, leading this latest decline to damage its mid-term market structure.

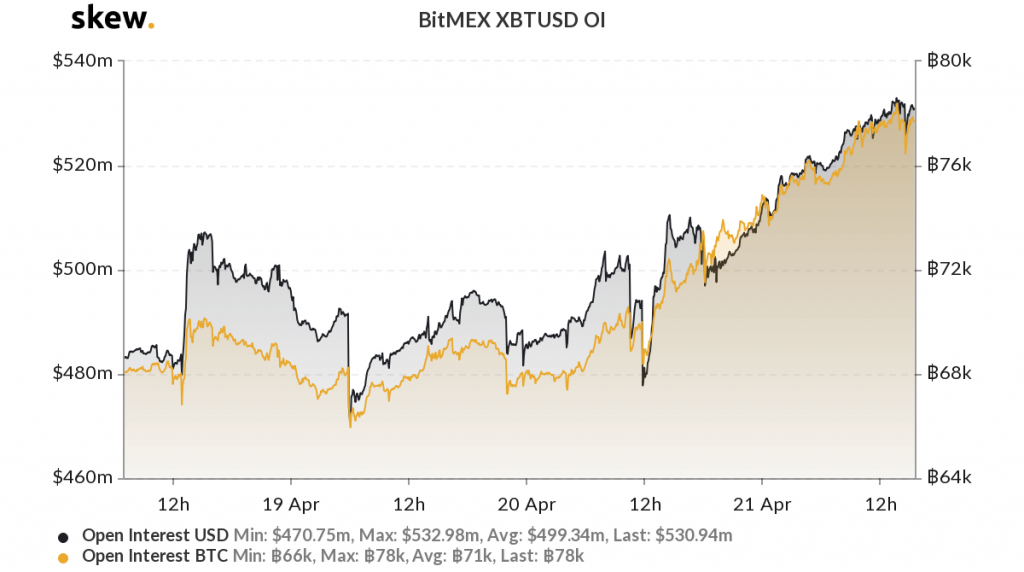

It is important to note that this boring price action may not last for too much longer, as Bitcoin has seen a notable rise in open interest on the Bitmex trading platform – a sign that a major movement is looming on the horizon.

Bitcoin sees rocketing open interest as traders prepare for imminent volatility

Bitcoin’s price is currently trading just above its support at $6,800, which has long been an important support level for the cryptocurrency.

This level was first established as resistance in late-March when the cryptocurrency rallied from its lows of $3,800. The resistance here led the crypto to consolidate for multiple days before bulls led BTC to surmount this level.

Following the confirmed break of this resistance, buyers began establishing this level as support, subsequently leading BTC to bounce here on multiple occasions.

It seems that the importance of this level in the short-term is not being underestimated by traders, as open interest on popular crypto trading platform Bitmex has ballooned in the time following BTC’s initial test of this level.

This trend is elucidated by data from the research and analytics platform Skew, which shows that OI has climbed from weekly lows of 65,000 BTC to its current level of 77,000 BTC.

Here’s another reason why traders may be expecting a big movement

The importance of the support at $6,800 isn’t the only factor that may be leading many analysts to begin opening positions, as Bitcoin’s decline to this level has also coincided with it testing a key descending trendline.

One popular analyst named Teddy pointed out the existence of this trendline in a recent chart, noting that the crypto won’t have a clearly discernable trend until it posts a clear reaction to this line.

“Nothing has changed – still playing with the same rules. Above red: bullish bias. Below red: bearish bias.”

If the crypto losses its support at $6,800, this will also likely force it below this trendline, potentially opening the gates for an explosive downside movement that is fueled by a growing number of open positions on BitMEX.

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=16&h=16&q=75)

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=100&h=100&q=75)