Here’s how Kyber Network’s “Katalyst” upgrade has boosted its fundamental strength

Here’s how Kyber Network’s “Katalyst” upgrade has boosted its fundamental strength Here’s how Kyber Network’s “Katalyst” upgrade has boosted its fundamental strength

Kyber Network (KNC) joins the DeFi party with Katalyst launch

Popular DeFi protocol Kyber Network (KNC) recently released their highly anticipated Katalyst upgrade, allowing KNC token holders to engage with the network on a deeper level.

This upgrade incentivizes investors to vote on important economic proposals for the network by offering staking rewards. Users can also delegate their votes to a trusted user or address.

Despite being widely watched by those involved within the DeFi sector, Katalyst did not have any positive impact on KNC’s price.

From a fundamental perspective, however, it has significantly bolstered Kyber Network, with KNC’s daily active address count and the number of transactions both rocketing higher.

Kyber Network’s Katalyst upgrade doesn’t spark excitement from investors

On July 7th, the Kyber Network implemented its Katalyst upgrade.

The implementation of the upgrade went off without a hitch, and instantly caused the supply of KNC within smart contracts to rocket from 16 percent to 20 percent.

Analytics platform Glassnode spoke about this rise, offering a chart showing the sharp surge that took place following the upgrade’s implementation.

“Just one day after the deployment of Kyber Network’s Katalyst upgrade & the KyberDAO, KNC supply in smart contracts has jumped from 16% to over 20%.”

Despite this being a positive development, it didn’t excite investors.

Just before the upgrade was implemented, KNC was trading at under $1.80. In the time since, its price has been sliding lower, hitting lows of $1.55 earlier today.

It is still trading up nearly 100 percent from its early-June lows of $0.80 but is down slightly from its weekly highs of over $1.90.

KNC’s fundamental strength boosted by Katalyst upgrade

Although it has not boosted the token’s price, the Kyber Network’s recent upgrade has significantly bolstered its fundamental strength.

Blockchain data platform IntoTheBlock spoke about two metrics that elucidate KNC’s fundamental growth in a recent blog post

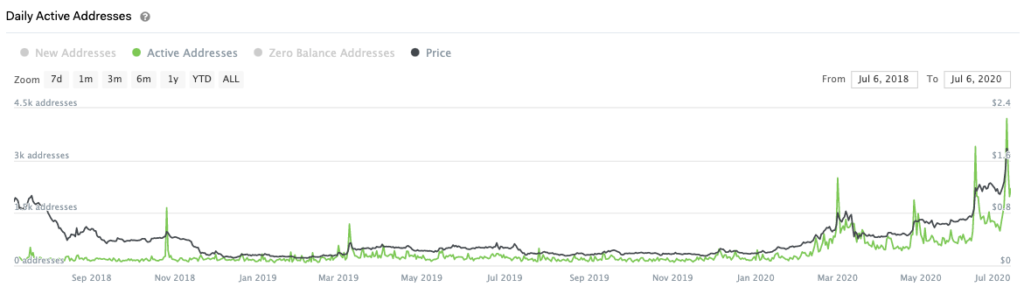

The first facet that has seen a notable uptick is the token’s daily active address count.

They note that this metric has not been this high since April of 2018.

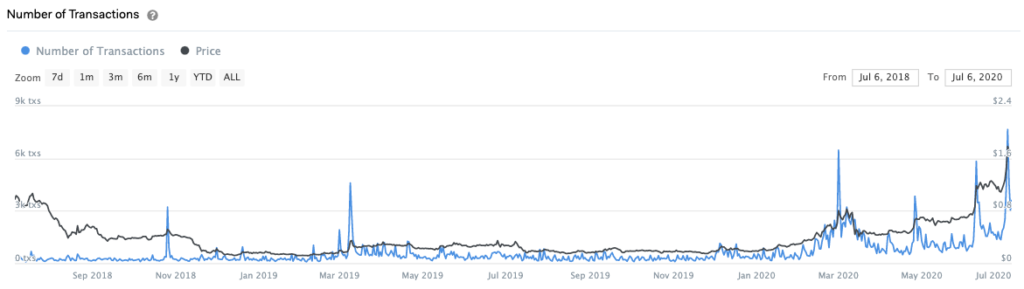

The other facet that has seen growth is the number of Kyber Network’s transaction count, which just hit a fresh 2-year high.

IntoTheBlock explains that the daily transaction count is now ten times higher than that seen at the beginning of 2020.

“The number of daily KNC transactions has averaged 3,970 over the last week, representing almost a 10x increase versus the number seen at the beginning of 2020. Overall, anticipation for the Katalyst upgrade has evidently led to on-chain growth for Kyber’s underlying network.”

KNC’s stalling momentum may be coming about as a result of that seen by the aggregated DeFi sector.