FLEX jumps 7% as 3AC cofounders OPNX exchange goes live

FLEX jumps 7% as 3AC cofounders OPNX exchange goes live FLEX jumps 7% as 3AC cofounders OPNX exchange goes live

Open Exchange (OPNX) is not available for users in the U.S. and other selected regions, according to its terms of service.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

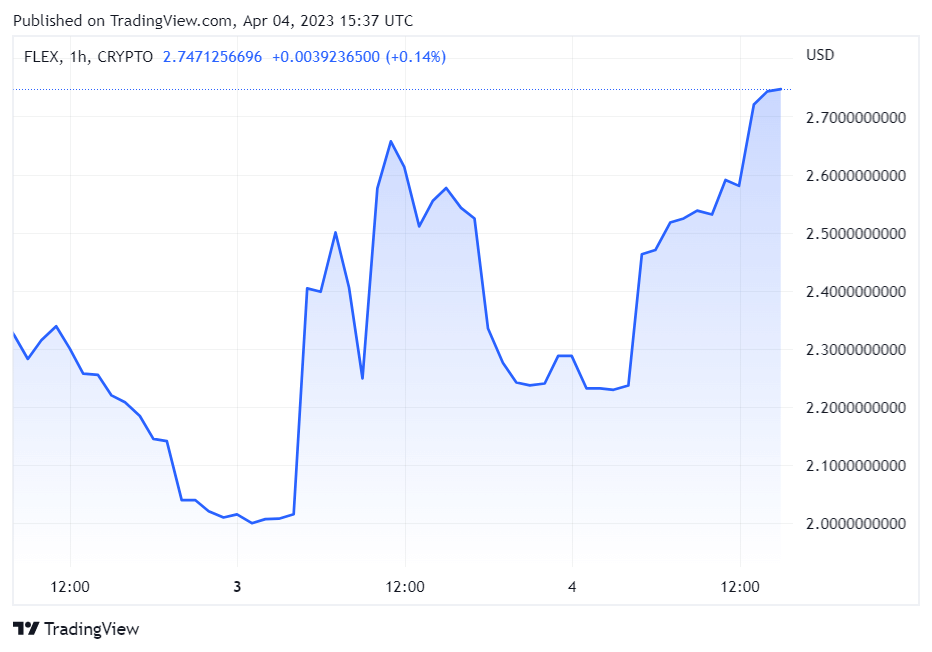

CoinFLEX’s FLEX token increased by more than 7% to $2.73 after Three Arrows Capital’s (3AC) cofounders — Kyle Davies and Su Zhu’s — new Open Exchange (OPNX) went live earlier.

OPNX is a specialized exchange that allows users to trade claims of bankrupt crypto companies. The exchange adopted the FLEX token as its native asset, allowing holders to get up to 50% discount on trading fees.

A visit to the exchange’s website showed that spot and futures trading options were available for cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), USDC, and Dogecoin (DOGE).

However, bankruptcy claims trading is expected to become available at an unannounced date.

The exchange is described as the “first public marketplace for crypto claims” and has drawn heavy criticism due to its link with the 3AC cofounders and the struggling CoinFLEX exchange.

In a video shared on Twitter, OPNX CEO Leslie Lambs said they are building the exchange to help the industry. She added that there are more than 20 million claimants affected by the bankruptcy of several crypto firms like FTX and others.

According to its terms of service, OPNX is not available for users in the U.S. and other selected regions. The exchange is not also available for former government officials or “politically exposed persons” as defined by FATF’s 40 Recommendations.

FLEX rallies

Since OPNX adopted the FLEX as its utility token, the asset has risen by more than 5000% in the current year, according to CryptoSlate’s data.

The digital asset traded for around five cents in January but shot over $2 after OPNX’s adoption.

Going by this, it has outperformed other notable digital assets like Bitcoin and Ethereum during the same period.