European Parliament: Cryptocurrency Could Replace Fiat Currency

Photo by Cuongdv on Pixabay

An in-depth analysis of the fintech sector by the European Parliament Committee on Economic and Monetary Affairs revealed a highly nuanced EU Parliament position on cryptocurrencies, with the committee stating the possibility for crypto to function as an alternative to fiat currency in a variety of different applications.

The July 2018 report, entitled “Competition Issues in the Area of Financial Technology (FinTech),” expands upon concepts explored in the EY policy Department for Economic, Scientific, and Quality and Life Policies report on the future challenges presented by cryptocurrencies.

While the previous report focuses on potential issues presented by the future of cryptocurrencies, the latest investigation published by the EU parliament is focused primarily on the conflicts and competition catalyzed by the rapid innovation of the fintech sector.

EU Parliament Expands Cryptocurrency Horizons as Adoption Accelerates

While the core goal of the new ECON investigation is to anticipate and manage anti-competitive behaviors as they occur with a specific focus on the blockchain and cryptocurrency industry, the report reveals an exceptionally technologically adept perspective from EU regulators.

The growing number of digitally active consumers using fintech platforms such as digital banking, digital transfers and forex, and cryptocurrencies, according to the report, currently sits at 33%, with the UK and Spain leading the way in fintech adoption.

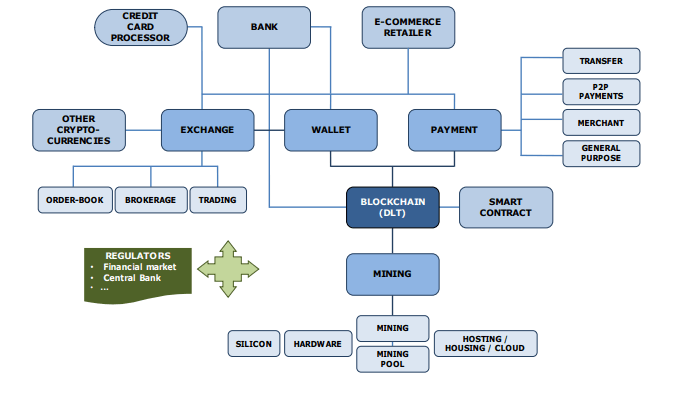

The most interesting element of the EU investigation is the insight it delivers into the EU Parliament stance on cryptocurrencies. The EU Parliament highlights distributed ledger technology as a greatly disruptive influence on the current financial ecosystem, noting that the development of permission bank-developed cryptocurrencies will “reshape the current competition level” of the crypto market, but notes that traditional banks may exert market power to execute predatory pricing schemes in an attempt to stifle decentralized competition.

Cryptocurrencies Are a Source of Disruption for Entire Financial Sector

The EU report identifies cryptocurrencies such as Bitcoin as a hugely disruptive and innovative application of blockchain technology and notes a range of industries in which startups are able to offer more cost-effective services when compared to traditional finance sector organizations:

“In this environment, new agents, particularly tech start-ups, are generally able to offer financial services for lower costs and at a higher efficiency than the incumbents, due to the lack of legacy infrastructures or organizations and the ability to better take advantage of innovations. It is also generally understood that they can offer better user experiences, which poses significant challenges to other agents, especially traditional financial service providers.“

The report places a specific emphasis on the implications of blockchain technology, noting that the permissionless nature of distributed ledger technology allows anybody to participate in the blockchain ecosystem — and its attendant use cases, such as banking — without regulatory oversight:

“If the cryptocurrency DLT is open, or permission-less, everyone can develop any of the activities without requiring any market entry authorisation, even leaving the system without any regulation.”

Interestingly, the EU analysis of potential competition arising between the developing cryptocurrency sector and the incumbent financial market identifies the potential inability of traditional financial institutions to combat the nascent crypto market, stating that central bank adoption of digital currency technology may be necessary in order to establish potential competition issues:

“A potential inadequacy of traditional competition policy to address competition issues in the cryptocurrency markets can be found, suggesting direct public participation through a central-bank digital currency as a remedy”

Ultimately, the EU investigation into fintech competition identifies cryptocurrencies as a strong competitor to incumbent financial services, highlighting the fact that blockchain platforms offer more efficient, lower-cost alternatives to traditional models.

While the EU Parliament may be aware of the disruptive nature of cryptocurrencies, however, oversight does not appear to be an issue for EU regulators — the report accurately outlines that,

“Europe leads, at the international level, the supply of wallet and exchange services, with 42% and 37% in terms of number of players.”