Ethereum’s Shanghai and Capella updates drive $17M inflows: CoinShares

Ethereum’s Shanghai and Capella updates drive $17M inflows: CoinShares Ethereum’s Shanghai and Capella updates drive $17M inflows: CoinShares

Despite the inflows to the ETH-based products, the overall crypto-based investments market recorded a $30 million loss last week.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Ethereum’s (ETH) Shanghai and Capella — Shapella — updates increased investor confidence, which led to $17 million worth of inflows into ETH-based investment products during the week of April 17-23, according to CoinShares’ weekly report.

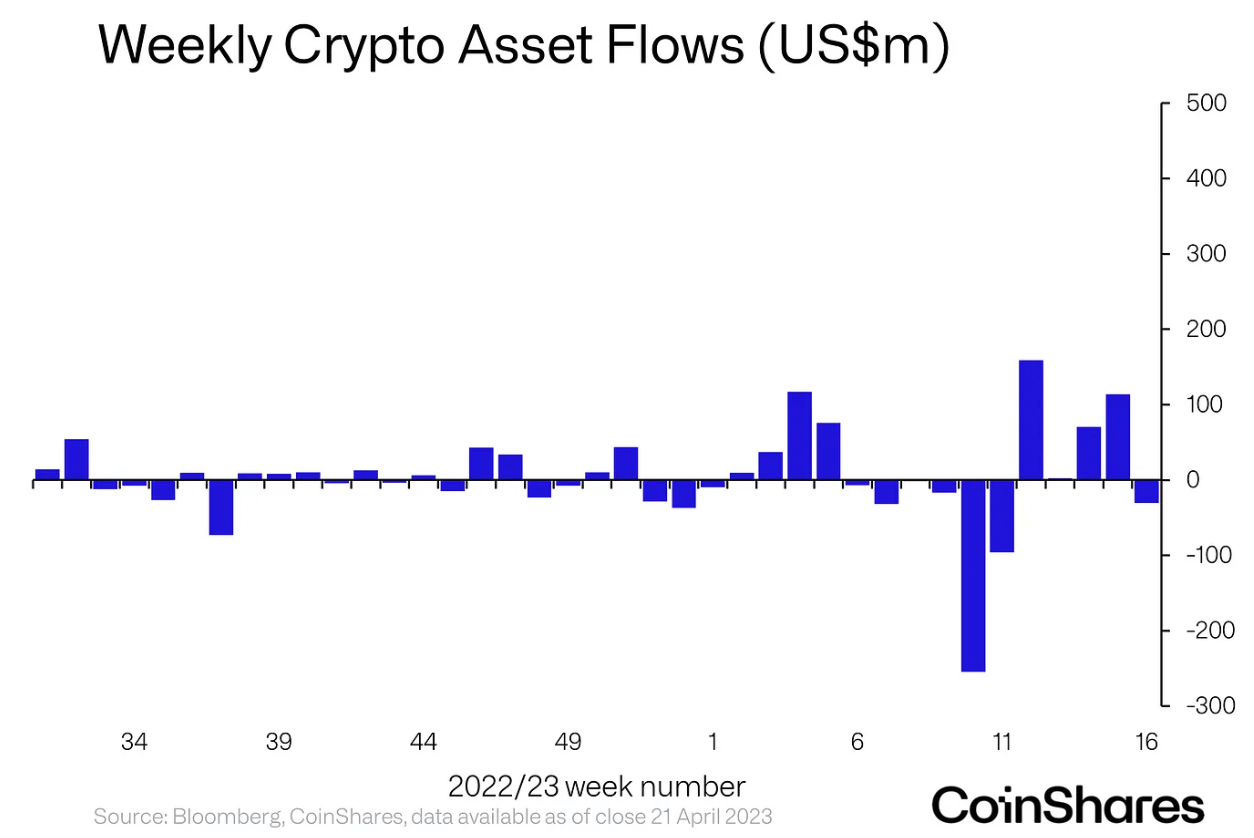

Although ETH-based products flourished, the overall crypto investment tools market recorded a $30 million loss during the previous week, as the CoinShares report stated.

The losses recorded on the week of April 17 were the first hostile movement in five weeks. The report noted that the outflows started to increase during the week before, on April 14 — which was around the time when Bitcoin (BTC) surpassed the $30,000 price mark.

ETH’s Shapella upgrade also coincided during the same week — pushing the investors towards betting on BTC during the week of April 10. Considering that the outflows started to surge during the middle of the week suggests that the sell-off was likely the result of investors who wanted to scoop profits.

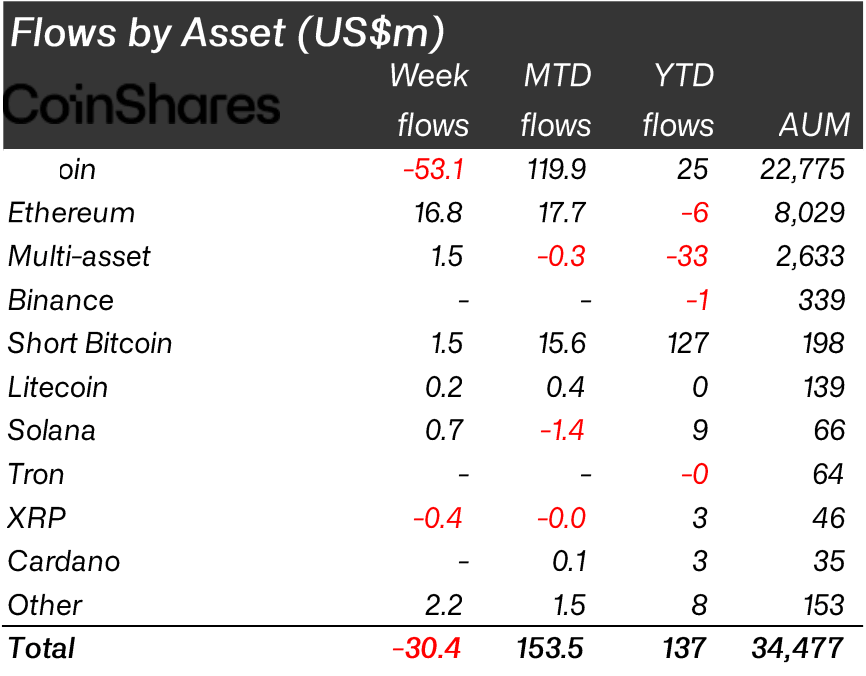

Flows by asset

The outflows emerged on April 14 and continued during the week of April 17. However, as the report defined, the profit-taking was only limited to BTC — which recorded $53.1 million in outflows.

Ripple (XRP) was the only other asset contributing to the outflows by losing $400,000 during the week.

ETH led the assets that contributed to inflows by collecting $16.8 million. Short-BTC products, Litecoin (LITE) and Solana (SOL), also recorded inflows worth $1.5 million, $200,000, and $700,000, respectively.

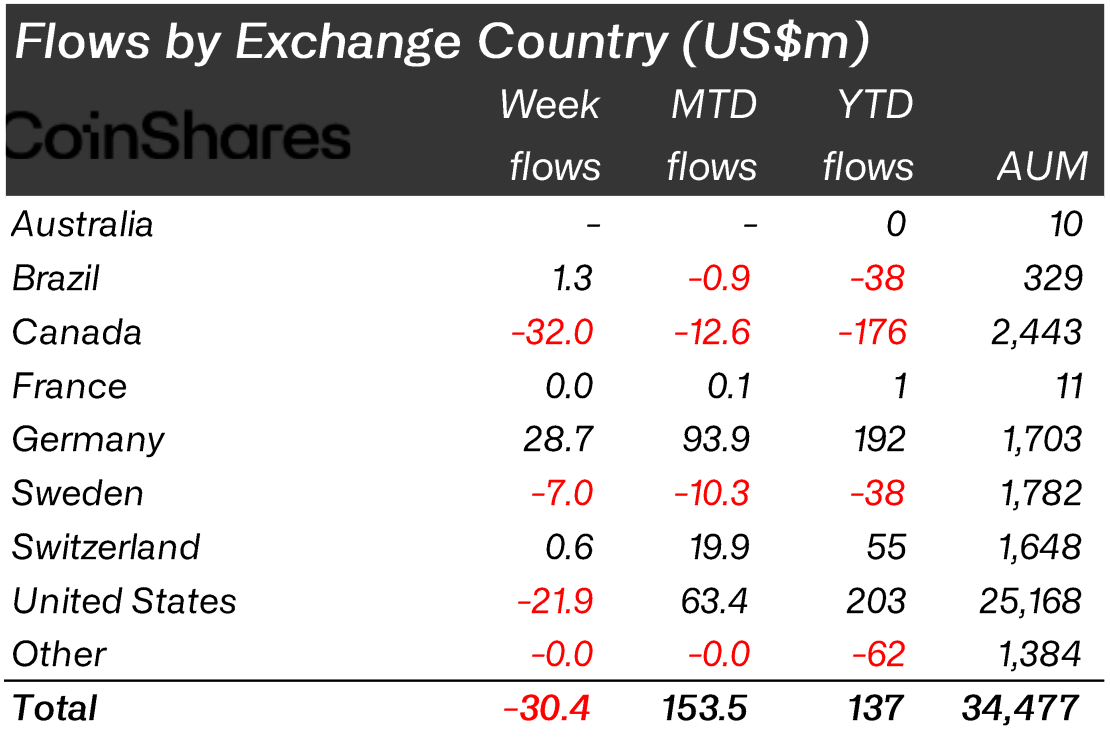

Flows by country

Regionally, North America led the BTC sell-offs. Canada recorded $32 million in outflows — while the U.S. recorded another $21.9 million. Sweden also contributed another $7 million to flows as well.

Meanwhile, Germany emerged as the leading country in inflows by adding $28.7 million to the market. Brazil and Switzerland also recorded inflows — worth $1.3 million and $600,000, respectively.

Categorizing the flows by providers, ProShares emerged as the main provider that recorded the highest amount of outflows worth $23.4 million. 3iQ and CoinShares XBT recorded another $20.9 million and $7 million in outflows.

CoinShares Physical saw $15.7 million in inflows, bringing the aggregate to $8.7 million in inflows for CoinShares. 21 Shares and Purpose also recorded $2.3 million and $900,000 in inflows, respectively.