Ethereum shows strong outperformance of ERC-20 tokens as many fade to darkness

Ethereum shows strong outperformance of ERC-20 tokens as many fade to darkness Ethereum shows strong outperformance of ERC-20 tokens as many fade to darkness

Photo by Jonatan Pie on Unsplash

ERC-20 tokens have become a large component of the Ethereum ecosystem, but many of them have seen unprecedented losses throughout the past year, with only a handful being able to outperform ETH.

Recently released data from a popular analyst highlights the mixed performance seen by this digital asset class, showing that the vast majority of them have seen losses totaling at between 50 and 100 percent.

There are, however, a handful of these tokens – including Chainlink – that have seen insane gains over the past year.

Vast majority of ERC-20 tokens significantly underperform Ethereum

Ethereum has seen some incredibly bullish price action throughout the past year, clocking the majority of its gains in 2020.

Earlier this year, ETH found itself caught within the throes of a parabolic rally that allowed it to climb to highs of $290 before it lost its momentum and ultimately declined all the way to yearly lows that were set within the sub-$100 region.

This decline was short-lived, as it quickly saw a sharp rebound that has since led it back into the $200 region, and the crypto is now showing some tempered signs of being on the cusp of further gains as the aggregated market grows increasingly bullish.

Most of the ERC-20 tokens that were built upon the Ethereum network, however, have not been so fortunate.

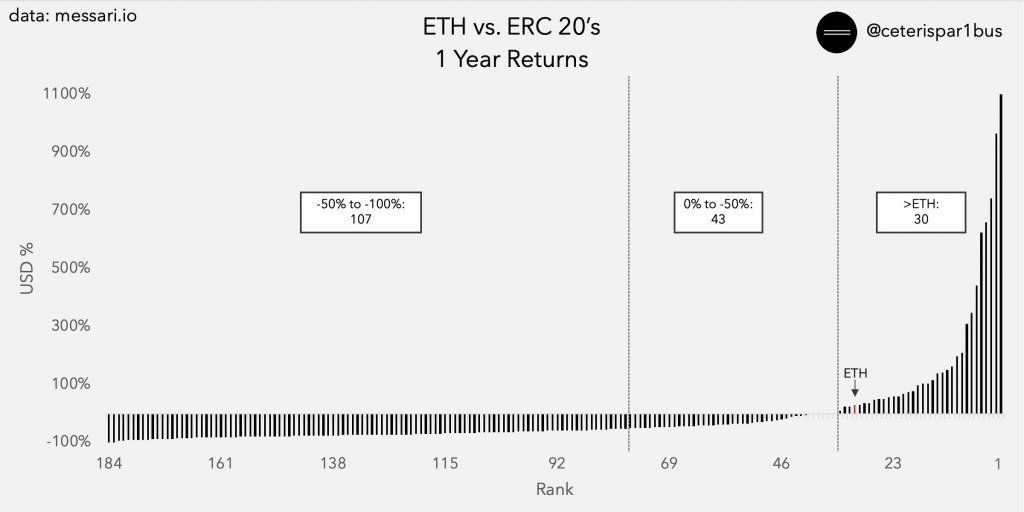

According to data from Ceteris Paribus – a popular analyst – out of 180 ERC-20 tokens, 107 of them have seen one-year returns of between negative 50 and 100 percent, while 43 have declined between zero and 50 percent.

Only 30 of them have outperformed Ethereum’s 30 percent climb seen throughout the past year.

“ETH vs ERC 20’s: 1 Year Returns – 30 outperformed ETH’s 30% – 43 returned between 0 and -50% – 107 returned between -50% and -100%”

ETH shows impressive performance against tokens with illiquid order books

There are some major high market cap ERC-20 tokens that offer liquidity – including Chainlink – but the vast majority have limited liquidity, and thus have price action that is largely controlled by market-making algorithms implemented by the company’s running the projects.

Spencer Noon, head of crypto investments at DTC Capital, noted that Ethereum has seen “impressive performance” for a $20B network as compared to the thinly traded ERC-20 tokens.

“Impressive performance for a $20B network vs. what are mostly a bunch of thinly-traded startups.”

The death of the vast majority of smaller tokens may be a trend that continues strong throughout 2020 as investors flee to more liquid and stable assets like Ethereum.