Ethereum Regains Momentum, Poised to Overtake Ripple by Market Capitalization

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

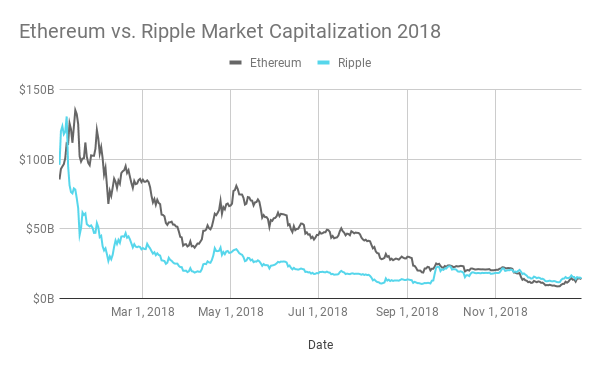

Ethereum’s price has surged in the past week, allowing the cryptocurrency to close its gap with its close rival, XRP. Going into 2019, it’s possible that Ethereum will regain its dominant position as number two by market capitalization.

Vying for Second Position

XRP was number two by market capitalization for most of 2015. Then, the Ethereum ICO was held between July and August of 2014, where it remained under the radar until August of 2015. Then, interest in the project exploded. From there Ethereum has remained at the public forefront and solidified its position as the number two crypto after Bitcoin. That is, until Q4 of 2018.

Ethereum is experiencing a hangover from its astronomical highs in late 2017 and early 2018. At its apex in June of 2017, a single ether was worth a tenth of a bitcoin; Ethereum dominated the market at 32 percent of overall market capitalization. Now, it’s twenty-seven ether to a bitcoin and Ethereum has shrunk to just 11 percent of the overall market.

In 2017 Ripple exploded back onto the scene after lining up a series of heavy-hitting partnerships, including American Express, Santander, RBC, IndusInd Bank, and many others. Ripple has substantially more large-scale institutional customers than any other cryptocurrency. Ripple’s progress allowed XRP to weather the market winter, experiencing smaller losses than most other cryptocurrencies—all while Ethereum withered.

However, over the last month ether has demonstrated sizeable gains. Within the last thirty days, the price of a coin went from $117 to $141, over a 20 percent increase. This recovery has allowed Ethereum to once more vie for the number two spot:

Whether Ethereum will retain its strength or shrink back to the third position by market capitalization is still up for speculation. As the old adage goes, past performance does not guarantee future results.

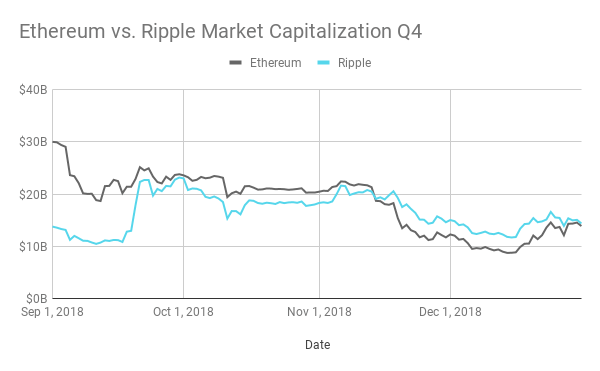

Price Analysis for Q4

For the majority of Q4, Ethereum was devastated by the cryptocurrency bear market. The price of ether went from $283 to a low of $82 a coin. However, within the last week, the price has surged back up to a comfortable $140.

Ethereum seems to be experiencing a hangover from its astronomical gains in 2017. Since then, the lack of forward progress and a mismatch of market expectations with actual results have decimated the price over the course of the crypto winter. The price may have bottomed out at in the low $80s and is now experiencing a rebound as confidence in ether returns, with anticipation of the Constantinople update adding to the resurrection.

Meanwhile, the XRP’s price has deteriorated after experiencing a major jump in September. At the start of Q4 the price of XRP was $0.35, and briefly touched $0.61 mid-September. At its low, the price slumped to $0.29 before returning to $0.36 at New Year.

XRP’s monumental price increase may have been triggered by the announcement of Ripple’s partnership with PNC Bank, a top ten bank in the United States. PNC joined RippleNet on Sep. 19th, allowing PNC customers to receive real-time cross-border payments.

Combined with increases in global remittances along with a string of other positive news, XRP trading volume grew from $200 million on Sep. 16th to $4.1 billion on Sep. 21st. At the present moment, trading volume for XRP rests at a modest $430 million compared to Ethereum’s $2.3 billion, one of the major factors working against XRP.

Ramifications of a Switch

Overall, absolute and comparative market capitalization are both poor tools for assessing cryptocurrencies. For example, projects like now-defunct BitConnect (BCC) thrived by the standard of market cap, ranking in the high 20s in 2017 even though the cryptocurrency was clearly a Ponzi scheme.

However, if Ethereum regains its position as number-two for a protracted amount of time, it’s possible that it will damage confidence in XRP. Whether that will happen though is anyone’s guess.

Tell CryptoSlate what you think in our Ripple vs. Ethereum poll on Twitter.

XRP Market Data

At the time of press 2:44 am UTC on Nov. 7, 2019, XRP is ranked #3 by market cap and the price is up 7.04% over the past 24 hours. XRP has a market capitalization of $14.74 billion with a 24-hour trading volume of $2.44 billion. Learn more about XRP ›

Crypto Market Summary

At the time of press 2:44 am UTC on Nov. 7, 2019, the total crypto market is valued at at $172.45 billion with a 24-hour volume of $79.69 billion. Bitcoin dominance is currently at 50.64%. Learn more about the crypto market ›

Ethereum Market Data

At the time of press 2:44 am UTC on Nov. 7, 2019, Ethereum is ranked #2 by market cap and the price is up 11.44% over the past 24 hours. Ethereum has a market capitalization of $17.71 billion with a 24-hour trading volume of $10.74 billion. Learn more about Ethereum ›

Crypto Market Summary

At the time of press 2:44 am UTC on Nov. 7, 2019, the total crypto market is valued at at $172.45 billion with a 24-hour volume of $79.69 billion. Bitcoin dominance is currently at 50.64%. Learn more about the crypto market ›