Ethereum outperforms Bitcoin 2X in Compound Annual Growth Rate over past 4 years

Ethereum outperforms Bitcoin 2X in Compound Annual Growth Rate over past 4 years Ethereum outperforms Bitcoin 2X in Compound Annual Growth Rate over past 4 years

On-chain data shows that Ethereum has performed twice as well as Bitcoin over the past 4 years with a CAGR of 66%

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

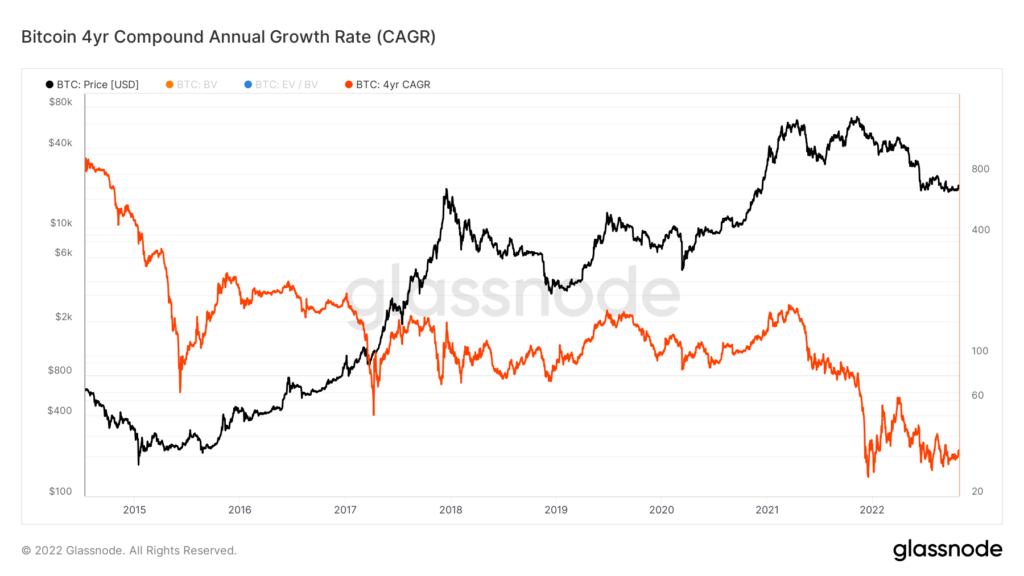

Data on the four-year Compound Annual Growth Rate for Ethereum and Bitcoin from the on-chain analytics platform Glassnode shows that ETH has outperformed Bitcoin since October 2019. The data is available via the two charts below, which depict the CAGR for both Ethereum and Bitcoin over the past four years.

The period was selected to capture both the classic Bitcoin halving cycle while also accounting for the typical bull/bear cycle, which tends to be of a similar duration. Bitcoin recorded a CAGR of 34.1%, but Ethereum returned almost double at 66.3%

CAGR data for Ethereum started in July 2019, and since then, the correlation between Ethereum and Bitcoin has been relatively low. Bitcoin’s peak CAGR was back in 2014, while Ethereum peaked on October 20, 2019.

Bitcoin’s peak CAGR was close to 800%, while Ethereum’s all-time came at around 350%. Both currencies have seen a decline in CAGR as their market cap increased and the markets matured. However, while Bitcoin has been on a downward trend in CAGR since 2016, Ethereum has seen growth in 2019 and 2021.

Further, the CAGR for Ethereum has been steadily climbing since June, yet Bitcoin has been range bound between 36% and 61% throughout the year. A crucial deviation between the Bitcoin price and the four-year CAGR occurred around July 2021. The CAGR of Bitcoin had been relatively correlated with its price until this point. However, as Bitcoin’s price returned to near 2017’s highs, the CAGR fell off a cliff in November 2021, just after Bitcoin recorded its all-time high.

Following the significant upgrades to the Ethereum network that occurred due to The Merge, could its CAGR indicate that it will lead the next bull run? The fundamentals of Ethereum and Bitcoin have changed more than ever, heading toward the 2024 Bitcoin halving.

Ethereum’s max supply has slowly been falling since The Merge, and an increase in on-chain activity could speed up this process. Bitcoin’s maximum supply is fixed, and emissions will be halved during the next halving. However, Ethereum has just underdone what was known as a ‘triple halving’ as the effects of The Merge reduce ETH emissions by a factor of three halving events.

The previous two Bitcoin halvings occurred around 18 months before a new all-time high was recorded. Could the same delayed effect play out for Ethereum following The Merge to ignite the next bull run?

CryptoSlate releases daily research reports on the data covering events like these. Make sure to bookmark our Research category to stay up to date on any developments in the data included in this article.