Ethereum Berlin upgrade is now live—how will it affect ETH prices?

Ethereum Berlin upgrade is now live—how will it affect ETH prices? Ethereum Berlin upgrade is now live—how will it affect ETH prices?

The upgrade includes a mechanism to fix the infamously high gas fees on Ethereum.

Photo by Christian Lue on Unsplash

The new ‘Berlin’ upgrade stands to make high gas fees on Ethereum are all set to be a part of history, at least by a small amount.

Berlin is here ?? https://t.co/CvL9rWeOuc

— Tim Beiko | timbeiko.eth ☀️ (@TimBeiko) April 15, 2021

What Berlin brings to Ethereum

Completed today, Berlin has incorporated four Ethereum Improvement Proposals (EIPs), submitted by users in its upgrade. Two of the major ones are EIP-2565 and EIP-2718—the former helps reduce some gas costs algorithmically; the latter a ‘wrapper’ that allows multiple transactions on the blockchain.

Understanding ‘Gas’ requires preliminary knowledge of how Ethereum works. The network is maintained and all transactions are processed by ‘miners,’ or entities with massive computing power at their disposal who solve millions of complex mathematical problems each second to ‘mine’ blocks and win ETH ‘rewards.’

These miners use up a lot of resources in maintaining the network, meaning they are economically incentivized to do things that, ultimately, lead to more revenues for them.

This is where Gas starts to creep in. On paper, it’s simply a small ETH amount included by users conduct a transaction or execute a contract on the Ethereum blockchain platform. Miners pocket these fees, and prefer to include blocks or process transactions which brings them the most gain.

Welcome to #Berlin! ??

Our first block mined after the fork: https://t.co/y7XMyswKl2 https://t.co/gIwdeNoR8f

— f2pool (@f2pool_official) April 15, 2021

And in bull markets, token pumps, and jaw-dropping yield farms, the inclusion of transactions into blocks becomes a numbers game. ‘Wealthy’ users can include bigger amounts of Gas as fees, which in turn ends up making the whole network more expensive.

It’s where the EIP-2565 and EIP-2718, i.e. today’s Berlin upgrade, step in. These would make the network a tad cheaper while bringing in other technical advantages.

ETH prices

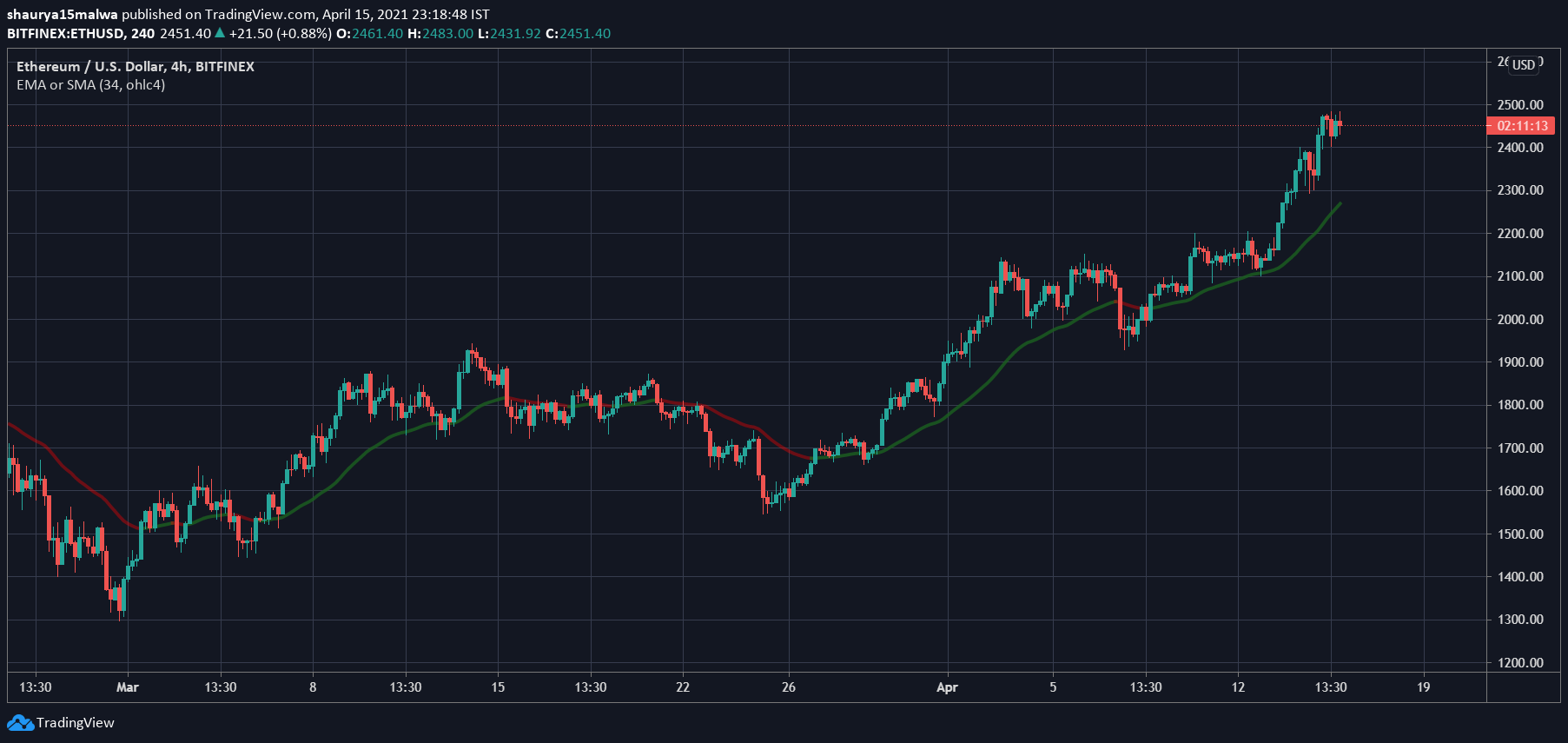

The buildup to Berlin saw ETH touch new all-time highs of nearly $2,500. The asset powers the world’s most-used blockchain, and is used to pay for transactions and smart contract integrations on the Ethereum network.

Lower fees mean active code development and an engaged developer community, which, in turn, translates to a better long-term outlook for the currency. As the image below shows, ETH trades above its 34-period moving average, a popular tool used by traders to determine the market trend, and remains in a strong ‘uptrend.’

ETH trades at $2,447 at press time and has a network value of $282 billion. Its current circulating supply is 115 million ETH.