Ethereum active addresses rocket as crucial moment fast approaches

Ethereum active addresses rocket as crucial moment fast approaches Ethereum active addresses rocket as crucial moment fast approaches

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Ethereum has seen a notable price spike today that has come in tandem with a recovery seen across the aggregated cryptocurrency market. This movement has allowed ETH to recapture its position above $180 as Bitcoin navigates into the $7,000 region.

One interesting fundamental development that has coincided with Ethereum’s recent price rise is that its number of active addresses has been rocketing upwards, rapidly approaching its one-year highs.

This heightened activity from investors comes as the crypto nears what analysts are calling a “crucial moment” that could determine which direction the asset trends in the weeks to come.

Ethereum pushes higher as market participants grow increasingly active

At the time of writing, Ethereum is trading up just over five percent at its current price of $182, up from daily lows set within the lower-$170 region yesterday.

This climb came about concurrently with that seen by Bitcoin and most other cryptos, and ETH is currently one of the best performing altcoins – only trailing the 24-hour gains seen by Tezos by roughly 2%.

This movement marks an extension of the uptrend that Ethereum first incurred when it dipped to its sub-$100 yearly lows in mid-March, and bulls are beginning to show some notable signs of strength.

One factor that could influence ETH’s price trend in the near-term is increased market participation rates amongst investors.

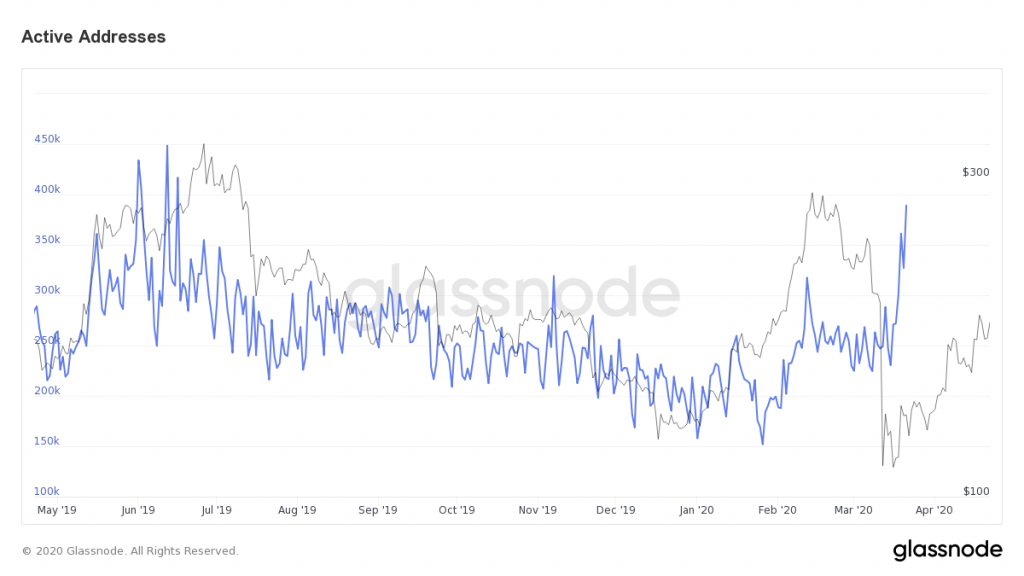

According to data from analytics platform Glassnode, Ethereum’s active address count has spiked in recent times, climbing from 200,000 in early-March to nearly 400,000 by the end of the month.

Although the data is trailing by a couple of weeks, it is possible that this trend has extended due to the strength of its uptrend seen throughout April.

The highest active wallet count that Ethereum has seen in the past year is 450,000 – a number that may soon be surpassed.

It’s a critical moment for ETH from a technical perspective

This heightened market participation rate comes as Ethereum enters what analysts are describing as a “crucial moment.”

One popular pseudonymous options trader on Twitter named Chase_NL spoke about this in a recent tweet, explaining that how Ethereum and Bitcoin react relative to each other will offer key insights into where they will both trend in the weeks ahead.

“Crucial moment here for BTC and ETH. Can ETH rally hard enough to bring BTC back above the yearly open? Or will BTC’s sluggishness and inability to close above the yearly open bring ETH back downwards? This will set my ‘bias’ for the coming days/week most likely.”

The coming days are likely to hold in store further volatility for Ethereum, as the ballooning market participation rates are bound to magnify the intensity of movements in both directions.