DEXs Are Already Here, but Are They Really Decentralized?

DEXs Are Already Here, but Are They Really Decentralized? DEXs Are Already Here, but Are They Really Decentralized?

Decentralized exchanges (DEXs) are live and running but they’re facing an ongoing liquidity problem that is currently handled by centralized exchanges and in some cases– with less-than-honest methods. DEXs promise to deliver true decentralization but still heavily rely on centralized governance. Is it possible to create a truly decentralized exchange?

Where Are the DEXs, and What Are They Doing Differently?

Despite the need for liquidity management in any market, there are already a number of decentralized exchanges are active and trading. IDEX is the only decentralized Ethereum exchange active within the cryptocurrency market and currently boasts a modest 24-hour trading volume of $6.6 million.

As a decentralized exchange, however, IDEX doesn’t charge fees for token listing:

“We evaluate each and every token submitted to make sure it matches our listing criteria, and determine whether or not to list it based on the quality of the project it supports. It is that simple.”

The listing process for IDEX still depends upon approval by the IDEX team, which carries out an evaluation of the platform — a process that is still technically centralized. There are a number of other Ethereum-specific decentralized exchanges, such as EtherDelta and 0x — the latter intends to not only eliminate centralized exchange structure but also completely decentralize the governance structure of an exchange.

Some DEXs have taken unique approaches to the issues presented by decentralized models. Kyber Network DEX, for example, is able to beat the liquidity issues by incorporating “reserve managers” into its economic model and using a liquidity pool created during the ICO Stage.

However, there are still a few concerns with DEXs that make them far less popular than their centralized competition. Before they can compete with centralized exchanges, DEXs face a large obstacle: accessibility. Many DEXs are relatively complex, making them unapproachable to newer crypto investors. Moreover, the decentralized nature of DEXs makes them incompatible with any kind of link to fiat currency trading.

DEXs are, for the most part, decentralized. Free from legal or regulatory obligations caused by maintaining custody of customer capital, DEXs enjoy loose regulation and offer crypto traders the ability to trade with each other in a true peer-to-peer manner. Most DEXs, however, don’t incorporate governance models that list tokens in a decentralized manner, leaving listing decisions to centralized teams.

The Future of Centralized Exchanges

Decentralized exchanges may not be ready for prime time, but there are a number of changes afoot within the cryptocurrency exchange landscape that could bring integrity and transparency integrated into centralized exchanges.

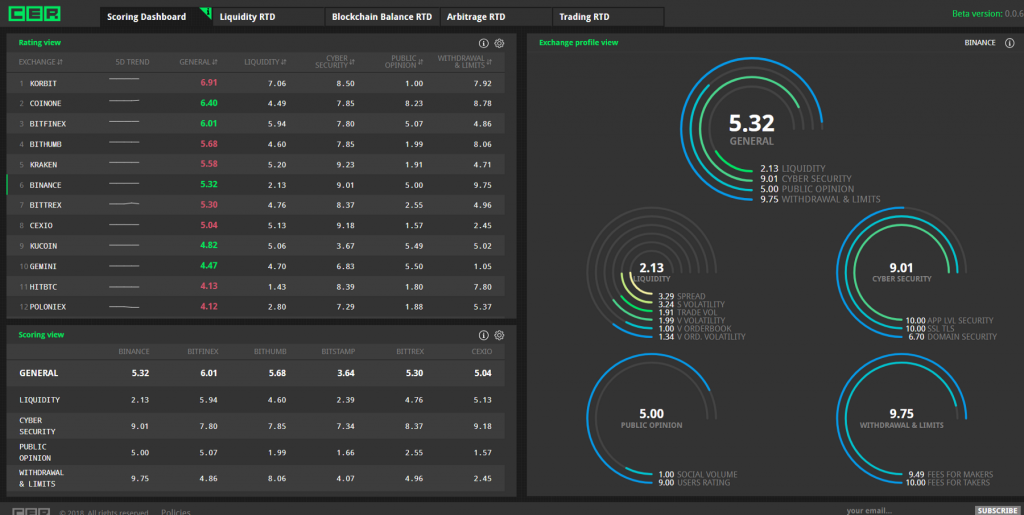

White hat community token project Hacken recently launched Crypto Exchange Ranks (CER), a platform that provides live analysis of data gathered from accounts opened on cryptocurrency exchanges. CER highlights liquidity, quotations clarity, arbitrage trading, legal compliance and legitimacy, community opinion, and security in order to provide traders with the genuine integrity of any given exchange.

In an interview with CryptoSlate, CER CEO Dmytro Shestakov highlighted the importance of transparency within the cryptocurrency exchange ecosystem. Shestakov stated that the launch of Crypto Exchange Ranks corresponds to Hacken’s mission of making the crypto economy setting clear, objective standards. In order to improve the current market landscape, several changes must occur according to Shestakov:

“First, liquidity transparency should be proved by quotations clarity and anti-manipulation detection mechanisms. Second, KYC and AML procedures should be clearly settled and pursued. Third, bug bounty programs might be an integral practice. Fourth, technical infrastructure should be developed according to best world standards of exchange technologies.”

Custodial practices must also be improved:

“Fifth, counterparty risks of crypto exchanges might be mitigated by segregating depository activity by cold and hot wallets. Sixth, market needs for standardization and certification, mapping of PCI DSS and ISO 27K standards to crypto exchange market.”

Blockchain-Based Settlement Could Solve Transparency Issues

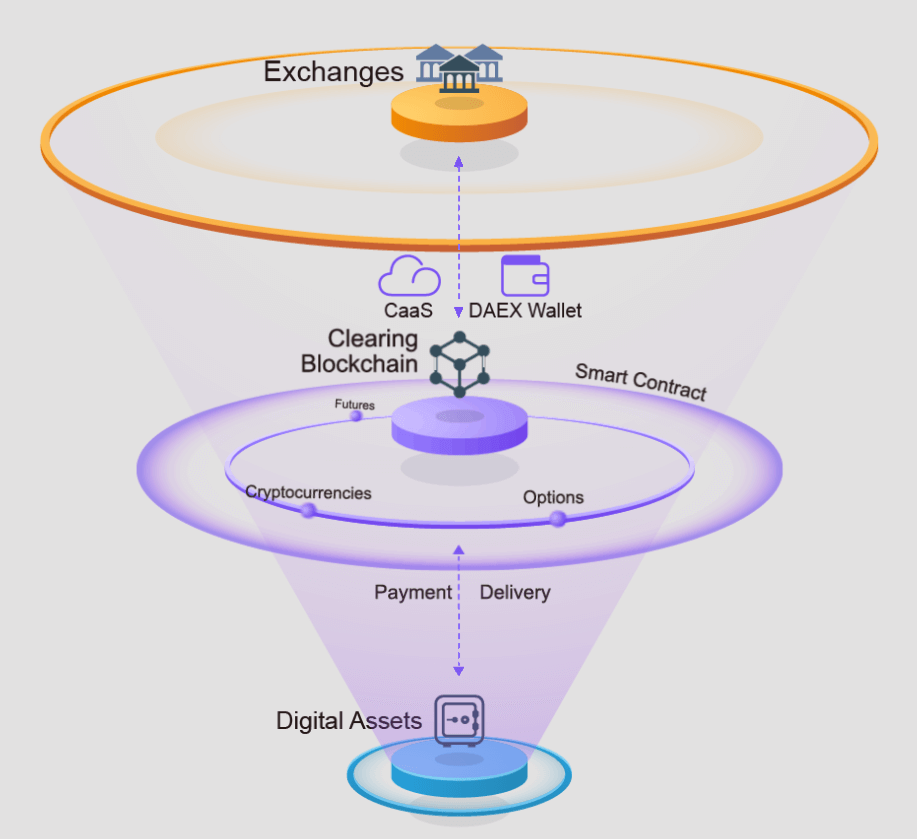

While Hacken may be attempting to improve exchange transparency and integrity with data collection, another project is seeking to enforce it with blockchain technology. DAEX is a relatively unknown blockchain project that aims to establish a new clearing and settlement model to solve the safety and trust issues present in the current centralized exchange paradigm.

By programming clearing and settlement rules into smart contracts on a DAEX clearing blockchain, the DAEX project aims to eliminate third party individuals or institutions from the clearing process. As a result, the project would deliver a hybrid of decentralized and centralized approaches to promote exchange transparency.

DAEX Chairman Benjamin Gu, speaking with CryptoSlate, highlighted the benefits of a blockchain-based settlement layer:

“By using distributed ledger technology to do post-trade clearing, DAEX effectively removes lots of functions performed by a traditional clearing house. The clearing process is, therefore, more effective and less costly. It also reduces customer’s market risk.”

Centralized exchanges, however, are at least aware of the threat DEXs present to their current dominance. Binance, one of the largest exchanges in the world, announced its intent to create a hybridized DEX via its Binance Chain project earlier this year, predicting that “Centralized and Decentralized exchanges will co-exist in the near future, complementing each other, while also having interdependence.”