Deputy Treasury Secretary warns crypto companies not to neglect safeguarding against illicit finance

Deputy Treasury Secretary warns crypto companies not to neglect safeguarding against illicit finance Deputy Treasury Secretary warns crypto companies not to neglect safeguarding against illicit finance

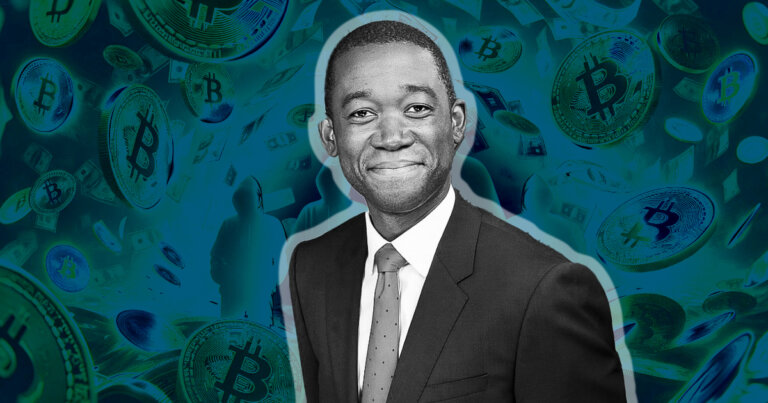

Deputy Treasury Secretary Wally Adeyemo said if digital asset companies "do not act to prevent illicit financial flows, the United States and our partners will."

United States Department of the Treasury / Public Domain. Remixed by CryptoSlate

The U.S. government has raised concerns about digital asset companies failing to address the flow of illicit funds in the industry adequately.

In an Oct. 27 speech delivered at London’s Royal United Services Institute, Wally Adeyemo, the U.S. Deputy Treasury Secretary, pointed out that some companies in the crypto industry are primarily focused on technological innovations, which makes them sometimes overlook the potential consequences of the unlawful flow of funds.

Adeyemo stated that while the majority of stakeholders in the industry are collaborating with the authorities in stamping out terrorist funding, “there are those in the digital asset space who wish to innovate without regard to consequences instead of doing so responsibly, including protecting against illicit financing.”

“Our expectation is that financial institutions and digital asset companies and others in the virtual currency ecosystem take steps to prevent terrorists from being able to access resources. If they do not act to prevent illicit financial flows, the United States and our partners will,” Adeyemo added.

Crypto in terrorism

Adeyemo’s statement is coming on the heels of growing concerns over the role cryptocurrencies play in funding terrorism, particularly in the aftermath of the Hamas attack on Israel.

Several crypto stakeholders, including Coinbase, have extolled the potential for crypto and blockchain technology to mitigate terrorist funding. However, some U.S. lawmakers, like Senator Elizabeth Warren, have, in some instances, overstated the extent to which terrorists exploit these technologies for their benefit.

During an Oct. 26 Senate Banking Committee hearing on “Combating the Networks of Illicit Finance and Terrorism,” Senator John Fetterman questioned why groups like Hamas didn’t use conventional methods such as credit cards or bank accounts for their activities, suggesting a heavy reliance on crypto.

Dr. Shlomit Wagman, the former Director-General of Israel’s Anti-Money Laundering Authority, responded to Sen. Fetterman’s question by emphasizing that terrorist organizations predominantly favor traditional fundraising channels over cryptocurrency.

Data confusion

Prior to the hearing, several crypto advocates had criticized reporting in the Wall Street Journal that claimed Hamas had “raised” through crypto donations. Analytics firm Elliptic replied to the idea that the numbers were faithfully represented by writing that donation volumes had been conflated with overall volumes of various wallets’ transactions. It wrote:

“The data simply does not support this. No public crypto fundraising campaign by a terrorist group has received significant levels of donations, relative to other funding sources.”

That said, Elliptic said that the wallets were likely owned by third-party services that may have been used by terrorist organizations in some cases but also catered to non-terrorist users. Some of these entities have been designated terrorist organizations themselves for their role in financing such activities.

The commingling of illicit funds with legitimate ones is undoubtedly problematic, but understanding its role adds necessary nuance for interpreting data concerning funding numbers.