Currency devaluation in Nigeria is driving a crypto boom in the country

Currency devaluation in Nigeria is driving a crypto boom in the country Currency devaluation in Nigeria is driving a crypto boom in the country

Loss of faith in the naira is prompting locals to turn to crypto.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Data from analytics firm Chainalysis shows that in May, Nigerians received a marked increase in crypto compared to last December.

Observers say this is partly due to the central bank’s recent currency devaluation, which weakened the naira to its lowest ever level against the dollar.

The resulting boom in crypto activity lends support to the idea that cryptocurrency provides a suitable fallback during times of economic strife.

Crypto is booming in Nigeria

According to Chainalysis, the dollar volume of crypto received by Nigerians has been rising throughout 2020 and 2021.

In May, Nigeria users received $2.4 billion worth of crypto, versus $684 million in December 2020.

The CEO of BiTA, a crypto education startup, Udeaja Kingsley, pointed out that the trigger for this was the recent currency devaluation. He added that it’s mainly young people, through peer-to-peer trading, who are driving this trend.

“Recently, the devaluation of our local currency [encouraged] people [to start] saving in crypto assets like bitcoin and ethereum.

Mostly the youths that believe in it and are trading it via the means of P2P.”

Like India, Nigeria has tried to stop cryptocurrency trading by threatening sanctions against financial entities that deal with crypto companies. In effect, blocking on/off ramping.

This has resulted in a resurgence of trading volume on peer-to-peer platforms, as Nigerians look to circumvent the policy.

Conceding defeat, in late May, the Central Bank of Nigeria (CBN) Governor, Godwin Emefiele, did a turn on the policy, saying he will now “allow” the trading of Bitcoin and other cryptocurrencies.

But many think he had little choice considering the economic pressures faced by locals looking to preserve their purchasing power.

Nigerians feel the pinch of economic woes

The CBN elected to weaken the naira in response to mounting pressure from external lenders, U.S dollar shortages, and oil price volatility which have combined to devastate the country’s budget.

Currency devaluation makes exports and currency more competitive, as they become cheaper to purchase. This can increase demand and reduce the trade deficit. But, the flip side makes imported goods more expensive and stimulates inflationary pressures. Purchasing power and domestic consumption often fall as a result.

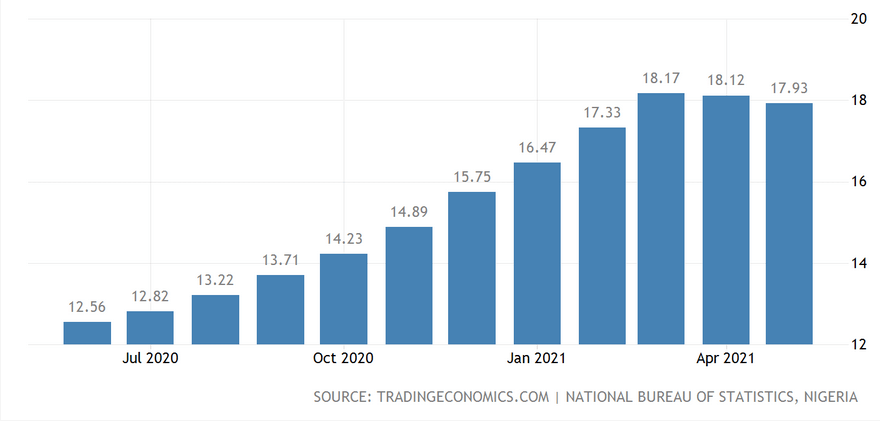

Nigeria’s inflation rate has seen a sharp rise over the last year, leading to a further squeeze on consumer budgets. Currently, it’s hovering around 18%.

Keith Mali Chung, the co-founder of Loopblock Network said Bitcoin and crypto have served as an alternative to the naira during these testing times. He added that many importers have already turned to crypto to counteract the effects of devaluation and inflation.

“Over 70% of all that is being consumed in Nigeria is imported, and with financial restrictions, Bitcoin is gaining all the attention it deserves.”

In the past, loss of faith in a domestic currency tended to prompt locals to switch to another currency, with the U.S dollar standing out as the go-to currency. But as we’ve seen in Nigeria’s situation, now, in 2021, it’s crypto that locals are turning to.