Crypto robo-advisor Makara launches mobile app with 20,000 on early access waitlist

Crypto robo-advisor Makara launches mobile app with 20,000 on early access waitlist Crypto robo-advisor Makara launches mobile app with 20,000 on early access waitlist

The SEC-registered crypto advisory tool has millions of dollars in assets under management.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

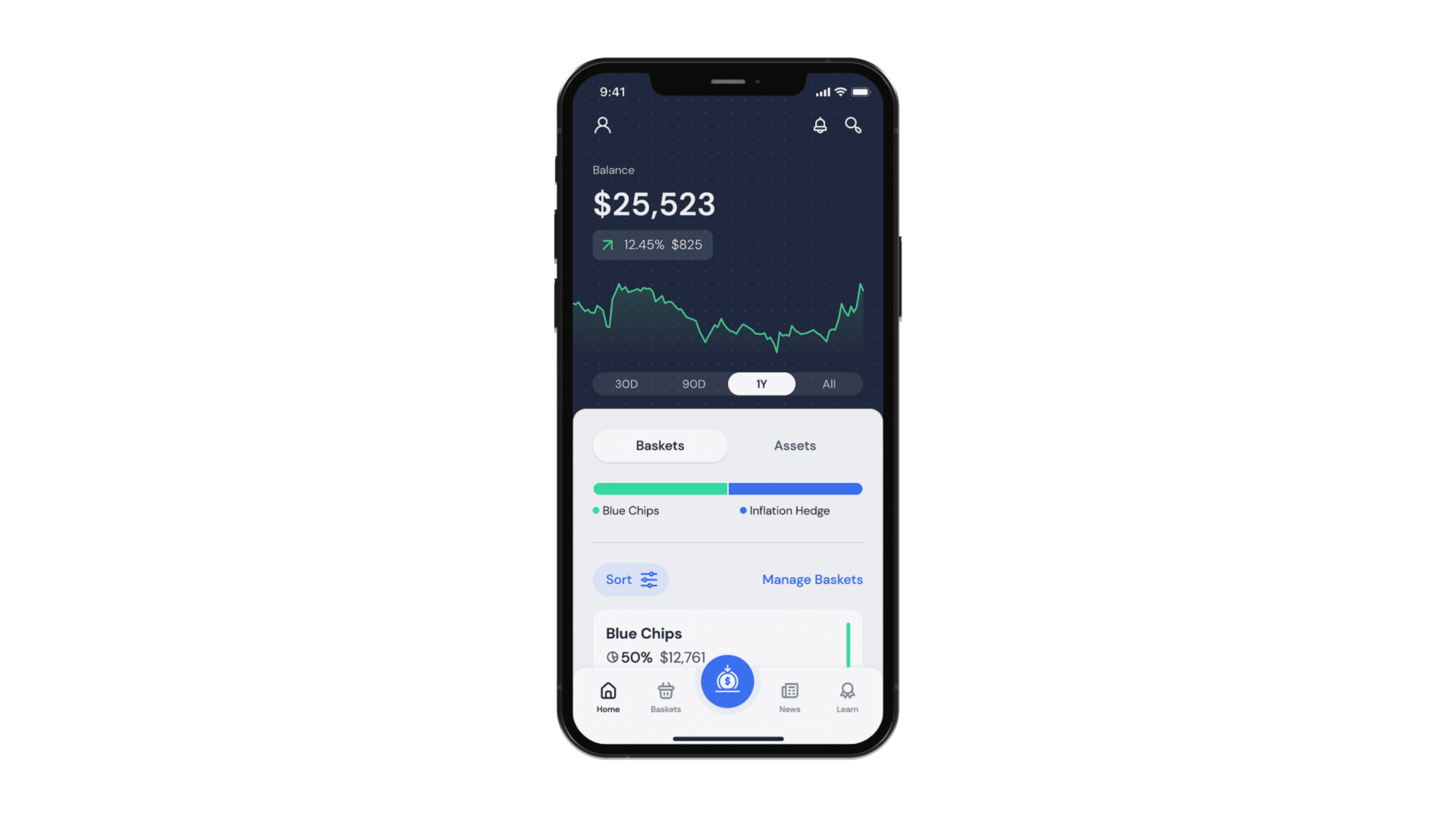

Makara, a leading SEC-registered cryptocurrency robo-advisor, today announced the launch of its service and availability in the App Store, as per a release shared with CryptoSlate.

The app was officially registered with the US Securities and Exchange Commission (SEC) earlier this year and has seen early demand for the service exceed more than 20,000 waitlist sign-ups, averaging over 350 new waitlisters each day.

Massive demand for SEC-registered crypto robo-advisor

Makara aims to make investing in cryptocurrencies more accessible for everyone through index-like allocations called baskets. As such, the app is powered by investment technology that’s been purpose-built for cryptocurrency and tested over the past three and a half years, clients are provided an intuitive and familiar experience.

“We believe Makara is solving real and existing obstacles for individuals accessing the cryptocurrency market and seeing the initial interest from our waitlist gives us confidence that our thesis is correct,” said Jesse Proudman, co-founder and CEO of Makara, in a statement.

He added, “This is still a retail-led asset class but this is not a single-asset asset class. We believe Makara can empower every investor to learn more and benefit from all the potential that cryptocurrencies offer.”

With a handful of beta clients currently onboard the platform, Makara already has millions of dollars in assets under management (AUM). And given initial demand, Makara’s waitlist will remain open for the next couple of weeks while Makara continues to onboard clients from its waitlist onto the platform.

“Traditional robo-advisors help their users invest in ETFs but obviously there aren’t any crypto ETFs in the U.S. right now…and if there were, investors would only be able to move in and out during traditional market hours. Not only that, but they wouldn’t actually be holding these assets directly,” shares Proudman. “At Makara, we believe investors deserve more than a Wall Street wrapper around cryptocurrency. We believe investors deserve true access and exposure to crypto whenever crypto markets are open, which is why our thematic baskets are so compelling.”

Advantages of using Makara

Makara’s unique, thematic baskets allow clients to streamline the crypto investment experience. Clients are able to gain broad exposure to a curated set of baskets based on their interests and goals.

On Makara’s end, the technology handles the complexities of buying, selling, and storing the underlying assets through Gemini, its trading and custody partner, so clients can have confidence that they’re optimized for the type of exposure they want.

Currently, the following investment baskets are offered by Makara:

- Decentralized Finance (DeFi): Equal-weighted allocations to cryptocurrencies that drive this emerging trend.

- Inflation Hedge: Equal-weighted allocations to historical and future state stores-of-value: tokenized gold and Bitcoin.

- Universe: Risk-weighted exposure to the entire investable universe of assets on the Makara platform.

- Blue Chip: Weighted basket of the largest cryptocurrencies with more than $10B in market cap.

- Bitcoin: Single asset basket for investors who want access to the industry’s largest asset and the most established cryptocurrency.

- Ethereum: Single asset basket for investors who want access to the second-largest asset and the leading distributed computing platform.

In addition to the simplicity of the basket structure, Makara’s platform will also offer investors a plethora of educational resources.

Newcomers welcome

For newcomers to the space, or those who simply want a deeper understanding of these assets, they will have access to a large amount of self-serve content about cryptocurrencies and the industry.

“Investors shouldn’t have to spend hours researching and tracking the market to demystify the asset class,” said Sadie Raney, Makara co-founder.

“We believe investors should understand what they’re investing in, which is why education is a huge component of Makara. We want our clients to feel like they’re learning new things every day as part of their investing experience,” added Raney

Makara is now open to US residents ages 18 and older. Waitlist participants will be the first investors invited to register for Makara and will also automatically have the first six months of their Makara fees waived.