Compound (COMP) sees massive surge in on-chain activity despite 23% price slide

Compound (COMP) sees massive surge in on-chain activity despite 23% price slide Compound (COMP) sees massive surge in on-chain activity despite 23% price slide

Photo by Erik Mclean on Unsplash

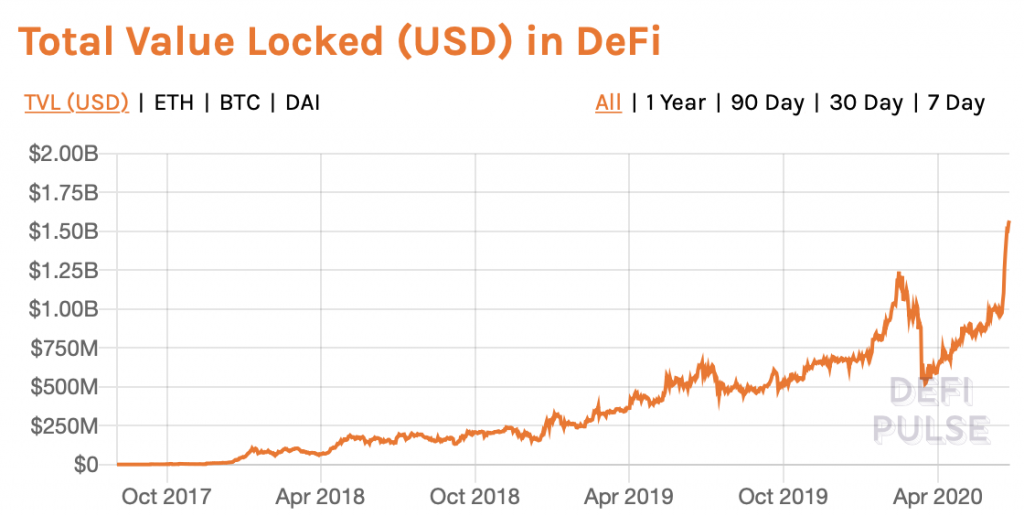

The recent growth of the DeFi sector has primarily been driven by the recent launch of Compound, which has seen massive inflows of capital and new users due to the bourgeoning “yield farming” trend.

Compound’s launch was highly anticipated and has long been in the works, and it has already been met with significant success – becoming the most-used DeFi platform in the world in a matter of mere days.

The hype surrounding COMP may be starting to fade, however, as its token price has plummeted by over 20% today.

This price slide has come despite it seeing a massive uptick in on-chain activity, suggesting that users are still flocking to the platform and engaging in “yield farming” despite Compound’s volatility.

Compound sees notable 20% selloff as hype shows signs of faltering

Compound drew the attention of the crypto sphere due to its successful launch, in which the price of COMP tokens rallied from lows of $65 to highs of $360.

It is important to note that the cryptocurrency’s uptrend was being driven by limited liquidity, and its price has been sliding ever since it was listed on Coinbase this past Monday.

At the time of writing, it is trading down 23 percent at its current price of $213. This marks a notable decline from daily highs of over $270 that were set this morning.

So far, COMP’s utility and price action has largely been driven by the wildly popular “yield farming” DeFi trend, in which users leverage ERC-20 tokens to receive massive returns. In some cases, these returns can stack up to be over 200% annually.

The lure of these returns has led to a total of $560 million to be locked within the protocol, with the total value of funds locked within collateralized DeFi loans across all platforms now sitting at $1.6 billion.

COMP’s on-chain activity remains high

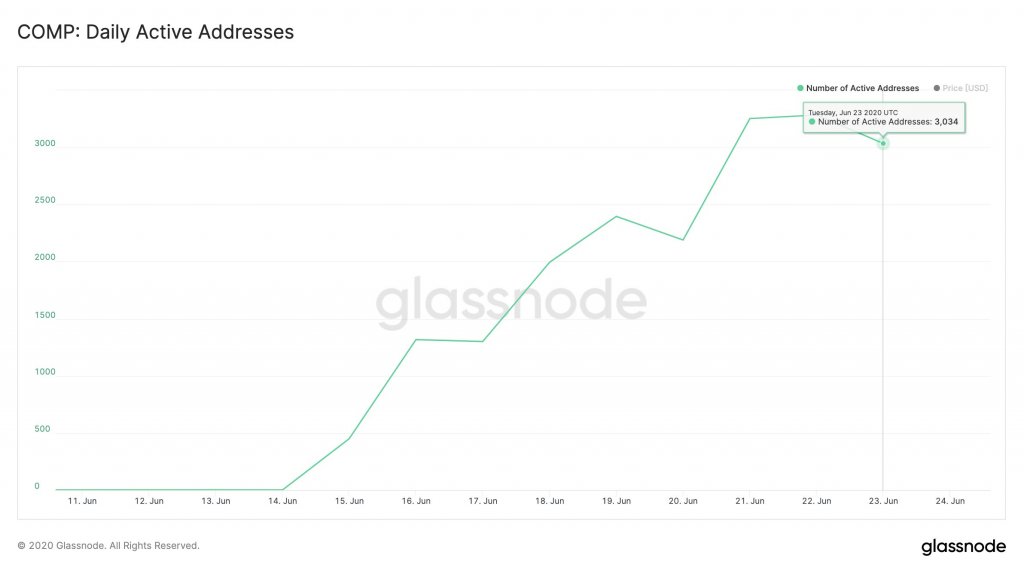

Despite its price sliding from its recent highs, Compound’s on-chain activity still remains incredibly high, signaling that its recent price volatility may simply be the result of trading activity.

Data from analytics platform Glassnode elucidates this trend, showing that there are currently 6,000 token holders and more than 3,000 active addresses buying and selling COMP on a daily basis.

“Since [Compound] started the distribution of their governance token COMP last week, network activity has quickly risen. There are currently 6,000 token holders, and more than 3,000 active addresses sending and receiving COMP each day.”

These numbers also show that there still remains serious room for growth when it comes to Compound’s userbase. As the “yield farming” trend continues evolving and drawing in more users, it is likely that these numbers will grow.

Compound Market Data

At the time of press 9:35 pm UTC on Jun. 24, 2020, Compound is ranked #24 by market cap and the price is down 22.74% over the past 24 hours. Compound has a market capitalization of $538.93 million with a 24-hour trading volume of $13.88 million. Learn more about Compound ›

Crypto Market Summary

At the time of press 9:35 pm UTC on Jun. 24, 2020, the total crypto market is valued at at $266.23 billion with a 24-hour volume of $69.61 billion. Bitcoin dominance is currently at 64.57%. Learn more about the crypto market ›