Challenger exchanges look to compete with Binance as OKX, Bitget claim market share

Challenger exchanges look to compete with Binance as OKX, Bitget claim market share Challenger exchanges look to compete with Binance as OKX, Bitget claim market share

Bitget emerges as a top contender in the crypto exchange market, outperforming others with a trading volume of over $60 billion

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

As reserves continue to decline across all major centralized exchanges (CEXs), Binance, the top exchange by trading volume, is beginning to lose market share to other competitors.

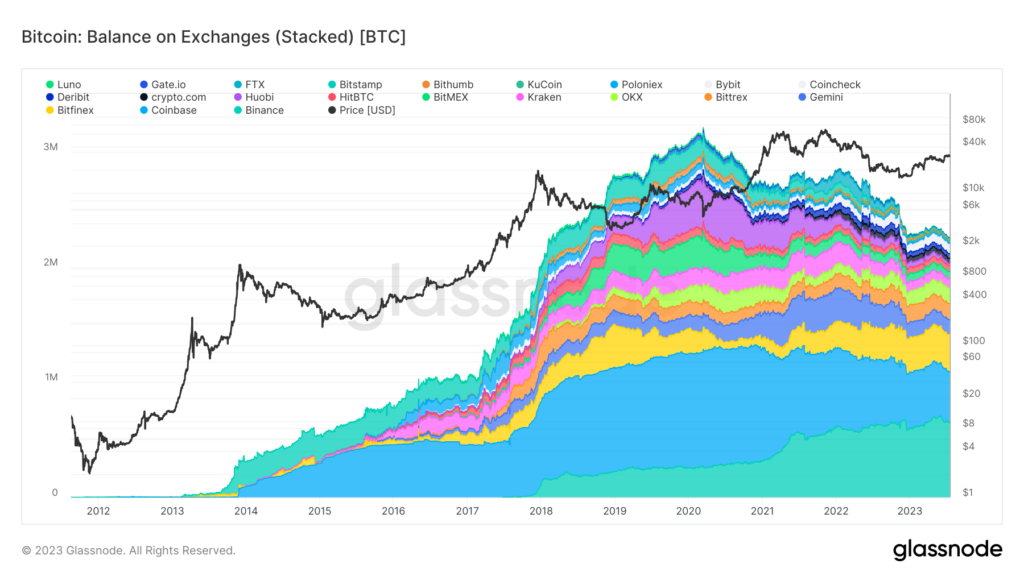

Data provided by Glassnode shows the peak for CEX Bitcoin reserves was hit in 2020, reaching 3 million BTC. Since then, levels have fallen to just over 2 million BTC.

A similar trend can be seen for other digital assets, such as stablecoins which peaked later, toward the end of 2022. Stablecoin balances on exchanges have begun a small revival since June 2023 but are still only at levels last seen in 2021.

Challenger exchanges gain market share.

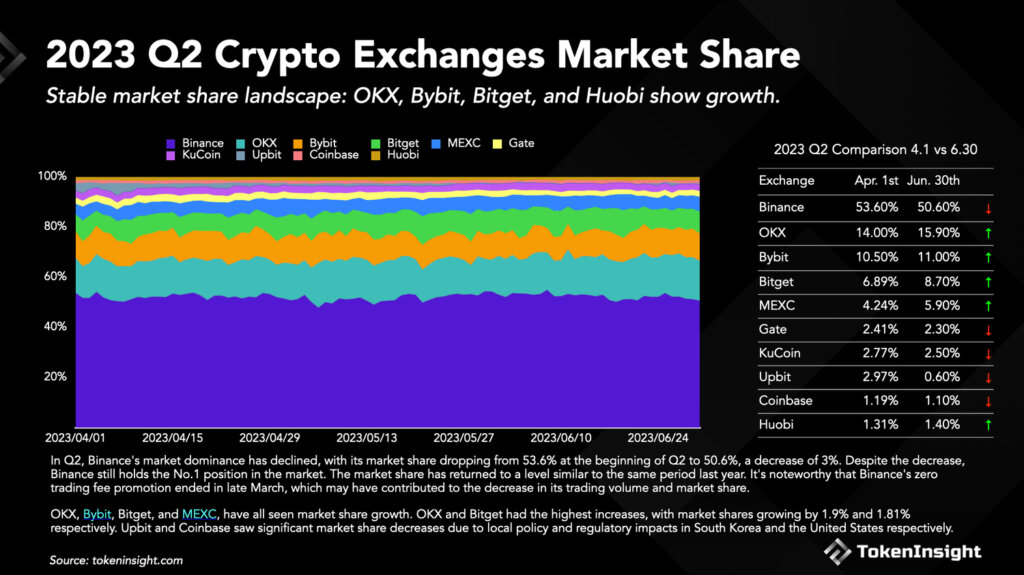

Within the evolving landscape, Bitget, a crypto derivatives exchange, has emerged as a notable contender, cementing its position as a top four CEX by market share. According to Bitget’s Q2 2023 Transparency Report, seen by CryptoSlate, the exchange saw significant growth in market share and a dramatic surge in the volume of its native token, BGB.

Adding to Bitget’s positive trajectory, the platform’s native token, BGB, surged by 80% in trading volume, making it the best-performing CEX token in 2023.

Bitget achieved a trading volume of over $60 billion for spot trading and $606 billion for futures trading, outperforming most centralized exchanges, as reported by the TokenInsight Crypto Exchange Report Q2 2023.

Bitget’s market share rose to 8.7% from 6.89%, while Binance’s market share by quarterly accumulated trading volume fell 3% to 50.6% from 53.6%.

However, OKX led challenger exchanges over the period with market share growth of 1.9% to reach 15.9%, narrowing the gap to Binance. Following updates to regulations in Hong Kong, OKX onboarded over 10,000 new customers in its first month of trading in the region.

These changes come amidst a challenging period for the crypto industry, with Bitcoin prices fluctuating and legal issues plaguing major players like Binance and Coinbase.

Changes to the CEX landscape.

As per data from Glassnode, the aftermath of the FTX collapse led to a significant divergence between Bitcoin deposits and withdrawals, indicating a decreased trust in crypto exchanges. Additionally, a review of exchanges holding fewer than 20,000 Bitcoin shows a general downward trend in Bitcoin storage, with Huobi seeing a dramatic decline.

Despite this trend, Binance remains dominant, holding over 652,000 Bitcoin- over 3.2% of the total Bitcoin supply. However, Binance CEO Changpeng Zhao (CZ) anticipates that decentralized finance (DeFi) will outgrow centralized finance (CeFi) in the next six years,

“More people will use DeFi products and interact directly with blockchains. This also offers financial access to people where TradFi (or banks) have no penetration. It is my strong belief that DeFi will become bigger than CeFi in the next 6 years or so.”

Supporting CZ’s thesis, the platform has recently faced heightened regulatory scrutiny, leading to investigations and exits from specific markets. While CZ is optimistic about the future of Binance, the potential of DeFi, mixed with regulatory uncertainty, and the rise of challenger exchanges, poses an interesting challenge for the pillar of the crypto world that is Binance.