Chainlink oracles will now power Crypto.com’s DeFi Wallet

Chainlink oracles will now power Crypto.com’s DeFi Wallet Chainlink oracles will now power Crypto.com’s DeFi Wallet

Photo by Bruno Figueiredo on Unsplash

Chainlink’s famed decentralized price oracles will now provide data to Crypto.com’s newest DeFi-focused product, as per an announcement on Monday.

Crypto.com onboards Chainlink oracles

A few days after Hong Kong-based crypto exchange and crypto card provider Crypto.com unveiled its DeFi Swap — a Uniswap fork and automated market maker — the firm onboarded Chainlink’s oracles to provide data to all its listings.

Crypto trading, finance & payment platform @cryptocom is now using #Chainlink's Price Reference Data directly in their DeFi wallet. They will also be consuming two price feeds for their native asset CRO, to improve their platform's decentralization and transparency.

— Chainlink – Official Channel (@chainlink) September 14, 2020

For the uninitiated, oracles are third-party tools that fetch data from outside a blockchain to within, as the latter can store data immutably but not verify its authenticity. And while the crypto space is dotted with various oracle providers, Chainlink has emerged as the market leader due to its trusted developer team and a battle-tested oracle network.

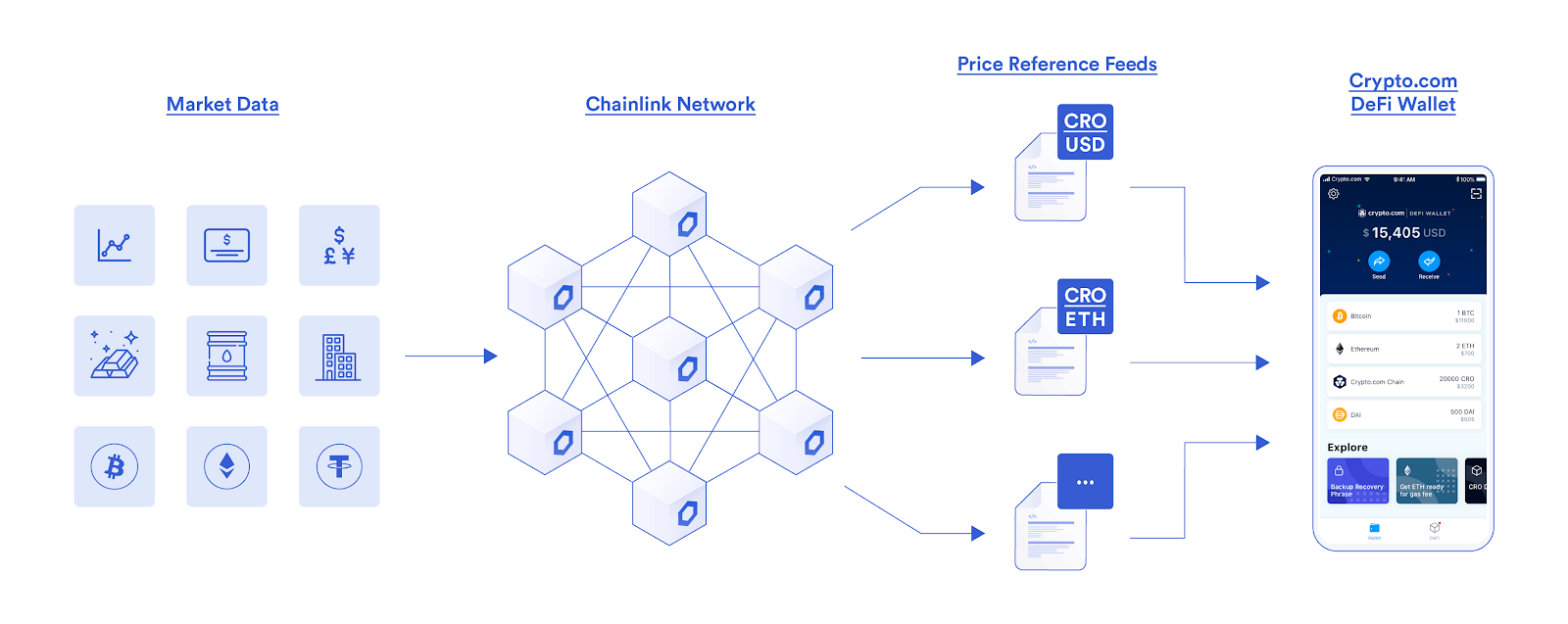

In a blog post, Crypto.com said it had integrated Chainlink’s Price Reference Data into the Crypto.com DeFi Wallet on its mainnet to provide decentralized price feeds for DeFi tokens.

The firm added it will first launch the decentralized price reference data feeds first for its own coin, the CRO, with two trading pairs — CRO/ETH and CRO/USD.

While the DeFi Swap is a new product, Crypto.com launched its native DeFi Wallet earlier this year, allowing users to store their own private keys and access an open-marketplace based on the CRO token. Now, with the integration of Chainlink’s Price Reference Data, the firm said it ensures that “users receive highly accurate and transparent prices for DeFi assets held within it.”

Kris Marszalek, the co-founder and CEO of Crypto.com commented on the launch:

“Chainlink will help us decentralize and give our users more control to verify where and how price data is received and used within the Crypto.com DeFi Wallet.”

He added that the integration gives users more control of their money, data and identity without needing to trust centralized entities, such as centralized crypto exchanges.

Verified data prevents “Black Thursday” mishap

As per the release, all Chainlink Price Reference Data is secured by decentralized oracle networks made up of Sybil resistant node operators, which secure millions of dollars in similar protocols. Each node sources data from high-quality off-chain data aggregators, which maintain strong volume-adjust market coverage across all trading environments.

By pooling the data fees from several sources instead of one, applications utilizing the feeds have access to highly available, accurate, and manipulation resistant price feeds that are protected against any single point of failure.

This vastly helps in times of a drastic market drop. An example is the now-colloquially known “Black Thursday” event in March 2020 when the crypto market fell an average of over 45% in a single day. At the time, the lack of a verifiable oracle provider to Maker caused its users to lose over $4.1 million to “zero-bid” offers on the network, as CryptoSlate reported.

But with the verifiable price oracles using various data sources, instances like the above are avoided. Sergey Nazarov, the founder of Chainlink, explained:

“By shifting key financial product processes like calculating interest rates and managing a portfolio to more transparent and decentralized alternatives, users receive even greater guarantees that those services are reflective of true market conditions and not be subject to any form of human tampering.”

At press time, Chainlink’s native LINK tokens trade at $11.93 while CRO exchanges hands at $0.16.