Bitcoin was one of the worst performers in Q1, but these altcoins astonished

Bitcoin was one of the worst performers in Q1, but these altcoins astonished Bitcoin was one of the worst performers in Q1, but these altcoins astonished

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Despite the state of commotion in the global financial markets, several altcoins were able to provide significant gains during the first quarter of the year.

Bitcoin: the worst performer in Q1

In a recent report, Binance Research affirmed that Bitcoin displayed a negative performance throughout the first quarter of the present year. Although the flagship cryptocurrency surged more than 50 percent between January and mid-February, the recent downturn in the market was able to erase all gains made.

Indeed, BTC plunged from a high of $10,500 to hit a low of $4,000 on March 13. This price level has not been seen since over a year.

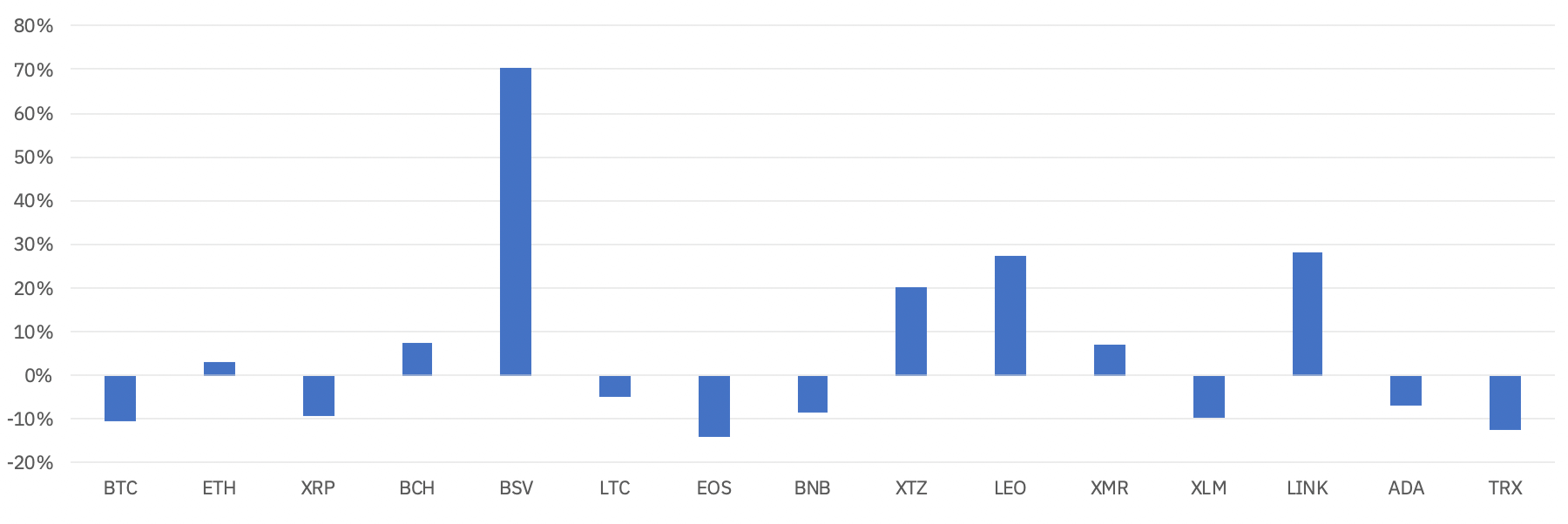

The significant correction that the pioneer cryptocurrency suffered made it one of the worst performers amongst the top digital assets by market capitalization, according to the research arm of the world’s largest crypto exchange by trading volume Binance.

Ethereum, on the other hand, ended the first quarter of 2020 in the green providing a quarterly return slightly over 3 percent while other altcoins showed significant gains.

Altcoins in the green

Binance Research explained that Bitcoin SV, UNUS SED LEO, Chainlink, and Tezos were able to perform positively during Q1 due to “idiosyncratic factors” including important news, mainnet launch, forks, and others. These altcoins displayed quarterly returns of 70 percent, 29 percent, 28.6 percent, and 20 percent, respectively.

The gains that BSV, LEO, LINK, and XTZ provided were quite surprising for many market participants since the global pandemic and fissures within OPEC were able to pulverize the global financial markets. The S&P 500, for instance, fell over 35 percent in March displaying a negative quarterly return of 19 percent.

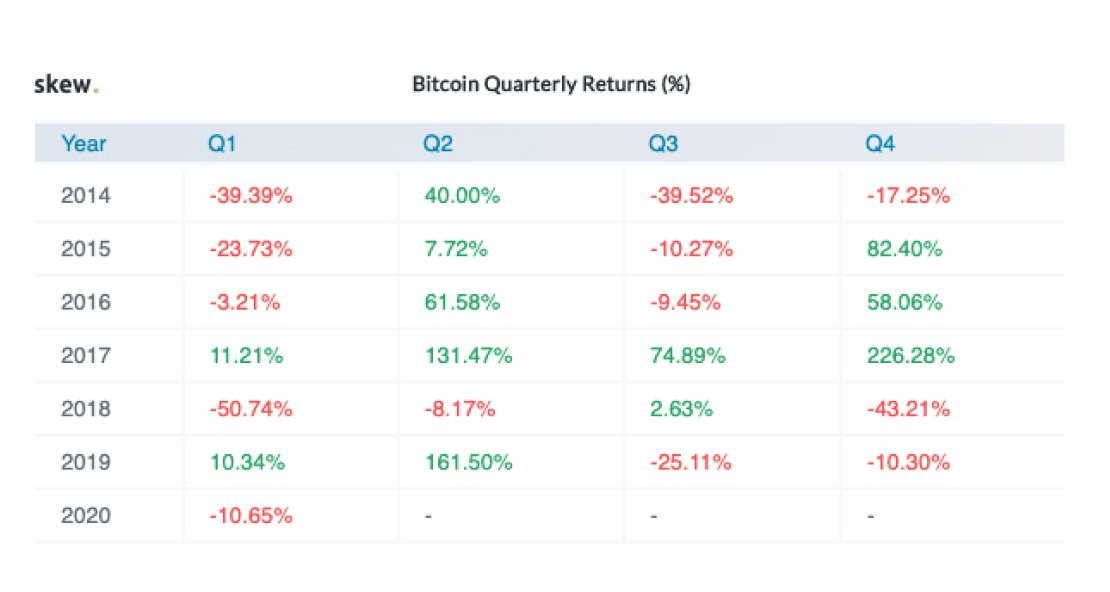

Now that a new quarter began, data from Skew reveals that historically Q2 has been a great month for the bulls. The crypto derivatives data analytics firm maintains that in the past six years, with the exception of 2018, Bitcoin has surged by nearly 80 percent on average from April to June.

Even though the cryptocurrency market has never gone through a global economic slowdown, this quarter will certainly demonstrate whether this new asset class is able to decouple from traditional markets and provide hedging opportunities.

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=16&h=16&q=75)

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=100&h=100&q=75)