Bitcoin spot volume is telling a bullish tale as analysts eye macro bottom

Bitcoin spot volume is telling a bullish tale as analysts eye macro bottom Bitcoin spot volume is telling a bullish tale as analysts eye macro bottom

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoin’s overnight break above the resistance it was previously facing at $7,200 has allowed the crypto to significantly extend the momentum that was first incurred when BTC dipped below the support it has established at $6,600 earlier this week.

This rally is further confirming that the cryptocurrency’s early-March lows could mark a long-term bottom, as the subsequent uptrend has shown signs of being highly sustainable.

This notion is also bolstered by an interesting occurrence seen while looking towards the cryptocurrency’s spot volume, which saw unprecedented growth during the recent bout of capitulation.

Bitcoin further extends upwards momentum in time following the rebound from $3,800

In the time following Bitcoin’s monumental decline to lows of $3,800 on March 12th, the cryptocurrency has been able to post a sustainable rebound that led it to highs of $7,500 – the point at which the crypto was met with some significant selling pressure.

Although the visit to this level did force BTC to decline slightly, bulls were able to build a massive amount of buying pressure around $6,600 that has since led it to climb back to its current price of $7,250.

This momentum, which was extended overnight, has led BTC to surmount several key resistance levels, allowing the crypto to now retarget its high-time-frame resistance at its multi-week highs.

The sustainability of this rebound isn’t just illuminated by Bitcoin’s steady price gains, but can also be seen while looking at its rise in spot buying volume seen throughout the past month.

One popular pseudonymous trader named Bitcoin Jack recently took to Twitter to point to the rise in spot buying volume seen in the time following the drop, concisely calling it the “one divergence nobody told you about” while referencing the below chart.

Drastic rise in spot volume suggest long-term bottom is in

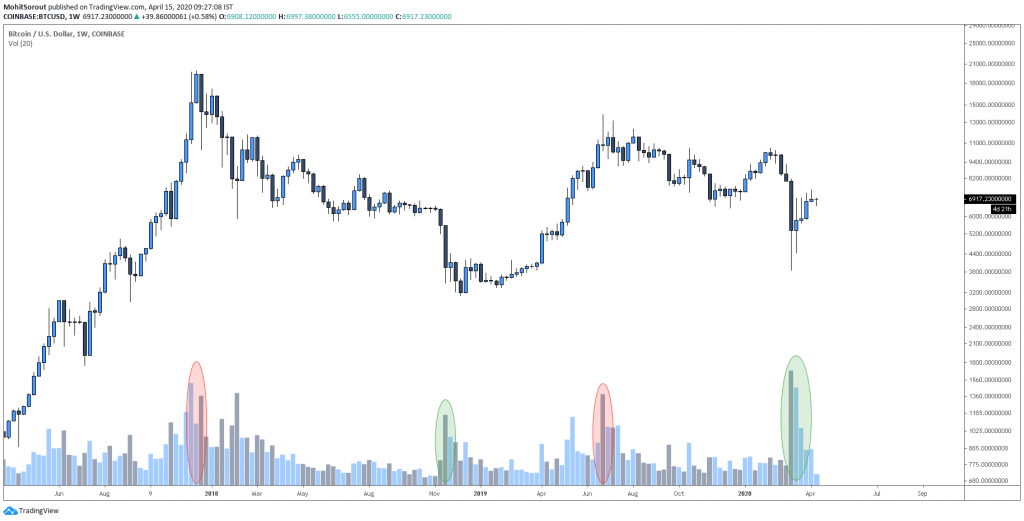

While analyzing the recent trends surrounding Bitcoin’s spot volume, it is also important to note that the benchmark crypto saw a rise in buying pressure in early-March so significant that it rivals that seen during other historic market bottoms.

Mohit Sorout – a founding partner at Bitazu Capital – recently offered a chart displaying this occurrence, noting that it is “trying to tell something.”

“Spot volume on BTC is trying to tell something. Wonder what it means.”

The culmination of these factors does seem to suggest that Bitcoin’s ongoing uptrend could soon transform into something much larger than just a short-term rebound.

Bitcoin Market Data

At the time of press 6:55 am UTC on Apr. 20, 2020, Bitcoin is ranked #1 by market cap and the price is down 0.25% over the past 24 hours. Bitcoin has a market capitalization of $132.36 billion with a 24-hour trading volume of $31.42 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 6:55 am UTC on Apr. 20, 2020, the total crypto market is valued at at $209 billion with a 24-hour volume of $126.76 billion. Bitcoin dominance is currently at 63.41%. Learn more about the crypto market ›