Bitcoin sees sharp decline as stock market futures plummet 5%; is all hope lost?

Bitcoin sees sharp decline as stock market futures plummet 5%; is all hope lost? Bitcoin sees sharp decline as stock market futures plummet 5%; is all hope lost?

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoin and the aggregated cryptocurrency market attempted to rebound this evening following an intense bout of selling pressure seen earlier today, which came about in tandem with the decline seen by the U.S. stock market.

This backdrop of global bearishness has proven to be devastating for BTC, as its firm status as a risk-on asset has led it to shed a significant amount of its value as investors flee what they perceive as risky investments in favor of stability.

The strong support that Bitcoin had previously established at $7,700, however, may not be enough to help the cryptocurrency break its correlation with the global markets, as a decline in the stock market’s futures suggests further downside is still imminent.

Bitcoin fails to recapture $8,000 as bulls struggle to defend $7,700

At the time of writing, Bitcoin is trading down nearly three percent at its current price of $7,690, which marks a slight climb from daily lows of $7,600 that was set earlier today when bears first attempted to invalidate the support BTC has at $7,700.

The fleeting rebound from these lows seemed to confirm the importance of $7,700, which happens to be the level at which the benchmark crypto’s 2020 rally because of a bull trend in mid-January.

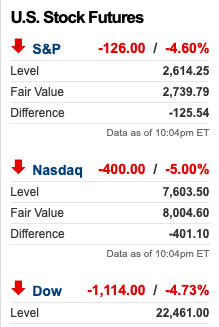

Today’s BTC volatility came about in tandem with an intense selloff seen by the equities market, with the Dow Jones Industrial, S&P 500, and Nasdaq all shedding 4% of their value today.

It now appears that this selloff will extend into tomorrow, as the stock markets’ futures are all trading down nearly five percent at the present moment.

Could BTC still break its correlation with the stock market and make a bid at $10,000?

Although BTC has been closely tracking the price action seen by the stock market, all hope is not lost yet for the cryptocurrency.

George, a well-respected trader, spoke about Bitcoin in a recent tweet, in which he notes that a strong and sustained bounce somewhere within the $7,100 to $7,700 region could open the gates for a move back into the five-figure price region – but a break below this price could prove to be dire.

“BTC HTF thoughts: 7.1k – 7.7k is key. If we bounce around here, I could see us go all the way back up above 10k. Break below… and I’d say 4k minimum and maybe even lower…”

If buyers are able to defend this level and push the cryptocurrency higher in the days and weeks ahead, it is possible that Bitcoin will break its close correlation with the stock market and begin incurring some independent momentum.

Bitcoin Market Data

At the time of press 9:21 pm UTC on Mar. 12, 2020, Bitcoin is ranked #1 by market cap and the price is down 26.95% over the past 24 hours. Bitcoin has a market capitalization of $104.84 billion with a 24-hour trading volume of $53.09 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 9:21 pm UTC on Mar. 12, 2020, the total crypto market is valued at at $161.4 billion with a 24-hour volume of $187.2 billion. Bitcoin dominance is currently at 65.07%. Learn more about the crypto market ›