Bitcoin price plunges 19% but key data suggests institutions are buying the dip

Bitcoin price plunges 19% but key data suggests institutions are buying the dip Bitcoin price plunges 19% but key data suggests institutions are buying the dip

Photo by Smit Patel on Unsplash

Article by Cole Petersen with contributions from Joseph Young

The Bitcoin (BTC) price plunged by 19 percent from $10,000 to $8,100 across major exchanges. The sell-off was so intense that Coinbase went down temporarily amid the drop. But, key data shows institutional investors are patiently investing in the cryptocurrency market.

Grayscale, which operates the Grayscale Bitcoin Trust, saw its assets under management (AUM) surge to $3.7 billion in the last several days.

05/08/20 UPDATE: Net Assets Under Management, Holdings per Share, and Market Price per Share for our Investment Products.

Total AUM: $3.7 billion$BTC $BCH $ETH $ETC $ZEN $LTC $XLM $XRP $ZEC pic.twitter.com/GM0YDAKf4g

— Grayscale (@GrayscaleInvest) May 8, 2020

The noticeable increase in CME open interest and the surging demand for the Grayscale Bitcoin Trust indicate institutions are not fazed by the recent trend of BTC.

Data shows crypto industry followed the lead of Paul Tudor Jones

The crypto industry has been captivated by macro investing legend Paul Tudor Jones offering an endorsement of Bitcoin as an investment tool in his latest market outlook – with many investors feeling vindicated by his comments.

His remarks may simply be the tip of the iceberg. Data suggests that he may just be one major investor who moved to gain exposure to the benchmark cryptocurrency throughout the past several months.

This comes as prominent figures within the crypto industry note that the public nature of Jones’ BTC endorsement is likely to spark a frenzy of institutionally driven BTC buying.

Bitcoin’s intense rally from its 2020 lows of $3,800 to recent highs of $10,100 has come about against a backdrop of immense global turbulence.

Its strength in the face of this uncertainty has bolstered its value as a so-called “hard asset” and has also drawn the eye of large investors keen on gaining exposure to high-performing assets.

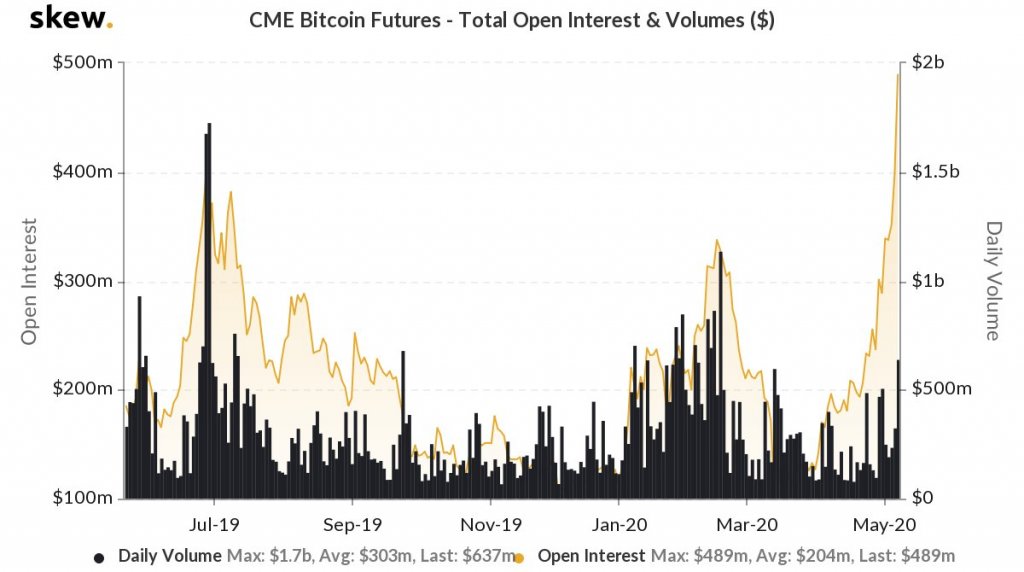

Throughout the past two months, open interest on the CME for Bitcoin futures has been exploding, hitting fresh all-time highs of nearly $2 billion this past week, according to data from Skew.

This has come about as trading volumes remain stagnant on the exchange, signaling that investors are less interested in attempting to trade Bitcoin, but are rather moving to gain mid or long-term exposure to the benchmark digital asset.

Could funds buy into Bitcoin?

It does appear that Jones’ comments regarding Bitcoin may mark the start of an institutional buying frenzy.

BitMEX CEO Arthur Hayes explained that he anticipates “beta fund managers” to begin cooking up “copypasta” – meaning that they will follow suit and also add the crypto to their portfolios.

“Paul Tudor Jones just removed career risk from investing in Bitcoin. Expect a lot of beta fund managers to begin cooking some copy pasta.”

Following a near 160 percent increase in price, a sharp Bitcoin pullback was widely expected. Historical data also showed that after a block reward halving, the price of BTC tends to drop.

With two days left until the activation of the halving, large traders seemingly front ran the market by initiating a steep sell-off, especially on BitMEX and Binance Futures.

Bitcoin Market Data

At the time of press 8:15 am UTC on May. 10, 2020, Bitcoin is ranked #1 by market cap and the price is down 11.21% over the past 24 hours. Bitcoin has a market capitalization of $158.95 billion with a 24-hour trading volume of $57.59 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 8:15 am UTC on May. 10, 2020, the total crypto market is valued at at $237.27 billion with a 24-hour volume of $190.53 billion. Bitcoin dominance is currently at 66.91%. Learn more about the crypto market ›

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=16&h=16&q=75)

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=100&h=100&q=75)