Bitcoin Plunges to $5400: 12 Month Low, Market Sheds $25 Billion

Bitcoin Plunges to $5400: 12 Month Low, Market Sheds $25 Billion Bitcoin Plunges to $5400: 12 Month Low, Market Sheds $25 Billion

Photo by Joel Filipe on Unsplash

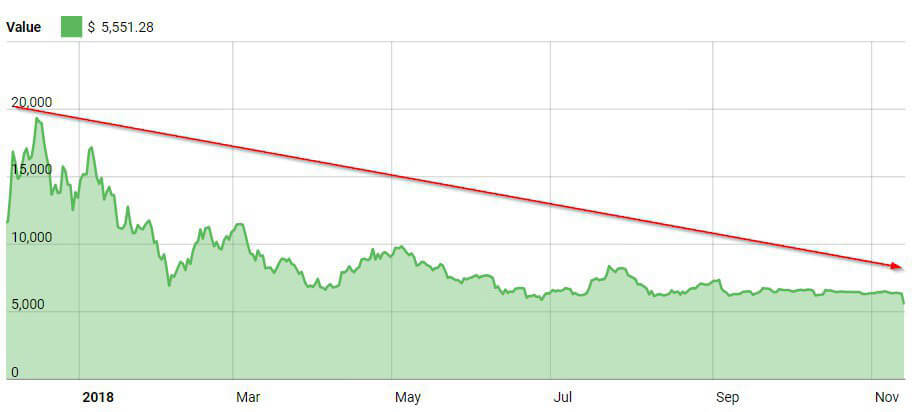

Bitcoin hits a historic 12 month low of $5400; The pre-eminent cryptocurrency has cratered 11 percent just within the last four hours. The enormous drop in price appears to be driven by major Bitcoin and derivatives exchange BitMEX, representing 34 percent of 24-hour market volume.

The bear market continues. Following the hysteria experienced during the peak of trading in prices in January, Bitcoin, Ethereum, and many other major coins are quickly shedding market capitalization. The across the board price drops are following the plunge in Bitcoin’s price.

The duration of the current bear market is unprecedented for 2015-2018, spanning five continuous months since the rebound in May.

That said, the market has made some major recoveries during this year. In February and May, the market rebounded to a total market capitalization of $500 billion and $450 billion and then experienced a minor rebound in late July at $300 billion.

However, None of these rebounds are even close to the market’s all-time high of $850 billion.

Bubble or Temporary Dip?

Is this year-long decline in the market temporary, or a lasting correction? The Bitcoin hysteria experienced 2017 through early 2018 could be coming to an end.

One source revealed that majority of ICOs and projects are scams or simply unable to live up to what they claim. Perhaps the market is learning that the next project to “revolutionize” or “up-end” existing services is likely to fall flat, so this correction could be a better indicator of the value of the underlying technology.

To put things in perspective, this isn’t the first nor the worst bear market in Bitcoin’s history.

In December of 2013, the market reached an all-time high of $13 billion, growing 8x (from $1.7 billion) in the span of two months. The market was then devastated over the next 10 months, shrinking below $3 billion and losing 77 percent percent of its value from all-time highs.

For those looking hedge against the volatility of the market, exchanging crypto for a stable coin such as TrueUSD, USD Coin, or Tether can mitigate further losses. Once the market stabilizes it is then possible to repurchase crypto holdings.

Risk Reward

Many crypto die-hards appear unphased by the drop in prices. For many, this is just another lull in the grand scheme of things. Many on Reddit and Twitter are doubling down on HODL, quoting that to “experience the highs of crypto it is necessary to endure the lows.”

Meanwhile, there are those in the broader community have been skeptical of Bitcoin’s adoption, with some claiming that the phenomenon is a bubble. The continuous price drops may be indicative of such claims. Whatever happens, the market shall decide who’s right.

Bitcoin Market Data

At the time of press 1:19 am UTC on Apr. 6, 2020, Bitcoin is ranked #1 by market cap and the price is down 11.26% over the past 24 hours. Bitcoin has a market capitalization of $97.95 billion with a 24-hour trading volume of $7.99 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 1:19 am UTC on Apr. 6, 2020, the total crypto market is valued at at $184.07 billion with a 24-hour volume of $23.58 billion. Bitcoin dominance is currently at 53.17%. Learn more about the crypto market ›