Bitcoin outperforms Layer 1s SOL, ETH, DOT, BNB, ATOM in December

Bitcoin outperforms Layer 1s SOL, ETH, DOT, BNB, ATOM in December Bitcoin outperforms Layer 1s SOL, ETH, DOT, BNB, ATOM in December

Bitcoin surges in price and dominance against everything else as the holiday season approaches.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

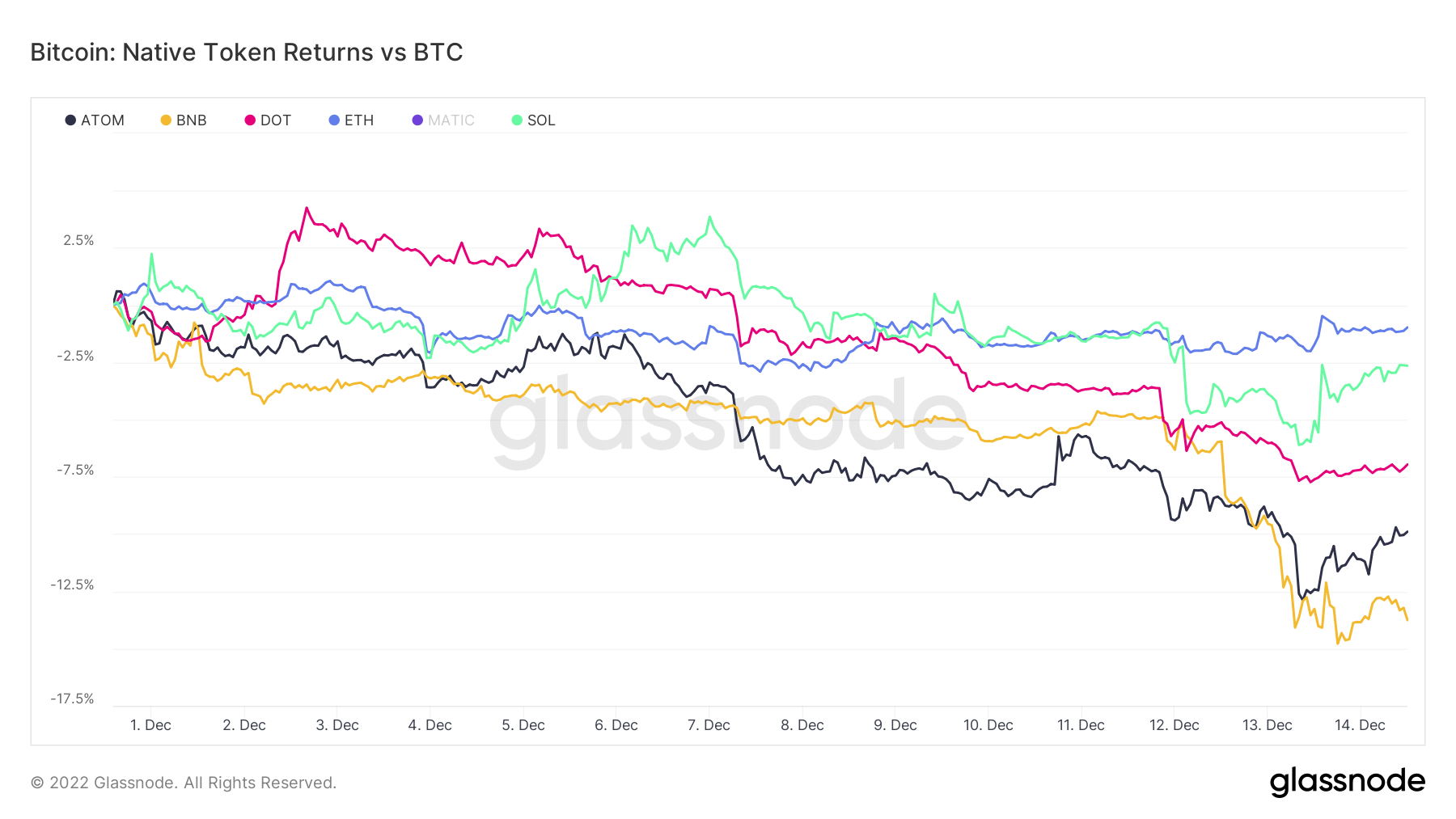

In December, Bitcoin outperformed the native tokens of the Solana, Ethereum, Polkadot, Binance, and Cosmos ecosystems, according to data analyzed by CryptoSlate.

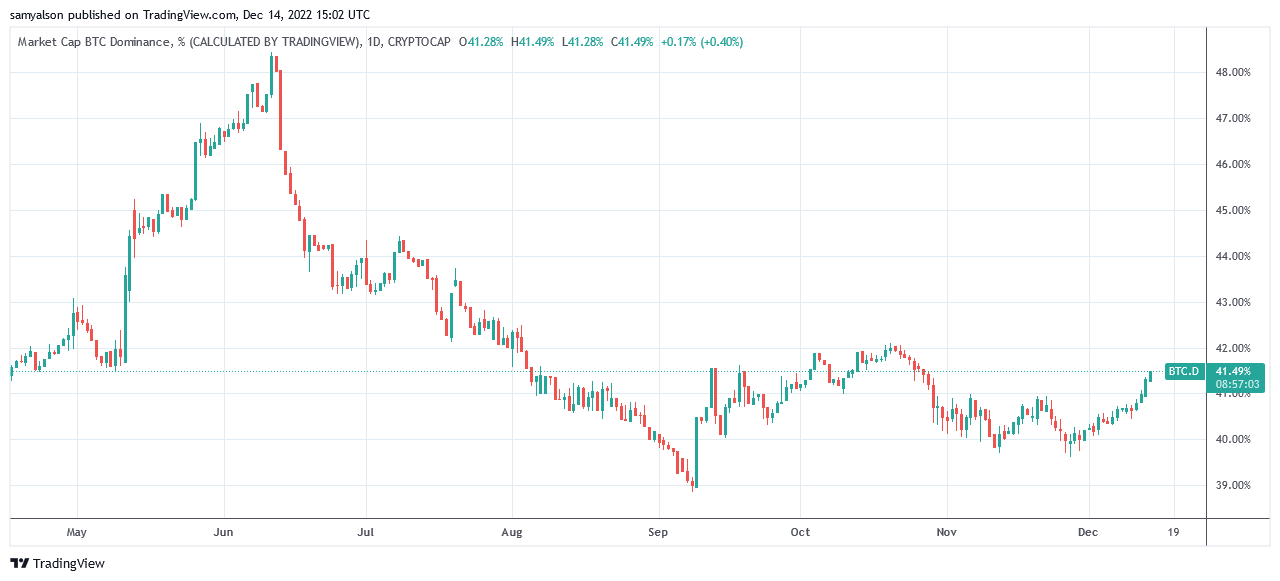

Bitcoin dominance (BTC.D) has also begun trending upward this month. The chart below shows BTC.D starting December at 39.9% and moving progressively higher. The current reading is 41.5% – a seven-week high.

Bitcoin beats large caps

Since December opened, Bitcoin has traded within a tight range between $16,790 and $17,400.

Following the release of better-than-expected U.S. Consumer Price Index (CPI) data on Dec. 13, BTC broke out of this range, spiking to $18,000, but giving up some of those gains, closing the day at $17,800.

Dec. 14 has seen the leading cryptocurrency build on the momentum, hitting a peak price of $18,130 so far. However, with uncertainty reigning, particularly with regard to the macro outlook going into the holiday season, none of this should be taken as a confirmed reversal.

Nonetheless, BTC has outperformed large-cap Layer 1s so far this month. Losses compared to Bitcoin for December came in at:

- Ethereum -1.0%

- Solana -2.9%

- Polkadot -7.2%

- Cosmos -11.2%

- Binance -13.6%

Binance’s performance noticeably deteriorated around Dec. 12, as FUD surrounding its solvency triggered a run on the exchange.

On-chain data showed that $6.5 billion was withdrawn over the last 24 hours. Binance CEO Changpeng Zhao (CZ) responded by saying it was good to “stress test” his company.

In an update, CZ said despite the massive outflows, recent activity was not in the top 5 for withdrawals. He added that the exchange is now seeing net deposits.

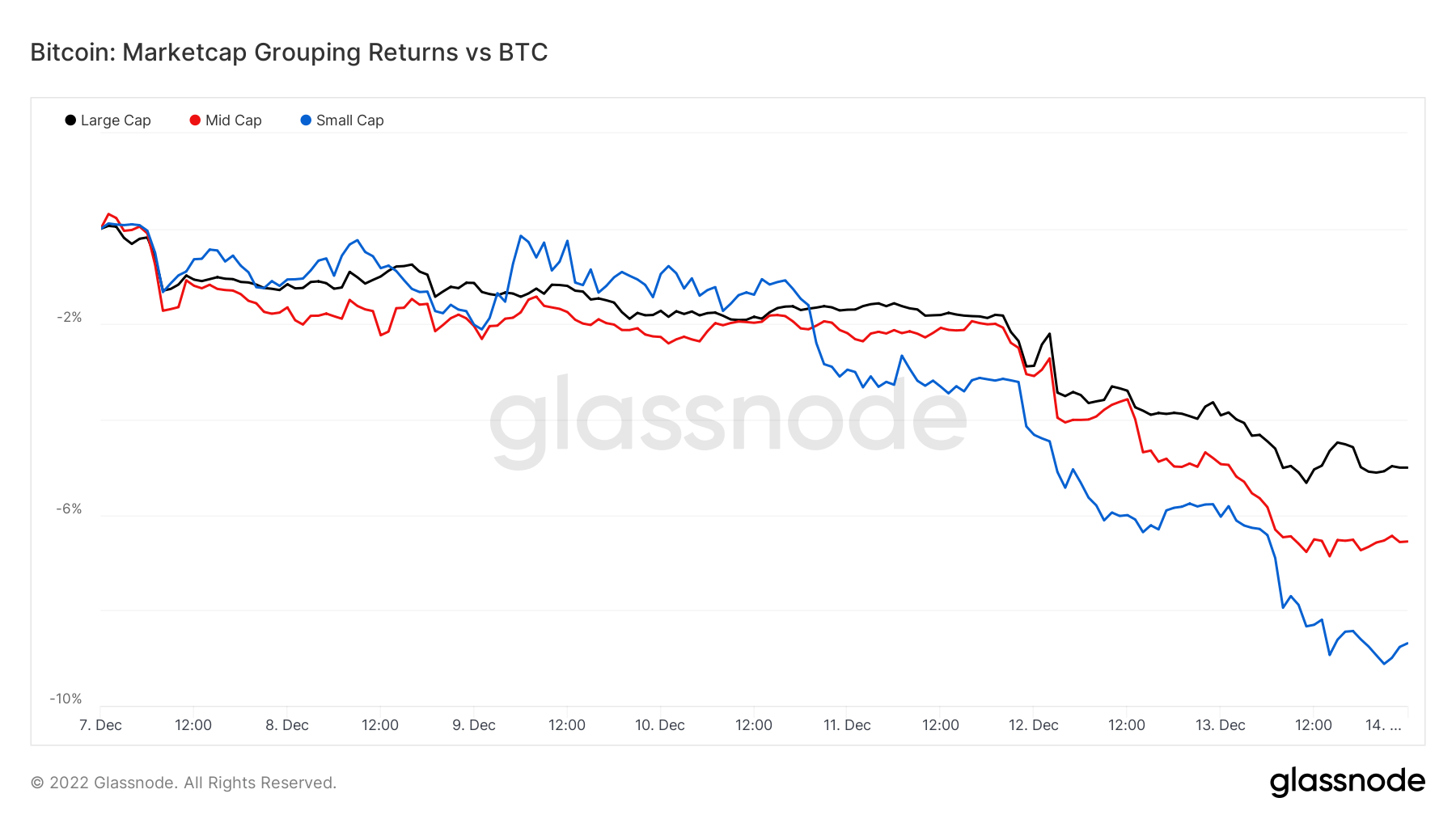

Small-caps go from best to worst-performing cohort

Analyzing the returns of large, mid, and small-cap cohorts against Bitcoin shows all three groups have failed to outperform the market leader since Dec. 7.

The chart below shows small-caps challenging BTC but coming unstuck around Dec. 10. Since then, small-caps have plummeted to the worst-performing cohort at -8.8%.

Against BTC, mid-caps returned -6.3%, while large-caps fared best at -4.8%.

Like Binance Coin (BNB,) Dec. 12 marked a noticeable downturn in performance for all three cohorts.