Bitcoin options on the CME are seeing surging popularity; here’s what this could mean

Bitcoin options on the CME are seeing surging popularity; here’s what this could mean Bitcoin options on the CME are seeing surging popularity; here’s what this could mean

Photo by Cupcake Media on Unsplash

After first launching Bitcoin futures products in late-2017, the CME has been garnering massive adoption amongst BTC traders and investors in recent times.

The platform’s options products, in particular, have seen a massive spike in popularity over the past few weeks, now accounting for 40 percent of the total outstanding open interest for Bitcoin futures products on the CME.

Analysts are noting that this growth may not actually be emblematic of any underlying shift in market participation rates.

Regardless, the growth of the platform’s aggregated OI does highlight a trend of heightened rates of institutional adoption.

CME Bitcoin options account for a growing percentage of the platform’s total open interest

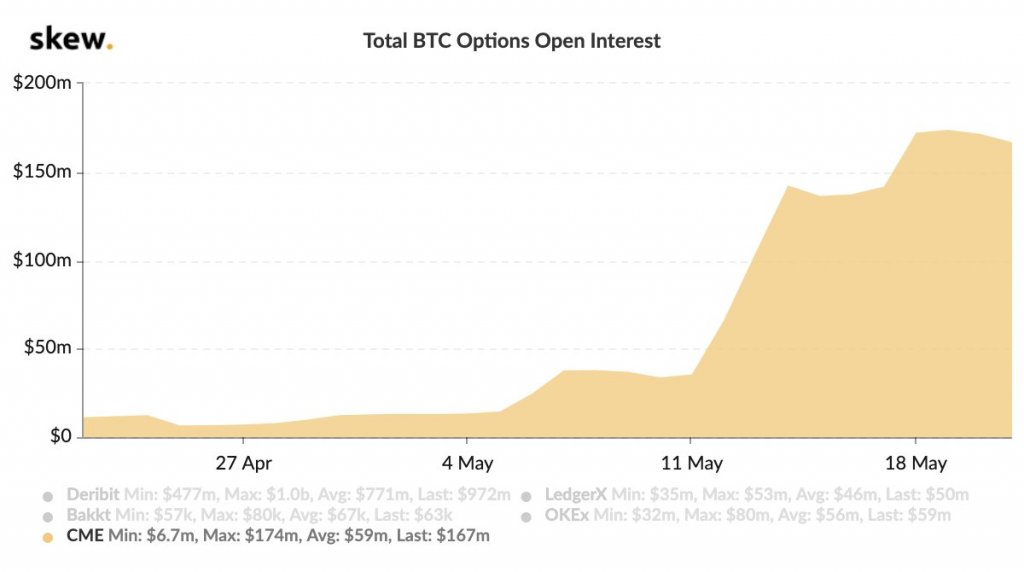

According to recently released data from Skew, BTC options on the CME now account for 40 percent of the aggregated open interest of Bitcoin futures products on the platform.

“Open Interest on BTC Options at the CME now represents ~40% of the Open Interest on its BTC Futures contracts.”

It is important to note that open interest for options on the platform is still trailing far behind that seen on other platforms like Deribit, although the CME’s share over the market is rapidly growing.

Analysts don’t seem to believe that this rise in options OI on the CME is emblematic of any sort of major shift in trading activity amongst Bitcoin’s market participants, however.

Mike McDonald – a poker player and respected Bitcoin advocate – spoke about this in a recent tweet, explaining that a properly placed $3 million options trade can make OI appear to be massive.

“The options OI numbers are pretty [whatever] if you ask me. If you buy $3,000,000 worth of June 32k calls off of me at the current market rate – we just added over $2,000,000,000 to the open interest and our 3 million dollar trade single-handedly made options OI bigger than futures.”

Data shows traders are flocking to the CME

Regardless of whether or not options open interest is truly indicative of heightened rates of market participation, other sets of data do indicate that the CME is gaining popularity.

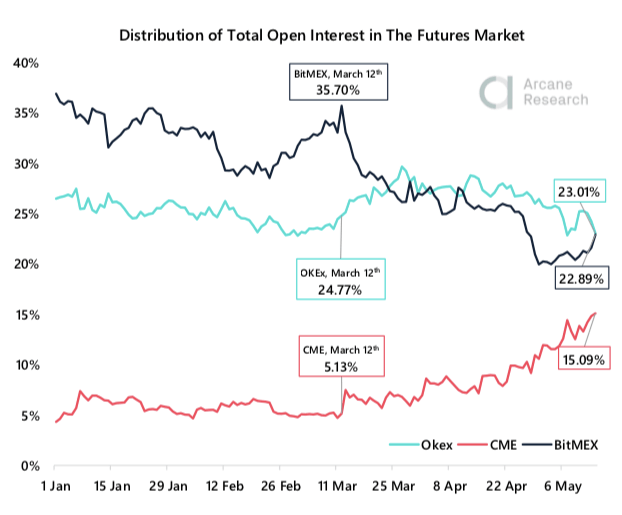

Per a recent report from CryptoSlate, the CME currently accounts for 15 percent of the aggregated crypto market’s open interest. This marks a sharp rise from that seen prior to March, when it only controlled between 4 and 8 percent.

Because the platform is tailored to institutions and professional traders, this does highlight a trend of greater “smart money” participation rates.

Bitcoin Market Data

At the time of press 7:37 pm UTC on May. 23, 2020, Bitcoin is ranked #1 by market cap and the price is down 0.3% over the past 24 hours. Bitcoin has a market capitalization of $168.73 billion with a 24-hour trading volume of $27.58 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 7:37 pm UTC on May. 23, 2020, the total crypto market is valued at at $255.56 billion with a 24-hour volume of $95.08 billion. Bitcoin dominance is currently at 66.01%. Learn more about the crypto market ›

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=16&h=16&q=75)

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=100&h=100&q=75)