Bitcoin mining hashrate touches new all-time high, mining difficulty expected to rise

Bitcoin mining hashrate touches new all-time high, mining difficulty expected to rise Bitcoin mining hashrate touches new all-time high, mining difficulty expected to rise

In the seven days, the miners responsible for most of the hash rates were Foundry USA, AntPool, F2Pool, Binance Pool and ViaBTC.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoin’s (BTC) hashrate has spiked to a new all-time high amid the current bear struggles of the broader crypto market.

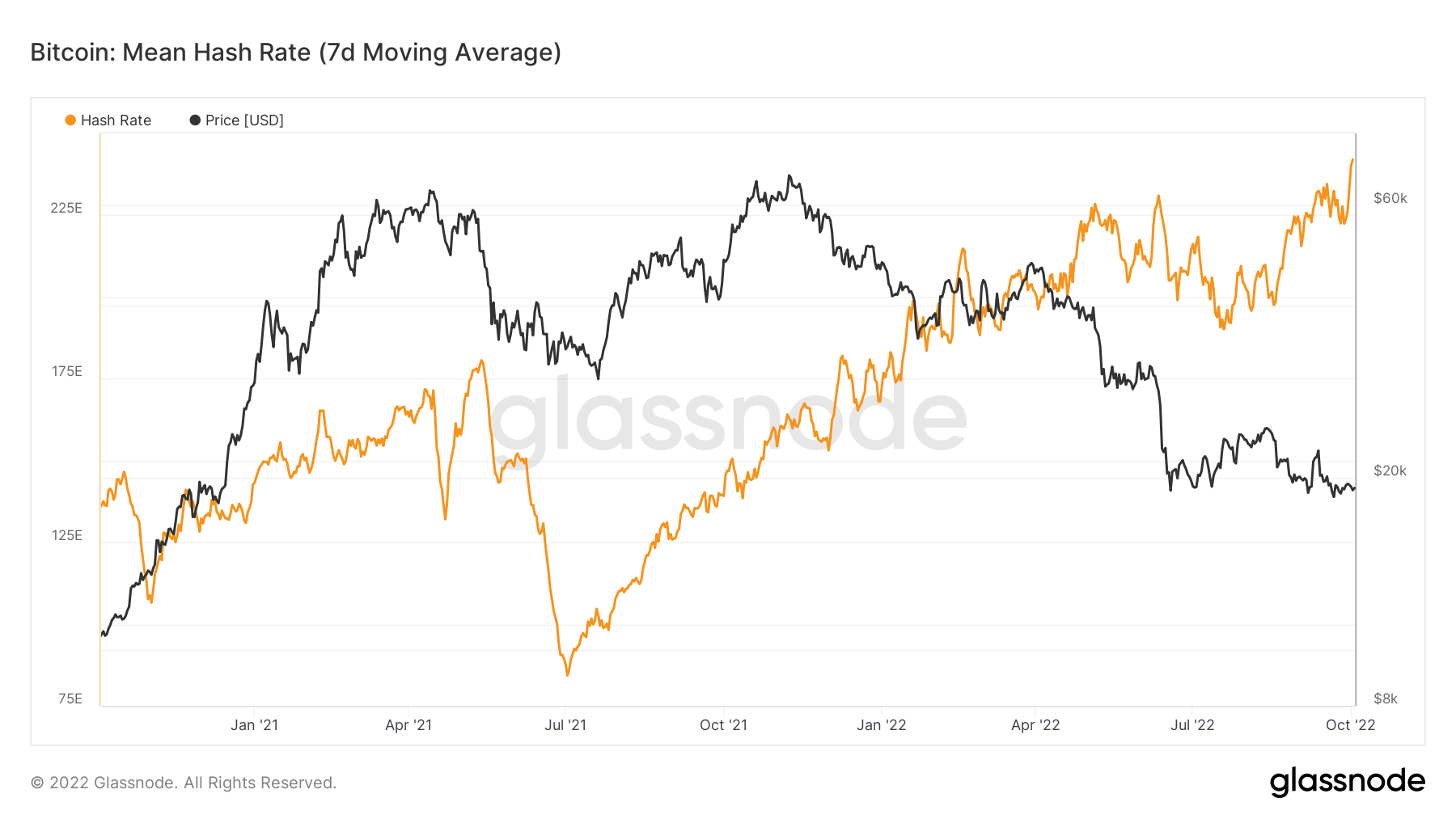

According to Glassnode data, as analyzed by CryptoSlate, BTC’s hashrate touched 244.25 EH/s on Oct. 3.

In the seven days, the miners responsible for most of the hashrates were Foundry USA, AntPool, F2Pool, Binance Pool, ViaBTC, and others.

BitcoinIsaiah pointed out that the hashrate is already up 84% this year, despite a 72% drop in BTC price.

Hashrate when #BTC was $69k: 161 EH/s

Hashrate today when BTC is only $19k: 297 EH/sDespite a 72% drop in price, hashrate has still exploded 84% within a single year. Unstoppable.

— ₿ Isaiah⚡️ (@BitcoinIsaiah) October 1, 2022

Since Bitcoin’s hashrate dropped to 200 EH/s on Aug. 4, the data has steadily grown as more machines are online after the hot summer. Several miners have also upgraded their equipment to ensure better efficiency.

Meanwhile, the hashrate increase is happening at a time when Bitcoin’s price has considerably struggled. CryptoSlate research revealed the possibility of the asset dropping to $12,000 if its low volume persists.

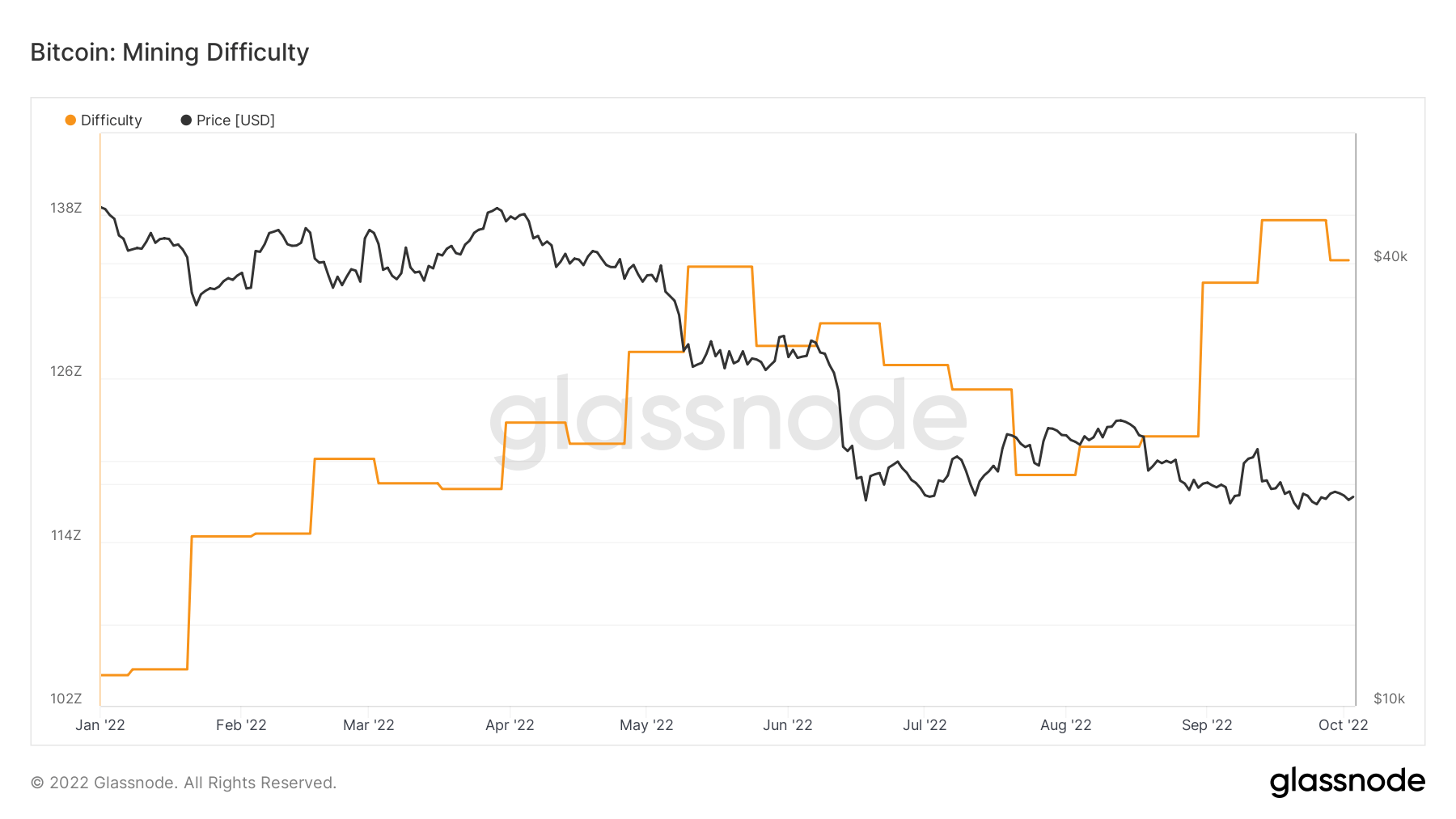

Bitcoin’s mining difficulty is also expected to increase between 3% to 10%, according to Glassnode data. On Aug. 3, the difficulty was 27.69 T but rose to 32.05 T by Sept. 24. However, the mining difficulty dropped to 31.36 T last week.

Bitcoin miners’ revenue takes a hit

Reports have revealed that Bitcoin miners’ revenue has dropped 72% in the last year. According to Blockchain.com data, revenue from bitcoin mining dropped to less than $20 million a day compared to the previous year, when miners were making around $62 million daily.

Miners have been considerably hit by the bear market and the global energy crisis that has led to a surge in electricity costs. A Bitcoin mining data center operator Compute North filed for bankruptcy after failing to meet its obligations to its creditors.