Binance completes Bitcoin Lightning Network integration

Binance completes Bitcoin Lightning Network integration Binance completes Bitcoin Lightning Network integration

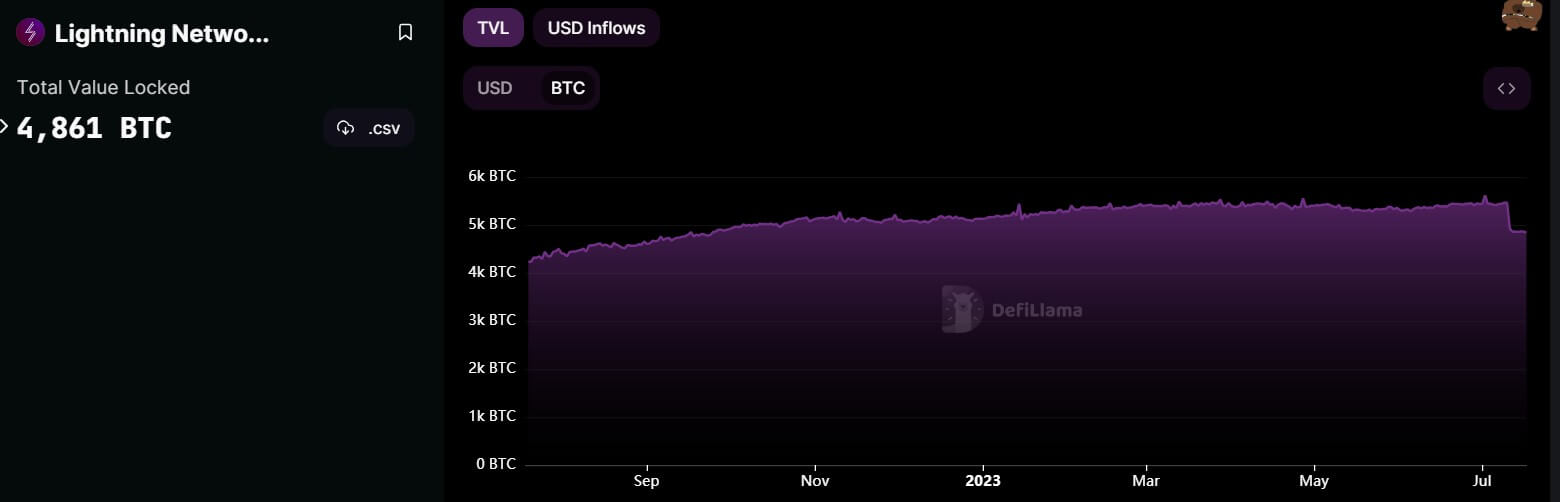

The total value of assets locked on Bitcoin Lightning Network dipped by 610 BTC within the last seven days.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Crypto exchange Binance has completed the integration of Bitcoin (BTC) Lightning Network (LN) for deposits and withdrawals activities, according to a July 17 statement.

LN is a “layer 2” payment protocol built on Bitcoin. The protocol enables faster, cheaper transactions between nodes and aims to solve BTC scalability issues, thereby improving user experience and potentially driving higher adoption of the flagship digital asset.

With its integration, Binance joins Bitfinex, Kraken, and OKX as one of the largest trading exchanges to integrate Lightning, according to a GitHub repository by LN advocate David Coen.

Meanwhile, Binance users can still deposit and withdraw their BTC via other networks on the platform, including BNB Smart Chain (BEP-20), Bitcoin, BNB Beacon Chain (BEP2), BTC (SegWit), and Ethereum ERC-20.

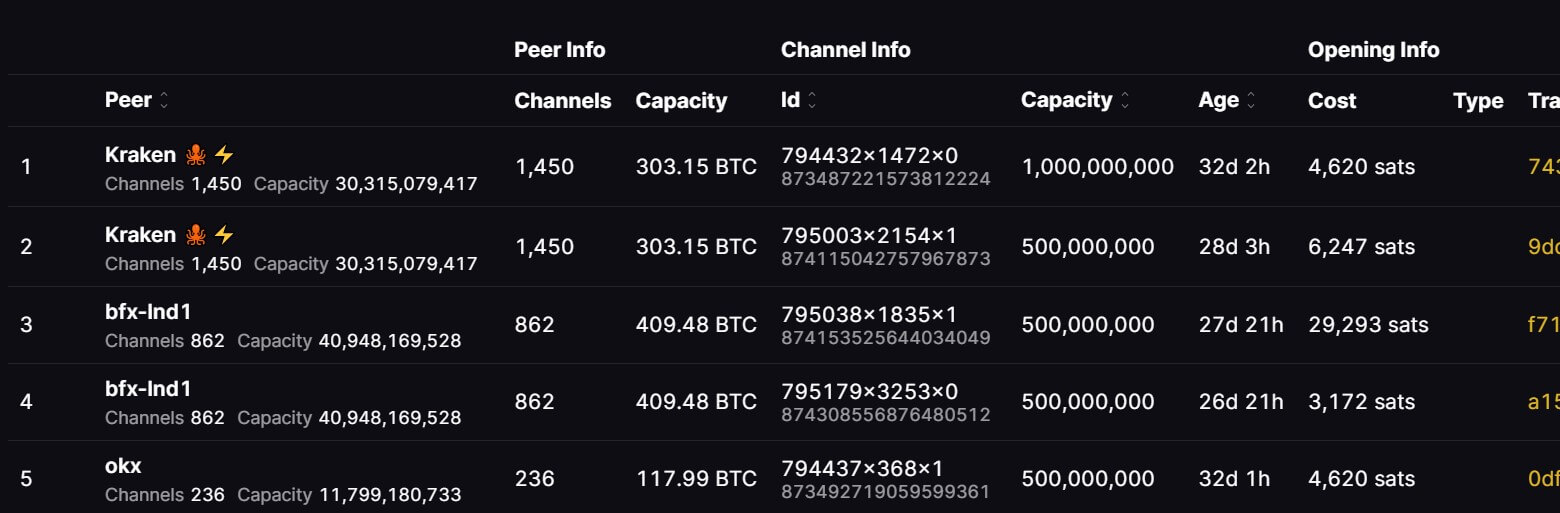

Binance nodes connected to rival platforms

Amboss’s dashboard shows that the Binance node is connected to rival exchanges, including Kraken, Bitfinex, and OKX. The dashboard further indicates that the Binance node has a total capacity of 3 billion Sats—the smallest unit of BTC.

In June, the crypto community spotted Binance’s LN nodes, with the exchange later confirming that it was working on the integration.

Binance experienced issues in May with the volume of pending transactions on its platform, leading to a pause in BTC withdrawals due to network congestion and high gas fees. These challenges necessitated the integration of LN to enhance its operations.

Bitcoin Lightning Network TVL declines by over 600 BTC.

Data from DeFiLlama shows that the total value of assets locked on the Bitcoin Lightning Network has dipped by 610 BTC within the last seven days to 4,861 BTC as of press time.

This represents a steep decline from the all-time high of 5,700 BTC recorded on June 20. However, market observers have suggested that Binance’s integration would further boost the network’s usage. The exchange is the largest crypto exchange by trading volume and controls over 40% of the market, according to CCData.