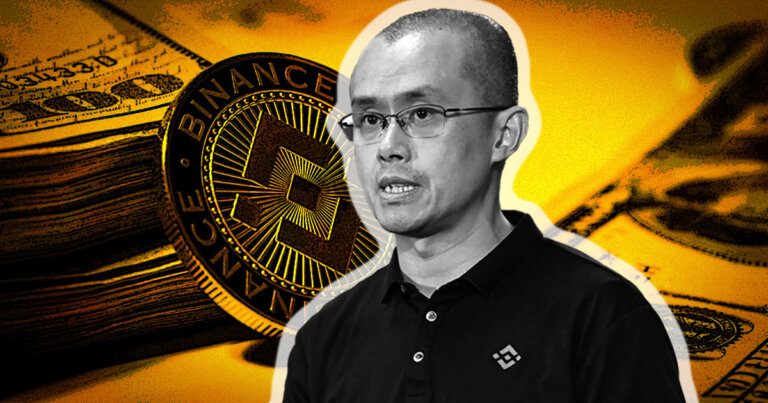

Binance CEO CZ confirms exchange has no outstanding loans

Binance CEO CZ confirms exchange has no outstanding loans Binance CEO CZ confirms exchange has no outstanding loans

CZ said that the exchange has no outstanding loans, adding that it is harder to audit its liabilities.

Web Summit / CC BY 2.0 / Flickr. Remixed by CryptoSlate

Binance CEO Changpeng Zhao “CZ,” said that the exchange has no outstanding loan, and challenged anyone to ask around.

Earlier on Nov. 25, Binance published its Bitcoin proof of reserves to show that its on-chain reserves of 582,485.9302 BTC were 1% higher than the total customers’ deposit of 575,742.4228 BTC.

Leading financial audit firm Mazars in its Dec. 7 publication, confirmed that Binance’s Bitcoin reserve was overcollateralized by over 100% of its total liabilities.

Despite the auditing efforts, Binance’s reserve reports have been criticized for not including its liabilities.

Bitcoin Analyst Willy Woo had asked Binance CEO “CZ” if his exchange was working to audit its liabilities. CZ replied in the affirmative, noting that auditing liabilities are harder.

yes, but liabilities are harder. We don’t owe any loans to anyone. You can ask around.

— CZ 🔶 Binance (@cz_binance) December 7, 2022

CZ added that Binance has no outstanding loans, and called on anyone to “ask around” to verify his claim.

Call to audit exchange liabilities

Following CZ’s comment on Binance’s liabilities, members of the crypto community have questioned why it’s harder to audit liabilities.

It's not “harder”; it's more revealing and incriminating.

— ᴳᴿᴼᴼᴷᴵ 𝚃𝚑𝚊 𝙼𝚘𝚗𝚔𝚎𝚢 (@Grooki2) December 8, 2022

Matt argued that since Binance has no outstanding loans, its liabilities can be easily audited by leading auditing firms like Deillotte/E&Y.

Then just do it, mate. Hire Deloitte/E&Y whomever – and just do the audit with liabilities to show the full balance sheet (ie snapshot of financials for those wondering) and close the matter. It’ll cost like $100k. Well worth it in my opinion.

— Matt 🏝🔭🇨🇱🇦🇺🇺🇸 (@1mattcollins) December 7, 2022

Kraken CEO Jesse Powell had earlier criticized Binance for excluding its liabilities. He argued that such exclusion was an “ignorant or intentional misrepresentation” of the exchange’s financial position.