Alameda’s capital portfolio reveals highest token investments in Polygon, Hole, and Port Finance

Alameda’s capital portfolio reveals highest token investments in Polygon, Hole, and Port Finance Alameda’s capital portfolio reveals highest token investments in Polygon, Hole, and Port Finance

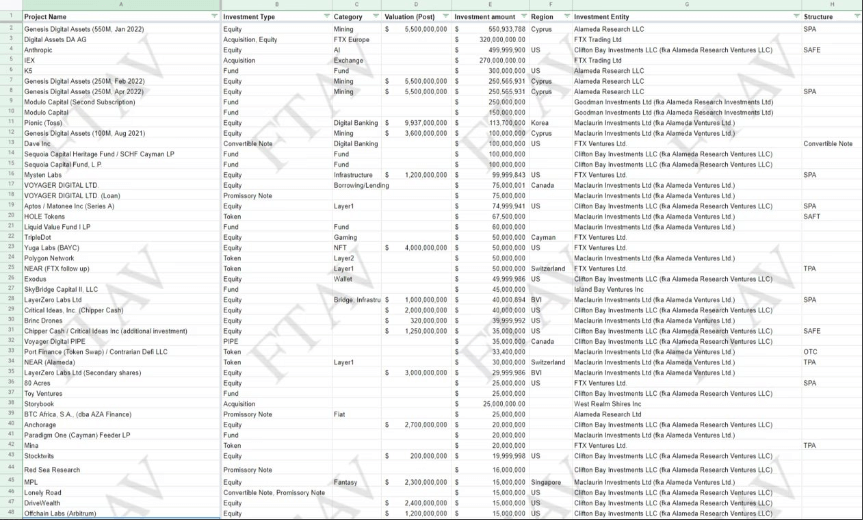

According to FTX/Alameda's spreadsheet, the portfolio of FTX/Alameda contains nearly 500 illiquid investments spread across 10 holding companies.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The capital portfolio of the fallen quantitative cryptocurrency trading firm Alameda Capital was recently released by Financial Times, revealing some interesting investments.

According to the spreadsheet, there are nearly 500 illiquid investments spread across ten holding companies in the portfolio of FTX/Alameda worth $5.4 billion.

Two of the most significant investments were cryptocurrency mining firm Genesis Digital’s $1.15 billion investment and Open AI founded Anthropic’s $500 million investment. Crypto influencer Wu Blockchain thinks the investments were “ridiculous. “

The two largest investments, the $1.15 billion investment in Genesis Digital, a cryptocurrency mining company, and the $500 million investment in Anthropic, founded by OpenAI employees, are ridiculous.

— Wu Blockchain (@WuBlockchain) December 6, 2022

Investments in Sequoia and Skybridge

A $200 million investment in Sequoia, the venture capital firm that wrote down its FTX stake to zero earlier, is also included among the fallen trading firm’s holdings.

Further, the Alameda document lists an investment of $45 million in Anthony Scaramucci’s SkyBridge Capital. Per the spreadsheet, FTX transferred 30% of its stake in SkyBridge to Alameda to protect investors’ assets. Later, its founder Anthony Scaramucci revealed that SkyBridge had lost money on its holdings of FTX’s FTT tokens.

Additionally, the portfolio revealed the largest token investments in the form of HOLE – $67.5 million, Polygon – $50 million, NEAR (FTX) – $50 million, Port Finance – $33.5 million, and NEAR (Alameda) – $30 million.

Last month, FTX announced filing for Chapter 11 bankruptcy along with its sister entity Alameda Research and approximately 130 other companies related to FTX.

However, an analysis by Arkham Intelligence on Nov. 25 revealed that Alameda Research withdrew over $200 million from FTX.US before the company declared bankruptcy. In addition, Arkham disclosed in a Twitter thread that Alameda Research, FTX’s sister company, had collected $204 million from FTX US in the final days before the collapse of various crypto assets.