Crypto Hedge Funds Raise Hundreds of Millions of Dollars, Even on Downtrend

Photo by Casey Horner on Unsplash

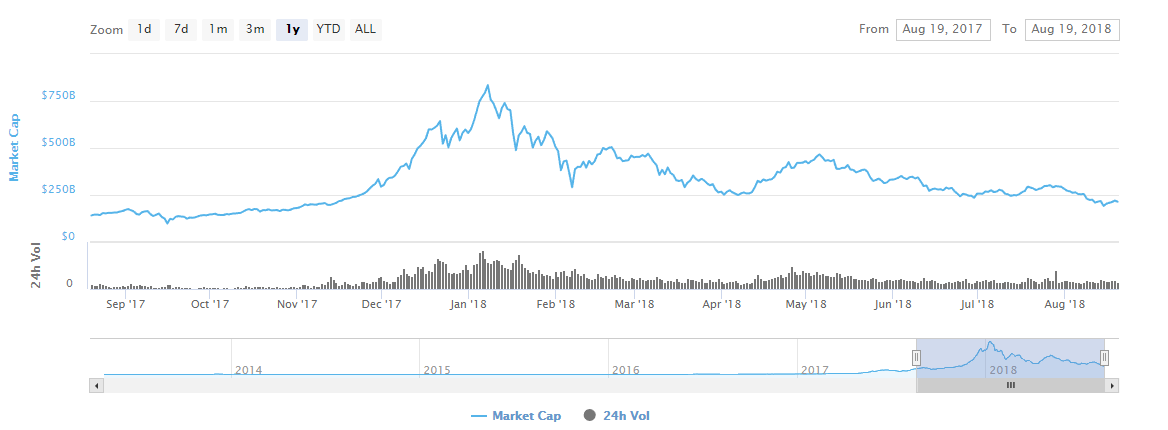

In the past eight months, the valuation of the crypto market has declined by more than 76 percent, from $900 billion to $215 billion. Yet, crypto hedge funds have raised more money than ever before.

Demand is Accelerating on a Downtrend

In July 2018, Barry Silbert’s Digital Currency Group subsidiary investment company Grayscale disclosed raising $248 million in the first quarter of 2018, bringing its portfolio valuation to $2 billion.

In an official report, the Grayscale team stated that the demand for its hedge fund and the investment vehicles have seen an unprecedented acceleration rate. The team wrote:

“As the investment community knows, over the last six months, the digital asset market experienced one of the largest price drawdowns since the inception of Bitcoin in 2009. However, what is more interesting, and somewhat counterintuitive, is that the pace of investment into Grayscale products has accelerated to a level that we have not seen before. In fact, we raised nearly $250 million in new assets in the first half of this year, marking the strongest inflows of any six month period in the history of our business.”

Most investors in the traditional finance market, especially in the tech market, eye opportunities on a downtrend, when the valuation of a market or an asset drops by more than 70 percent.

A similar trend has been demonstrated by investors in the US market, given the rapid increase in demand for Grayscale’s investment vehicles and products.

This week, Pantera Capital, one of the only two billion dollar hedge fund in the cryptocurrency sector alongside Grayscale, raised $71.445 million from 90 investors, forming its Third Venture Fund with total capital of $175 million.

In May 2018, Dan Morehead, the CEO of Pantera Capital, echoed the sentiment of Bitcoin vault service provider Xapo chairman, stating that Bitcoin is unlikely to see a low price range at $6,000 again in the years to come and that it is a valuable opportunity for investors to commit to the cryptocurrency sector.

Morehead said three months ago:

“All cryptocurrencies are very cheap right now. It’s much cheaper to buy now and participate in the rally as it goes.”

This month, Morehead stated that the price trend of the crypto market has demonstrated the instability in the market and the overreaction of investors to certain events, including the rejection of the Winklevoss Bitcoin exchange-traded fund (ETF).

Still, Morehead said that given the positive developments in the space such as the Baakt initiative of Starbucks, New York Stock Exchange, and Microsoft to improve the usability of digital assets, investors should focus on the positive aspect of the crypto market and invest in. Morehead added,

“That’s huge news. That is going to be a very profound impact over the next five or 10 years for the markets, and, to my mind, that’s what people should be focused on. It’s all perspective.”

Confidence of Hedge Funds

The confidence of crypto hedge funds like Pantera Capital and Grayscale have attracted investors into the cryptocurrency market, who have committed to the relatively new asset class as a long-term investment.

Crucially, the rise in demand from investors in the public market supported by the optimistic approach of major markets like Japan and South Korea to establish practical and efficient regulatory frameworks to govern crypto exchanges and protect investors are expected to have a large impact on the next rally of the market.

Farside Investors

Farside Investors

CoinGlass

CoinGlass