ARK Investment buys Coinbase shares worth $8.6M

ARK Investment buys Coinbase shares worth $8.6M ARK Investment buys Coinbase shares worth $8.6M

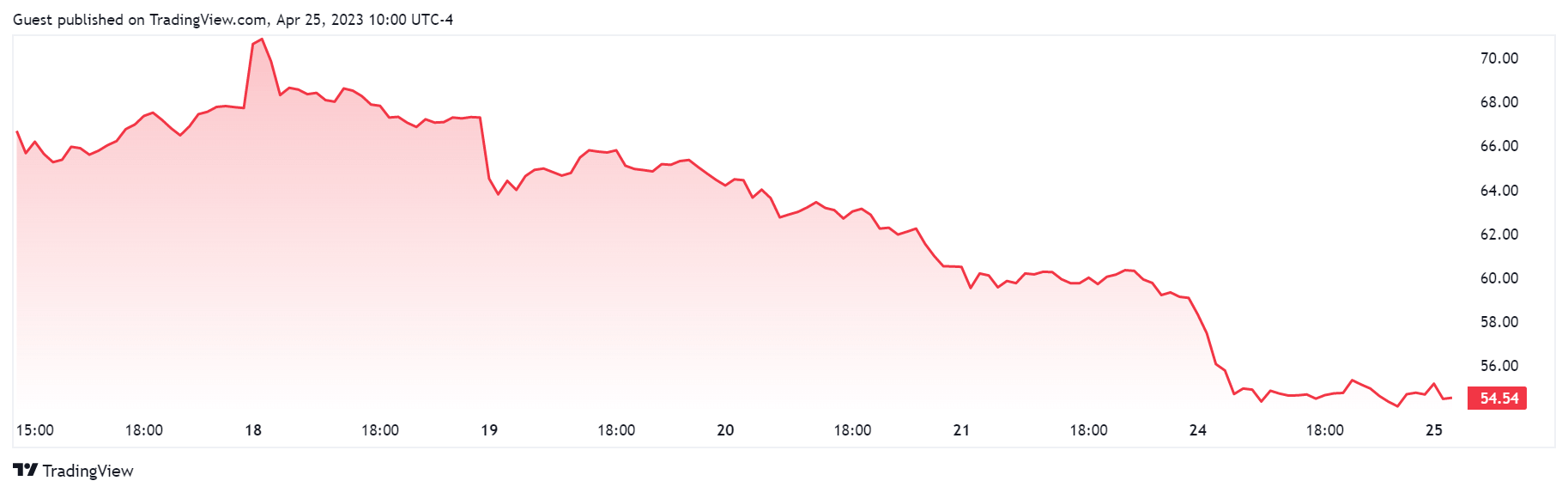

Coinbase COIN stock is down 15% over the last 30 days and was trading for $54.59 as of press time, according to Tradingview data.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Ark Invest Management has acquired over 157,000 Coinbase (COIN) shares for $8.6 million — its second buy order after selling in March.

The investment fund’s purchase is amid a string of poor price performance for the exchange’s stock. Tradingview data shows COIN fell 15% over the last 30 days and 23% in the previous five days.

The stock is up 0.84% in the previous 24 hours and is trading for $54.59 as of press time.

Meanwhile, COIN’s value has risen by over 50% on the year-to-date metric but is still down 51% over the past 12 months.

Cathie Wood is bullish on Coinbase stock

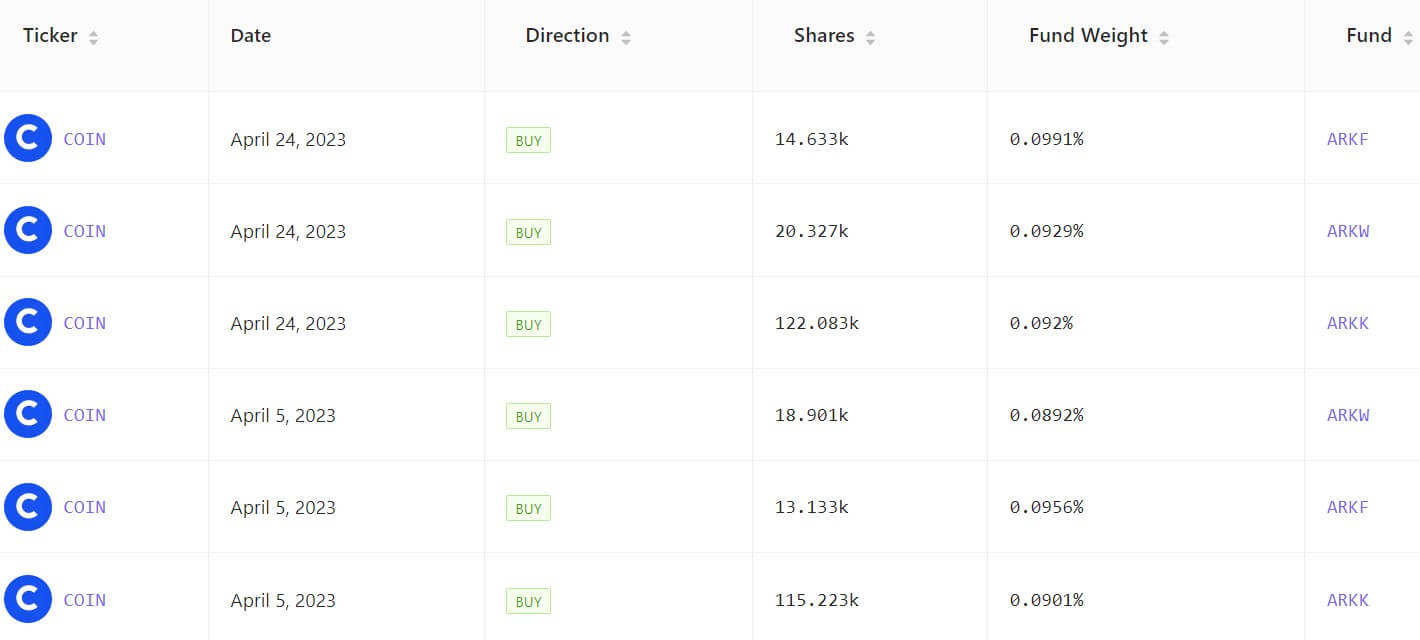

According to Cathiesark, ARK Innovation ETF bought 122,080 Coinbase shares, while ARK Next Generation Internet ETF purchased 20,320 shares. The ARK Fintech Innovation ETF also acquired 14,600 shares of the U.S.-based exchange.

Meanwhile, this is the second time the investment fund will purchase Coinbase’s stock this month. On April 5, the investment fund manager purchased 147,250 shares in three transactions.

Cathie Wood investment funds also have a bullish stance on Coinbase despite the current regulatory uncertainty. In March, the investment fund purchased Coinbase’s stock after it received a Wells Notice from the U.S. Securities and Exchange Commission (SEC).

Coinbase regulatory struggles

Meanwhile, the recent purchase comes a day after the exchange filed a legal action to compel the SEC to guide the crypto industry with its formal rulemaking process.

Coinbase’s chief legal officer Paul Grewal wrote:

“Regulatory clarity is overdue for our industry. Yet Coinbase and other crypto companies are facing potential regulatory enforcement actions from the SEC, even though we have not been told how the SEC believes the law applies to our business.”