Ethereum rises against Bitcoin as shappella upgrade nears

Ethereum rises against Bitcoin as shappella upgrade nears Ethereum rises against Bitcoin as shappella upgrade nears

Blockchain analytical firm Nansen says the selling pressure on Ethereum could be as high as $4.6 billion due to the upcoming upgrade.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

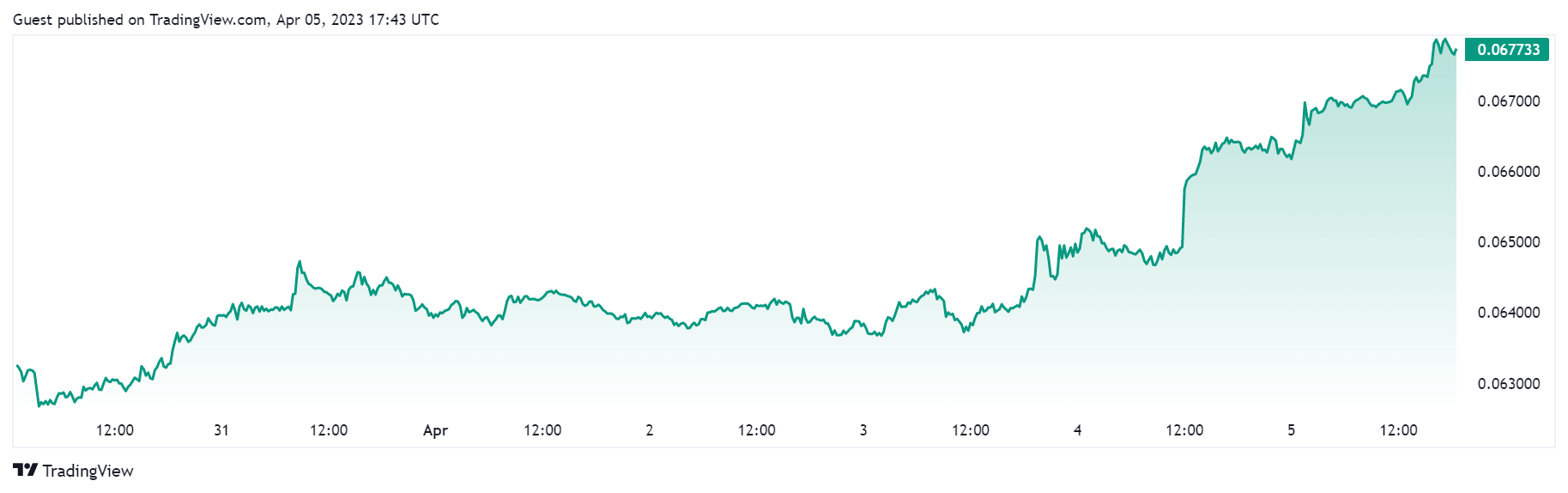

Ethereum (ETH) rose by around 5% during the past week against Bitcoin (BTC) as the community awaits the highly anticipated Shappella upgrade.

During the last 24 hours, ETH increased 2.11% against BTC, rising to as high as 0.067965 on Binance before retracing to 0.067965 at the time of writing.

The improved performance has seen ETH’s dominance rise to 19.84% for the first time since March 12, according to CryptoSlate’s data.

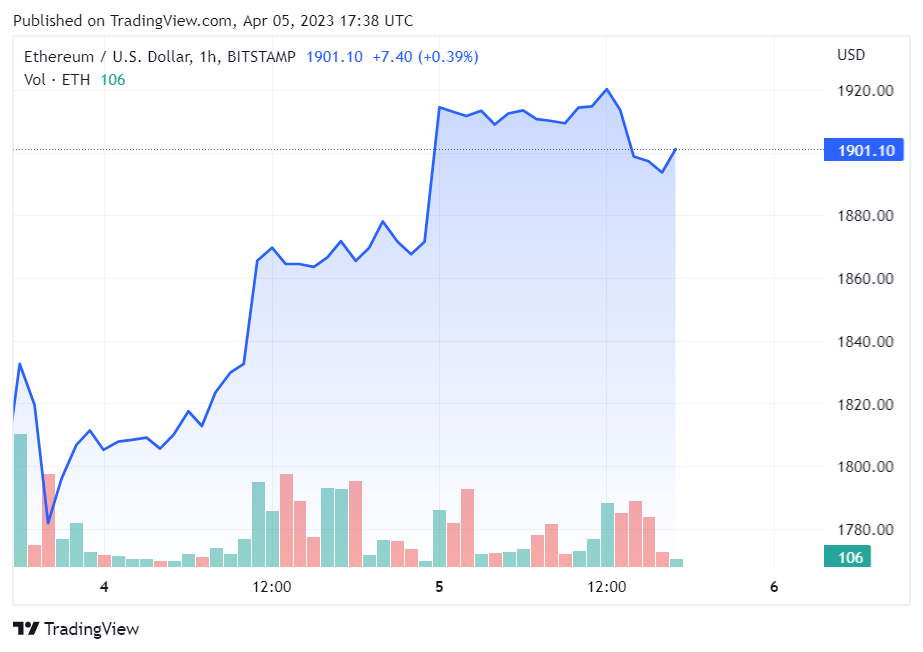

ETH’s USD value rises to an 8-month high

When ETH’s value is denominated in U.S. Dollars, it rose above $1900 for the first time since May 2022.

However, the asset has retraced to $1894 as of press time, according to CryptoSlate’s data.

The price movement continues its positive performance for 2023. ETH spiked 7.1% in the last seven days and has risen 22% over the past month. On the year-to-date metric, ETH is up roughly 60%.

Market sentiments surrounding the Shappella upgrade

With the Shappella upgrade confirmed for April 12, market sentiment surrounding ETH has turned largely positive, while some analysts believe that the move would increase the selling pressure on the cryptocurrency.

The Shappella upgrade would allow Ethereum stakers to withdraw their staked tokens from the blockchain network.

Blockchain analytical firm Nansen reported that the selling pressure on ETH from unstaking could be between $1.9 billion – $4.6 billion. According to the firm, this could hurt the asset because of the relatively thin liquidity of its spot markets.

However, Nansen added that the positive effects of the Shanghai upgrade on ETH would likely counteract the initial selling pressure.

Meanwhile, another blockchain analytical firm Santiment pointed out that ETH’s supply on exchange is currently at its lowest — 10.31%. The firm pointed out that investors are favoring self-custodial services for their assets.

Market analysts on Twitter have interpreted this to mean that holders strongly believe in ETH’s potential as a store of value. Since ETH completed the merge event in 2022, the asset has turned deflationary, and the volume held by long-term investors has risen.