Taking a deeper look into the UST-USD decoupling and how LUNA plummeted by 99%

Taking a deeper look into the UST-USD decoupling and how LUNA plummeted by 99% Taking a deeper look into the UST-USD decoupling and how LUNA plummeted by 99%

Being the third largest stablecoin by market cap, why did the algorithmic stablecoin UST experience such a severe price de-anchoring?

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

TerraUSDT (UST) is (though “was” might be better)an algorithmic stablecoin whose stability mechanism stemmed from the promise of a payout with LUNA. Having traders mint and burn tokens as needed to ensure the stability of UST out of trust in the Terra blockchain.

However, between the 9th and 10th of May, the UST’s price crashed, falling below ten cents and completely losing its peg. Before its decoupling from USD, UST was the third-largest stablecoin by market cap. This makes the collapse one of the most concerning developments in crypto and something that everyone interesting in blockchain needs to understand.

Why did UST, which has been so stable for so long, decouple? What are the consequences?

Algorithmic Stablecoins Are Different from Other Stablecoins

Before analyzing UST’s decoupling, let’s look at how it differs from the legal and over-collateralized stablecoins.

- Algorithmic stablecoins do not require any collateral. They instead adjust the number of tokens held by users through currency price fluctuations.

- Fiat and over-collateralized coins require collateral. For example, Tether (USDT) holds collateral in fiat USD. Hyper-collateralized coins use BTC and ETH as collateral. Because of the high price volatility of BTC and ETH, the collateral must be over-collateralized.

UST is a stablecoin anchored to $1, but without sufficient collateral assets. Once the token price fell below $1, its whole ecosystem, including LUNA and the Anchor protocol, were dragged down with it.

UST’s Decoupling: Before and After

UST token price stable at $1

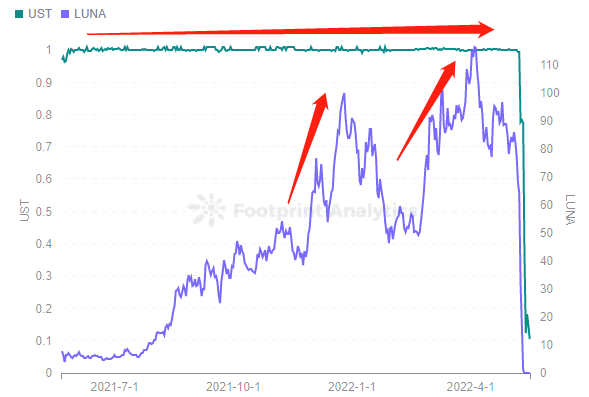

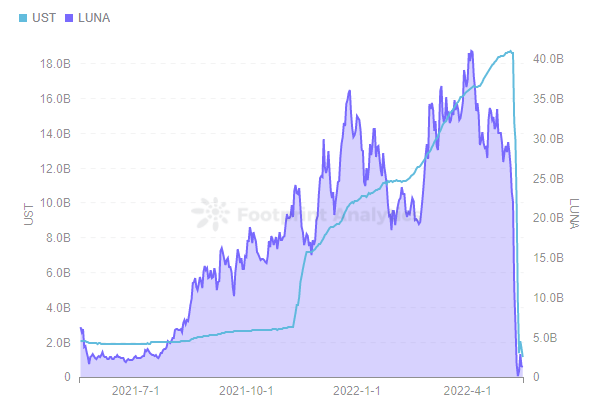

Footprint Analytics data shows that UST was stable at around $1 for about 1 year, from May 27, 2021 to May 8, 2022. During this time, LUNA’s price has seen 2 major increases, peaking at $116.32.

The stability of UST at the $1 anchor was the driving force behind the growth of Terra’s ecosystem.

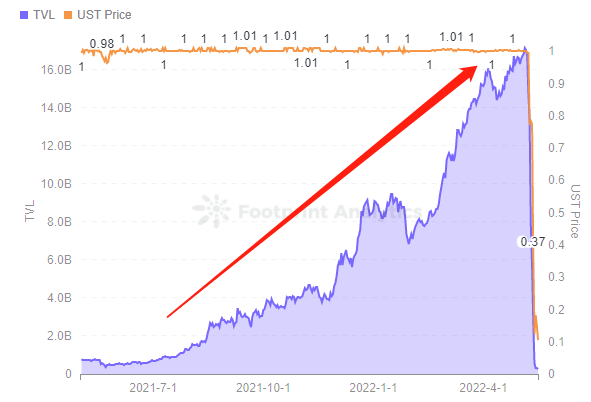

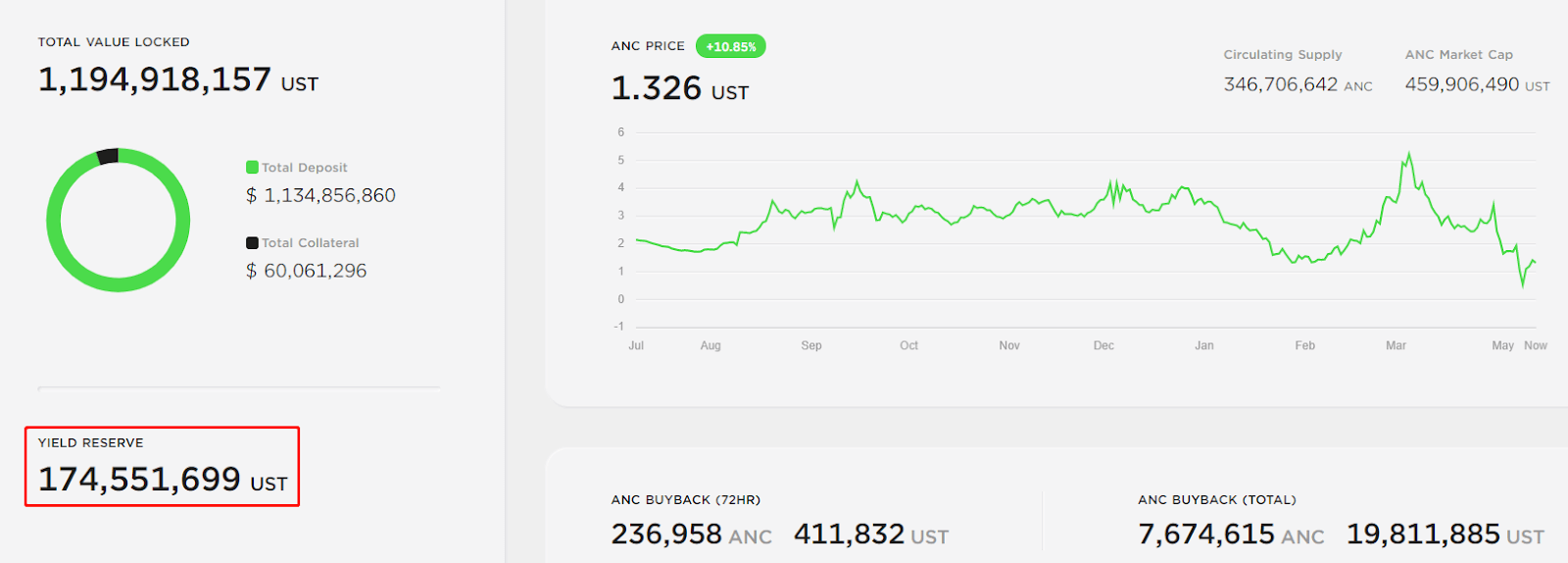

- The liquidity of the Anchor protocol in the past accounted for 50% of Terra TVL, and the stable storage income supported the stability of UST at $1. It provided more than $267 million in UST earnings reserves, which allowed users to earn 20% APY by depositing UST on the protocol—much higher than returns from other stablecoins. High yields are a big factor driving stablecoin demand and also led to Anchor attracting $17.2 billion in TVL.

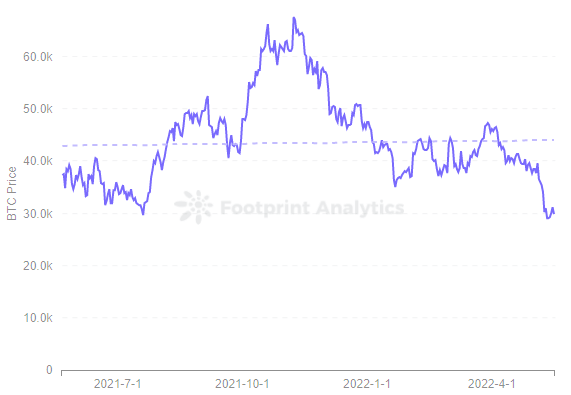

- The Luna Foundation Guard (LFG) was established in January 2022 to support the stability of the UST and facilitate the development of the Terra ecosystem. In February, it raised $1 billion in financing from multiple VCs through the sale of LUNA, backed by BTC to help anchor UST and develop the Terra ecosystem.

However, these mechanisms and reserves were not enough to sustain the stability of UST.

Why did UST decouple?

The price of UST fell from $1 on May 8 to around $0.18 on May 14. It briefly bounced back up, teasing that perhaps the mechanism would be resilient enough, but then resumed its crash.

As of May 16, UST appears to be dead and has killed the market’s confidence in algorithmic stablecoins as well.

What happened?

- A giant whale sold $285 million worth of UST on May 7. This was the trigger that prompted the decoupling of the UST from the dollar.

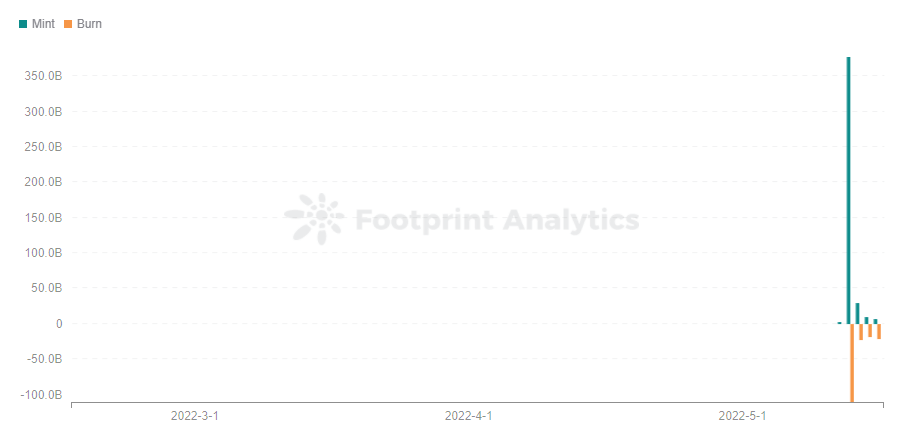

- As UST lost its peg, LUNA started printing. This is because users abandon the decoupled USTs in their hands, resulting in more minting of LUNA, which triggers a deeper drop in LUNA.

- However, the devaluation of LUNA happened so quickly that it was simply unable to buy back enough UST to repeg it to $1.

- Both LUNA and UST crashed to cents.

- Anchor, which relies on the Terra Fund to continually replenish its reserves to cover the 20% APY also crashed.

- LFG’s reserve of BTC was supposed to serve as a backstop to help anchor the UST. However, the price of BTC has been falling since its peak in November last year. As of May 16, the price of BTC has fallen below $30,000.

This has a negative impact on the anchoring of UST and the development of the Terra ecosystem.

- UST is different from fiat currency stablecoins and does not have sufficient collateral assets.

How the Collapse of UST Price Drop Affects the Terra Ecosystem and Crypto

With its precipitous collapse, the Terra ecosystem appears to be dead.

With UST below $1, the price and market confidence in Terra’s native token, LUNA, collapsed. Footprint Analytics data shows that the drop in LUNA’s token price and the rapid abandonment of UST by UST holders led to more Minting of LUNA, which triggered an even deeper drop in LUNA. As of May 16, LUNA’s token price fell below $0.11 from a peak of $116.32, a 99.9% drop in less than a month.

The market cap of UST and LUNA has inverted, with LURA’s market cap being smaller than UST’s. When LUNA falls, sufficient liquidation space is generally reserved to avoid extreme situations of insolvency.Now the market cap has fallen off a cliff to $1.2 billion for LURA and $1.15 billion for UST. This drop could easily cause confidence to collapse and a death spiral to occur.

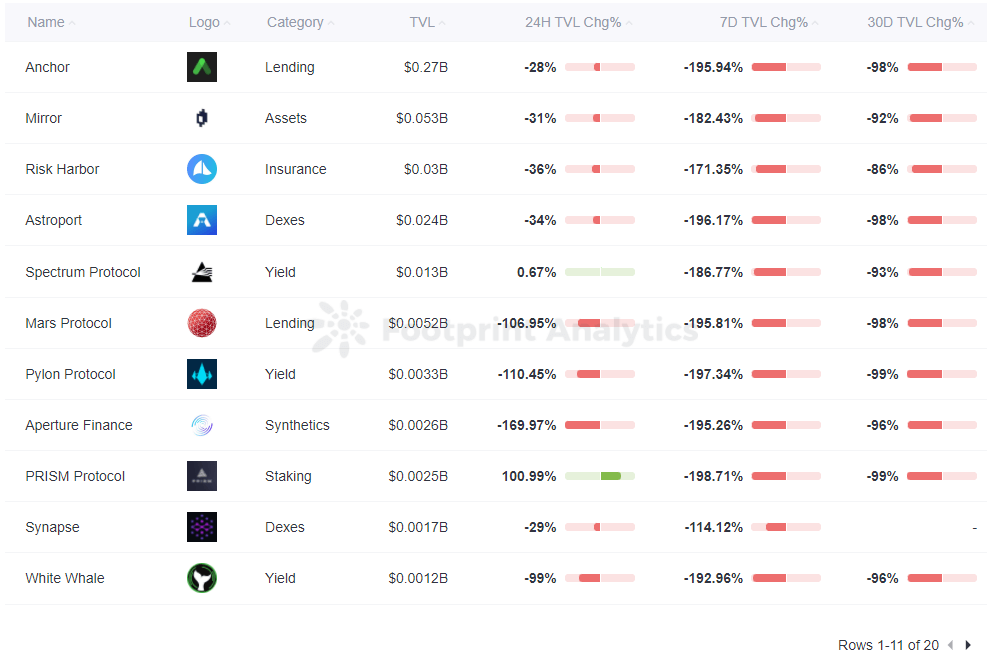

Of course, in addition to the currency price, market cap and other indicators being affected, there are also Terra ecosystem protocols TVL showing negative growth. Especially for protocols such as Anchor and Lido, TVL has dropped by more than 100%. Anchor is the most affected by the algorithm stable currency UST, while Lido is affected by the drop in the price of LUNA.

Summary

The current market panic is still spreading, the algorithmic stablecoin UST is severely unanchored, and the LUNA token price has seemed to take a catastrophic hit. While its survival doesn’t seem likely, crazy things can happen in the crypto world.

Date & Author: May. 2022, Vincy

Data Source: Footprint Analytics – Algorithmic Stablecoin Analysis

This piece is contributed by Footprint Analytics community.

The Footprint Community is a place where data and crypto enthusiasts worldwide help each other understand and gain insights about Web3, the metaverse, DeFi, GameFi, or any other area of the fledgling world of blockchain. Here you’ll find active, diverse voices supporting each other and driving the community forward.

What is Footprint Analytics?

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects, and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and invest smarter with Footprint.

CoinGlass

CoinGlass

Farside Investors

Farside Investors