Prominent crypto executives assess current market and share future predictions

Prominent crypto executives assess current market and share future predictions Prominent crypto executives assess current market and share future predictions

A handful of crypto executives spoke at the Tech.edu's Fintech event on 9th of March and discussed volatility, adoption as well as their future predictions.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

eToro‘s CEO Yoni Assia, Bitstamp‘s CGO Barbara Daliri, Utrust‘s CEO Sanja Kon and Finoa’s COO Michaela Fleischer joined Tech.eu‘s Fintech event and discussed the present and the future of crypto.

During his Q&A session, Yoni Assia talked about the reasons behind crypto’s volatility and adoption, as well as his expectations from the crypto space by 2030.

Following Assia, Daliri, Fleischer and Kon discussed how far the scale of adoption could go, who is responsible for the market volatility and what problems could be solved by education on crypto.

Crypto’s present

Two questions were discussed under crypto’s present: why high volatility exists, and what does the high adoption rate tell us?

Volatility

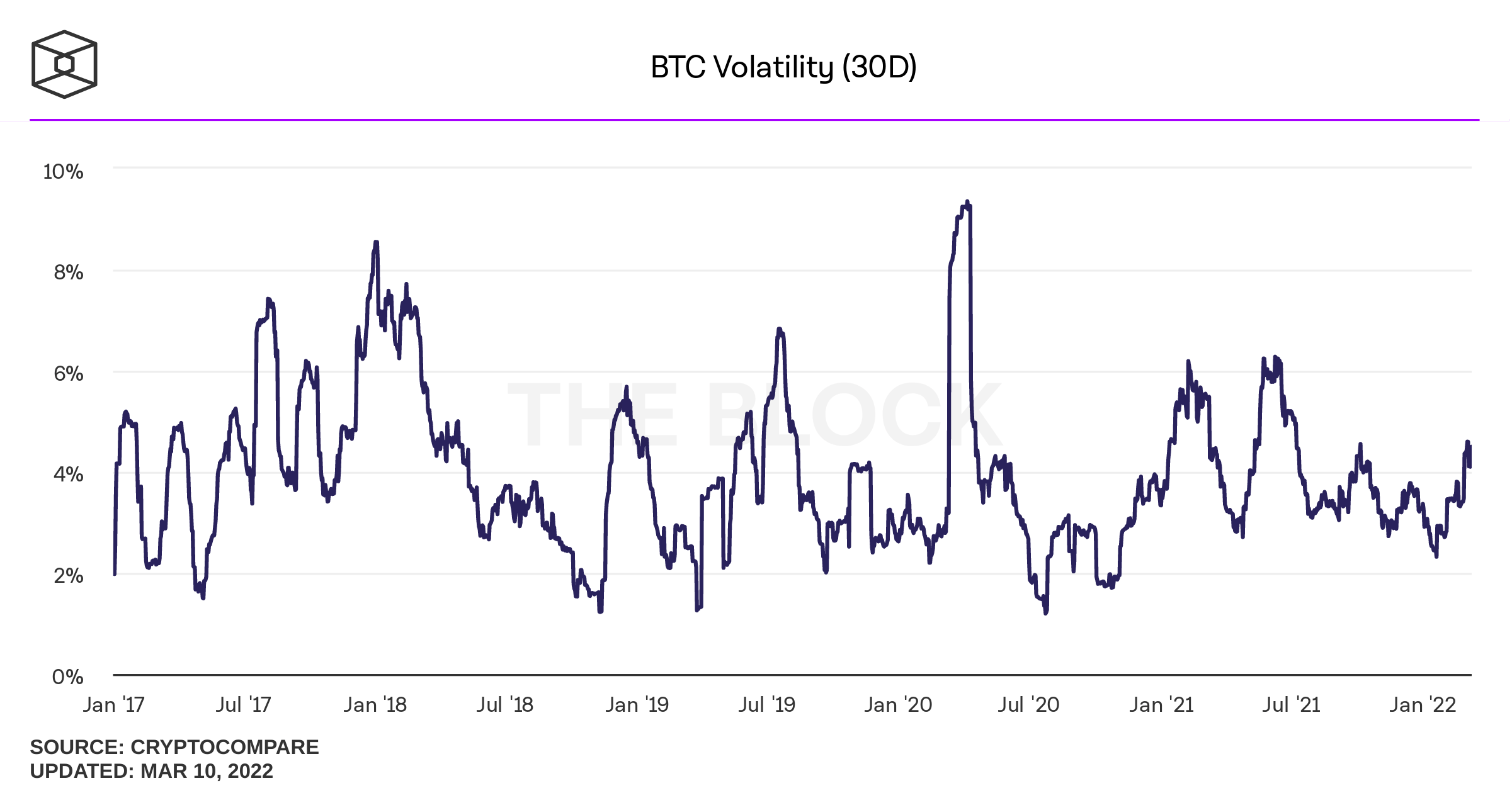

The above chart shows the 30-day moving average volatility index for Bitcoin, where volatility is defined as the standard deviation of daily revenue returns.

The most recent all-time low Bitcoin volatility was recorded in July 2020. Since then, volatility only continued to increase. Spikes recorded in December 2021 and early January 2022 were relatively calmer in comparison to Bitcoin’s history. However, sanctions against Russia led to a volatility surge.

Price volatility had always been a problem for all crypto assets, especially Bitcoin. Sudden movements within an hourly window have become the norm, and according to renowned crypto executives, volatility is not about to calm down any time soon.

eToro CEO Yoni Assia argues that high market volatility occurs as a result of an unbalance between “regular” owners and institutional investors. According to him, crypto prices are affected by the following:

“First, genuine contributions of regular users from all generations. Second, institutional investors, which are drawn to the market because they are intrigued by the high level of uncertainty.”

He further elaborated:

“When second actors see an increase in the market fear, they immediately sell-out and create further instability. These two are not at the right balance, which is why we experience volatility still. Volatility will continue to exist until they find the right balance.”

Following Assia’s session, Barbara Daliri and Michaela Fleischer approached market volatility from a bigger perspective.

Daliri mentioned that volatility is an inevitable part of all financial systems and it should not be discouraging for the investors. A similar approach has been stated by famous investor Anthony Pompliano as well.

Fleischer agreed with Daliri and further added:

“Crypto is a very young market. New actors of all sizes join in every day, and not all are well educated. They all contribute to volatility.”

Both Fleischer and Daliri highlighted that the crypto market is much more stable in comparison to its early years and it will only grow less and less volatile in time.

Adoption

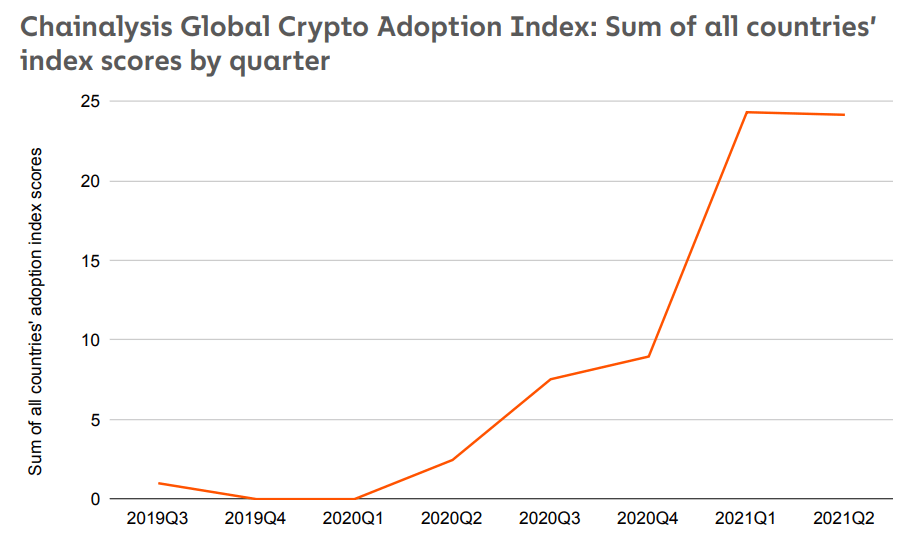

According to Chainalysis‘ 2021 Geography of Cryptocurrency Report, crypto adoption skyrocketed in the last twelve months.

The above chart shows global adoption at 2.5 at the end of 2022 Q2 and 24 at the end of 2021 Q1, indicating an 881% growth over less than a year. Overall adoption, from beginning to today shows more than 2300% growth since 2019.

The Chainalysis research revealed that the reason behind increased adoption differed around the world. Emerging markets turned towards cryptocurrencies to preserve their savings against currency devaluation, issue transfers and carry out business transactions. On the other hand, North American, Eastern Asian and Western European markets grew through institutional investments.

Yoni Assia, Sanja Kon and Barbara Daliri’s comments on increasing adoption also showed parallelism to Chainalysis’ report.

Assia mentioned the increased adoption amongst individual users and argued that it increased due to two factors: ownership and hedging capabilities. He argued that the scarcity of Bitcoin allowed it to behave like gold, which is a primary inflation hedge. Since fiat-based investments lost great value due to COVID, individuals turned to seek relief in crypto.

Assia noted:

“Money isn’t necessarily safe heaven and people now realized they needed to learn how to invest their money. Bitcoin is a hedge against the governments’ inflation because its scarcity transforms it into a form of digital gold.”

He also argued that with crypto individuals could both own their own money, and take advantage of the various investment opportunities. He added:

“Rest of the elements of crypto, like smart contracts and NFTs, bring their own value into the market. Each represents a different type of investment opportunity, entirely different from the capital markets and entirely owned by the asset holders. That’s why we see a genuine adoption from all generations.”

Kon mainly focused on adoption around business transactions. She mentioned that when Utrust was launched, all their merchants accepted payments in crypto only if it was immediately exchanged for fiat currencies. Now, more and more merchants are becoming accustomed to accepting crypto as payment without exchanging it. She said:

“Today, more than 50% of our merchants, even small ones are accepting Bitcoin or stablecoins as payment, and are keeping them that way. These numbers tell us that merchants are prone to understand crypto as a valid asset.”

Daliri, on the other hand, drew attention to the increasing number of industrial players. She argued that big actors were stepping into the crypto space all around the world, and their involvement increased crypto’s credibility. She added that with the help of the regulations, adoption across institutions would increase even more.

Crypto’s future

When it came to crypto’s future, Barbara Daliri and Sanja Kon talked about the importance of education while Yoni Assia shared his bold predictions.

Education

One of the main things all executives agreed on was the importance of education for the newcomers. Daliri and Kon argued that lack of education harmed the market by causing volatility and the individual by causing severe losses. In addition, these damages also negatively affected public opinion on crypto.

While discussing current volatility, Daliri stated:

“Teaching newcomers about the mechanics of the market is vital to healing volatility. With proper training, we could prevent big players to quit. We can also teach everyone how to protect themselves against volatility to prevent losses, which eventually creates volatility itself.”

Kon agreed with Daliri and added that education can be an accelerator for the adoption and that the regulations can increase education. She said:

“Both merchants and customers who deal with crypto want reassurance. We can provide it by building trust and educating them. Lack of education is one of the core barriers to adoption. As regulations consolidate, they should help with education levels as well.”

Yoni Assia’s predictions

During his Q&A session, Assia mentioned that the change we saw was only the tip of the iceberg. He argued that the crypto community was growing by the day and that people were not only participating but were identifying with it. He added that the next 10 years will prove how crypto is going to affect our lives on a bigger scale.

He stated:

“As people move towards an inevitable digital economy, we will see groundbreaking changes in the next 10 years. We will definitely have an embedded wallet in every browser by 2030. This is inevitable. Crypto as an asset will advance enough to make this a necessity.”

He also mentioned his confidence in NFTs and said:

“All crypto-related functions are incredible. But NFTs are the most unique things created so far. They are incredibly strong investment options. They also have unique functions which can be utilized in profound ways. In the future, NFTs will become a significant part of our lives, beyond investments.”

Assia concluded his words by agreeing with Kon and said eToro’s primary concern is to polish up their user experience and contribute to their education in an effort to further increase adoption.

CoinGlass

CoinGlass

Farside Investors

Farside Investors